Indian court recognizes crypto as property, not just speculative asset

The Madras High Court has ruled that cryptocurrency qualifies as property under Indian law.

- Madras High Court declared cryptocurrency a form of property under Indian law.

- The ruling came from a case tied to WazirX’s $230M Ethereum hack.

- Court affirmed Indian jurisdiction and urged stricter Web3 governance.

Justice N Anand Venkatesh stated that crypto can be owned and held in trust. The ruling came from a case involving the WazirX exchange hack.

An investor who purchased 3,532.30 XRP ( XRP ) coins worth Rs 1,98,516 in January 2024 sought legal protection after WazirX froze all accounts following a July cyberattack that cost the platform $230 million in Ethereum and ERC-20 tokens.

Court defines crypto property rights

Justice Venkatesh explained that cryptocurrencies possess all the main features of property. The Court stated: “There can be no doubt that ‘cryptocurrency’ is a property. It is not a tangible property, nor is it a currency. It is a property, which is capable of being enjoyed and possessed (in a beneficial form). It is capable of being held in trust.”

The judge noted that cryptocurrencies are identifiable, transferable, and controlled through private keys. He referenced Section 2(47A) of the Income Tax Act, 1961, which classifies cryptocurrencies as “virtual digital assets.”

The Court dismissed Zanmai Labs’ argument that the investor should share losses from the hack. Justice Venkatesh pointed out that the investor’s XRP coins were separate from the stolen Ethereum-based tokens.

“What were held by the applicant as cryptocurrencies were 3532.30 XRP coins. What were subjected to cyber attack on 18.7.2024 in the WazirX platform were ERC 20 coins, which are completely different crypto currencies,” the Court observed.

Indian courts hold jurisdiction over domestic crypto assets

The Court rejected claims that Singapore arbitration rules prevented Indian court intervention. Justice Venkatesh cited the Supreme Court’s decision in PASL Wind Solutions Pvt Ltd v. GE Power Conversion India Pvt Ltd (2021), confirming that Indian courts can protect assets located in India.

The investor’s transactions originated in Chennai and were made using an Indian bank account, placing the case under the jurisdiction of the Madras High Court. Justice Venkatesh noted that Zanmai Labs is registered with India’s Financial Intelligence Unit, unlike its Singapore parent company Zettai Pte Ltd.

The judge called for Web3 platforms to maintain corporate governance standards, including separate client funds, independent audits, and strong KYC and anti-money laundering protocols.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum price forecast: ETH eyes $4,500 amid bullish momentum

Hyperliquid price forecast after rejection at the 38.2% Fibonacci retracement level

Solana boost as Reliance adds SOL to treasury holdings

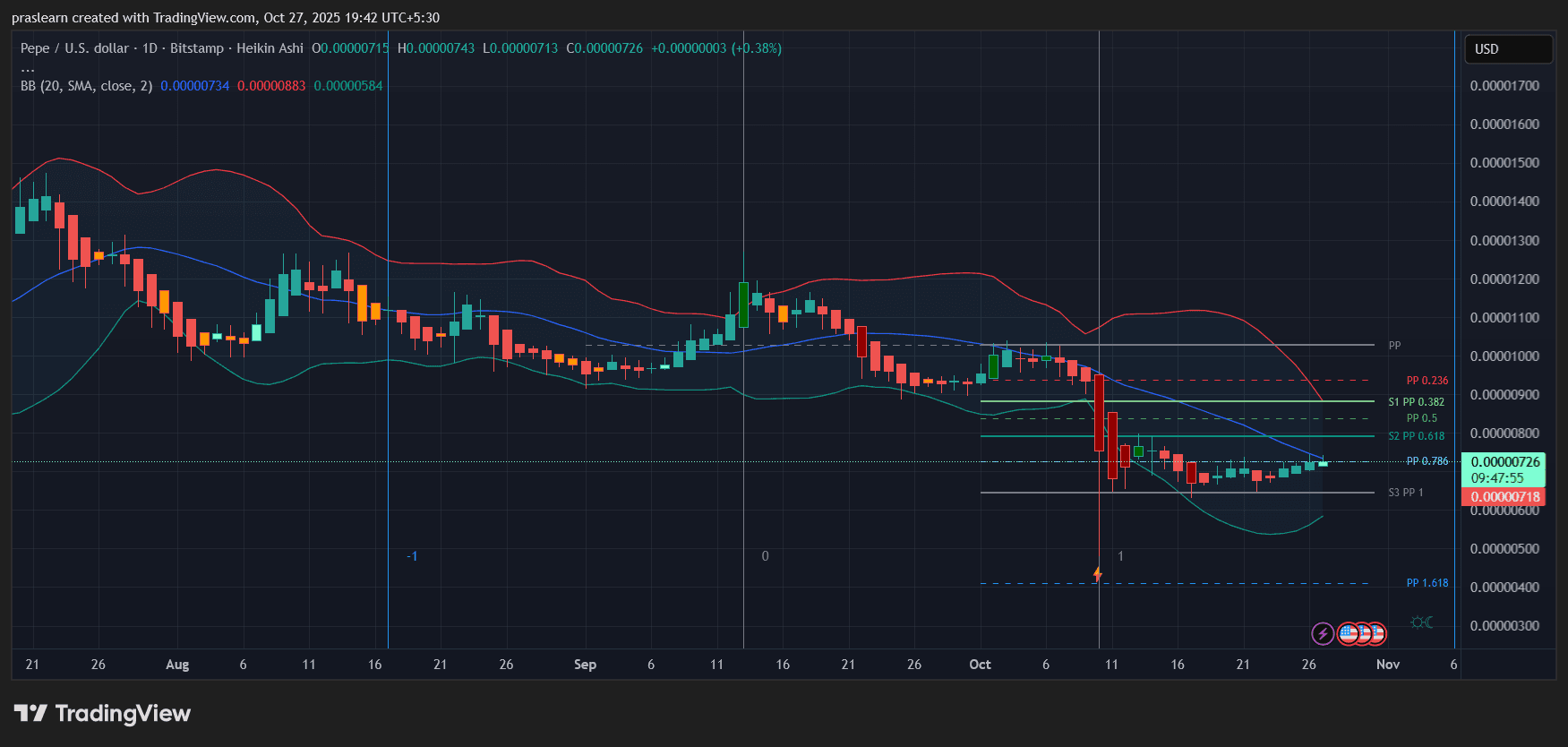

Is PEPE Gearing Up for a Comeback Rally Amid Wall Street’s Tech Frenzy?