Key Market Information Discrepancy on October 27th, a Must-See! | Alpha Morning Report

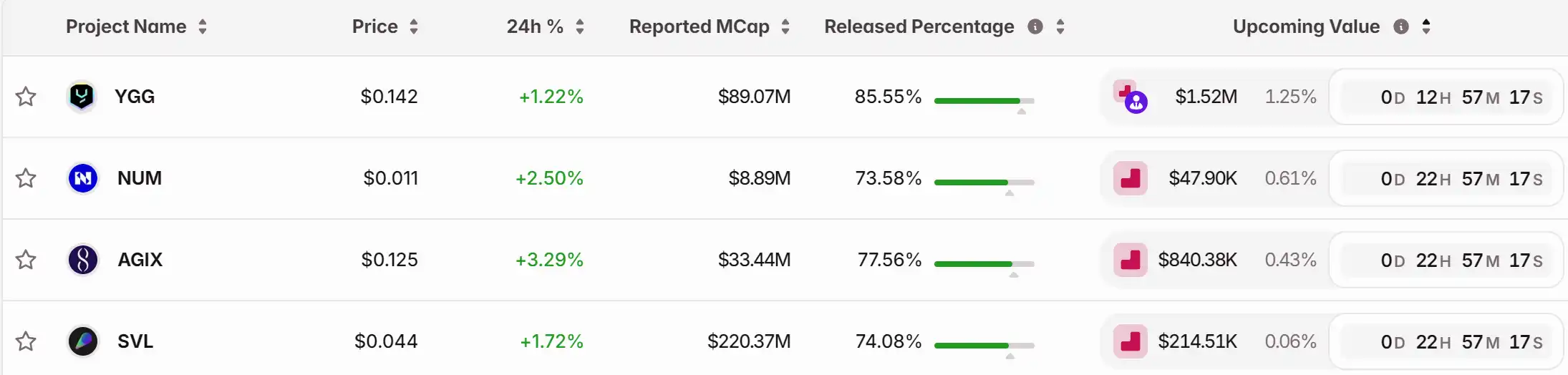

1. Top News: U.S. Treasury Secretary Yellen stated that the U.S. is no longer considering imposing 100% tariffs on China. 2. Token Unlock: $YGG, $NUM, $AGIX, $SVL

Featured News

1.US Treasury Secretary Yellen States US No Longer Considering 100% Tariffs on China

2.Bitcoin Price Rises, QWEN3 Yield Nearly 100% Securing Top Spot Among Six AI Model Trading Leaderboard

3.Monday Opening, Spot Gold Gaps Down Significantly by $40 Before Rebound

4.US Stock Futures Open Higher, Nasdaq Futures Up by 0.8%

5.US to Maintain 19% Tariffs on Thailand, Thailand to Remove Tariff Barriers on Approximately 99% of Goods

Articles & Threads

1.《AI's Darwinian Moment: When Models Begin to Fight for Survival》

Natural selection has always been a core driving force of human evolution, but does the evolution of artificial intelligence also follow this logic? The development journey of artificial intelligence is not determined by a single "invention" but rather propelled by countless "invisible competitions and experiments" – these competitions eventually sifted out the models that survived and eliminated the forgotten ones.

2.《Bloomberg: Peso Crisis Escalates, Stablecoins Become Argentinians' "Lifeline"》

As the mid-term elections approach, Argentine President Javier Mile tightened foreign exchange controls to support the peso exchange rate, while Ruben López and other Argentine citizens are turning to cryptocurrency to protect their savings. A new strategy has emerged: leveraging stablecoins pegged to the dollar at a 1:1 ratio to exploit the difference between the official exchange rate in Argentina and the parallel market exchange rate. At the current official exchange rate, the peso's value is approximately 7% higher than in the parallel market.

Market Data

Daily Market Overall Funding Heatmap (as reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Analyst Highlights How MSTR's Convertible Bonds Prevent Forced Bitcoin Sales

- MSTR's convertible debt structure allows debt repayment via cash, stock, or both, avoiding Bitcoin sales during market downturns. - The company raised €350M through a 10% dividend-bearing euro-denominated preferred stock offering to fund Bitcoin purchases. - Q3 results showed $3.9B operating income from Bitcoin gains, driving a 7.6% stock surge to $273.68 post-earnings. - Risks persist if Bitcoin fails to rally in 2028, potentially forcing partial liquidation amid $1.01B 2027 debt obligations. - MSTR hol

Solana News Today: Solana ETFs Surpass Bitcoin as Staking Returns Attract Institutional Investments

- U.S. spot Solana ETFs (BSOL/GSOL) attracted $199M in 4 days, outperforming Bitcoin/Ethereum ETF outflows. - 7% staking yields drive institutional inflows as investors rotate capital from major crypto assets. - Despite ETF success, SOL price fell below key support levels, raising concerns about $120 price floor. - Strategic staking and treasury purchases boosted Solana's institutional appeal, with $397M in staked assets. - Market remains cautious as ETF competition intensifies, with Bitwise's BSOL outpaci

Bitcoin News Today: Bitcoin’s Fourth Quarter Surge: Impact of Trade Disputes, Stronger Dollar, and Evolving Global Economic Strategies

- Bitcoin fell nearly 15% in October 2024, its worst quarterly start since 2022, driven by U.S.-China trade tensions, dollar strength, and macroeconomic caution. - A 100% U.S. tariff on Chinese imports and Fed rate-cut delays exacerbated selloffs, triggering $1.3B in liquidations during a flash crash below $103,000. - Key support levels at $107,000 and $101,150 face retests as traders warn of further declines, with market cap dropping below $3.6T amid fragile liquidity. - Wintermute denied Binance lawsuit

BNB News Today: AI and Blockchain Unite to Transform the Industry Through Decentralized Innovations

- ChainOpera, an AI-powered blockchain project, raised $40M+ in funding to expand decentralized infrastructure, highlighting growing investor confidence in AI-blockchain convergence. - FedEx partners with ServiceNow to implement AI-driven supply chain analytics, aiming to boost operational efficiency through real-time disruption prediction and automation. - BNB Chain emerges as an AI innovation hub with Avalon Labs' AI-MaaS marketplace and AEON's autonomous payment SDK, enabling decentralized AI model depl