S&P 500 Futures and Bitcoin Up Today on Trump-Xi Jinping Optimism

- US futures rise ahead of Fed rate cut

- Trump and Xi resume talks to end trade war

- Bitcoin and altcoins advance with global market optimism

U.S. stock futures started the week higher, driven by expectations of a Federal Reserve rate cut, solid earnings from major technology companies, and the highly anticipated meeting between President Donald Trump and Chinese leader Xi Jinping.

The positive movement began on Sunday night, when S&P 500 futures rose 0,7%, while Nasdaq 100 futures rose 0,9%. The Dow Jones Industrial Average also rose 0,6%, adding nearly 300 points.

The optimistic sentiment reflects a streak of gains on Wall Street. On Friday, the Dow Jones closed above 47.000 points for the first time in history, while the S&P 500 advanced 0,8%, approaching 6.800 points. The Nasdaq, driven by the performance of tech giants, ended the day up more than 1%.

Investors are eagerly awaiting the Federal Reserve's decision, scheduled for this week, amid near-unanimous expectations of a further interest rate cut. The move is expected to follow the release of lower-than-expected inflation data, which had been delayed due to the government shutdown.

Beyond monetary policy, the focus is also on Thursday's meeting between President Trump and Xi Jinping, scheduled for South Korea. The meeting aims to advance trade negotiations and ease tensions between the world's two largest economies. "I believe we've reached a very substantial framework," Treasury Secretary Scott Bessent said on Sunday. China, meanwhile, highlighted the "preliminary consensus" reached during the weekend talks.

No cryptocurrency market today, global optimism is also reflected in prices. Bitcoin, which was trading at $113.000, rose to $115.000 in the last 24 hours, accumulating a 3% increase. Ethereum returned to trading above $4.120, with a 6% gain. Among the highlighted altcoins, Zcash (ZEC) soared 24%, while Pump.fun (PUMP) advanced 15%, demonstrating that risk appetite remains high.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

When Bitcoin Splits into Sects: Developers Wage a Holy War Over “What Should Go Into a Block”

The Bitcoin community is facing internal division over the purpose of the blockchain, with the core controversy centered on whether to modify the code to accommodate more non-financial transaction data. The Core camp supports relaxing restrictions to expand use cases and increase miner revenue, while the Knots camp opposes this and has launched its own client software. Summary generated by Mars AI. This summary is generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative updates.

Another Plunge! Gold Falls Below the $4,000 Mark, Drops Over $100 in a Single Day

Bulls face another “bloodbath”! After losing the key psychological level of $4,000, gold faces more tests this week...

IOSG Weekly Brief|x402 - A New Standard for Crypto Payments by Digital Agents

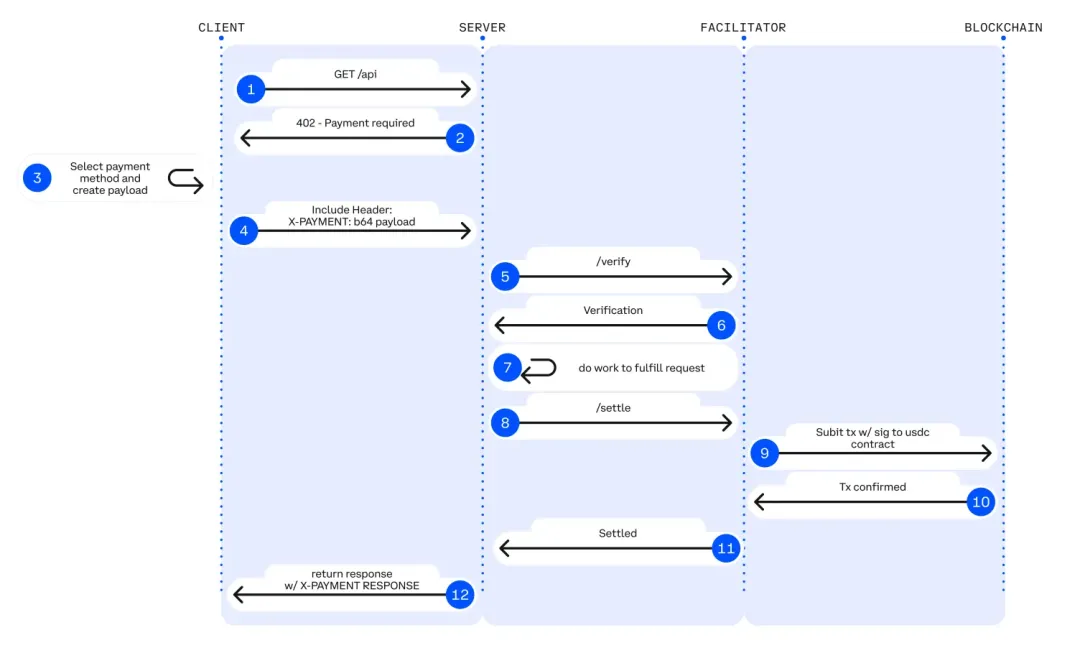

x402 is a revolutionary open payment standard that activates the HTTP 402 status code to embed payment functionality at the Internet protocol layer. This enables native payment capabilities between machines, driving the transformation of the Internet from an information network to a machine economy network, and creating a value transfer infrastructure for AI agents and automated systems without the need for human intervention.

Exclusive Interview with Aptos Founder Avery Ching: Not a General-Purpose L1, Focusing on a Global Transaction Engine

Aptos is not positioned as a general-purpose L1, but rather as a home for global traders, focusing on being a global trading engine.