Educational | How to Avoid Blindly Following the Crowd - A Beginner's Guide to Project Research

If you are a cryptocurrency newbie in need of a reliable hands-on approach, this article is prepared for you.

Original Title: How to do a good research?

Original Author: le.hl

Original Translation: Luffy, Foresight News

As an investor, the easiest way to lose money is to blindly follow the crowd, knowing nothing about the project, and simply enter the market based on others' advice. I have had such an experience, so I am sharing my project research experience here.

If you are a cryptocurrency newbie and need a reliable practical method, this article is prepared for you.

Define the Project Narrative

Narrative is one of the core elements of the cryptocurrency industry, and market trends often revolve around narratives. If you want to invest in a project, you must first understand the narrative logic behind it. If the project is still stuck in outdated narratives like the metaverse, GameFi, it is likely to have a hard time succeeding.

I usually look up the project narrative on certain well-known platforms.

Steps:

2. Enter the project name;

3. Scroll down to the "Tags" section to view the project's narrative.

After understanding the narrative, the next step is to identify the leading project in that sector. Observe its recent trading volume changes, assess the dynamics; and evaluate if the project you are interested in has the ability to compete with the leader. Remember, investing in the leader's competitors often has a better opportunity than chasing an already skyrocketed leader.

Choosing a currently trending narrative (such as AI, prediction markets, InfoFi, etc.) is the best path to profitability.

Verify the Project's Investors

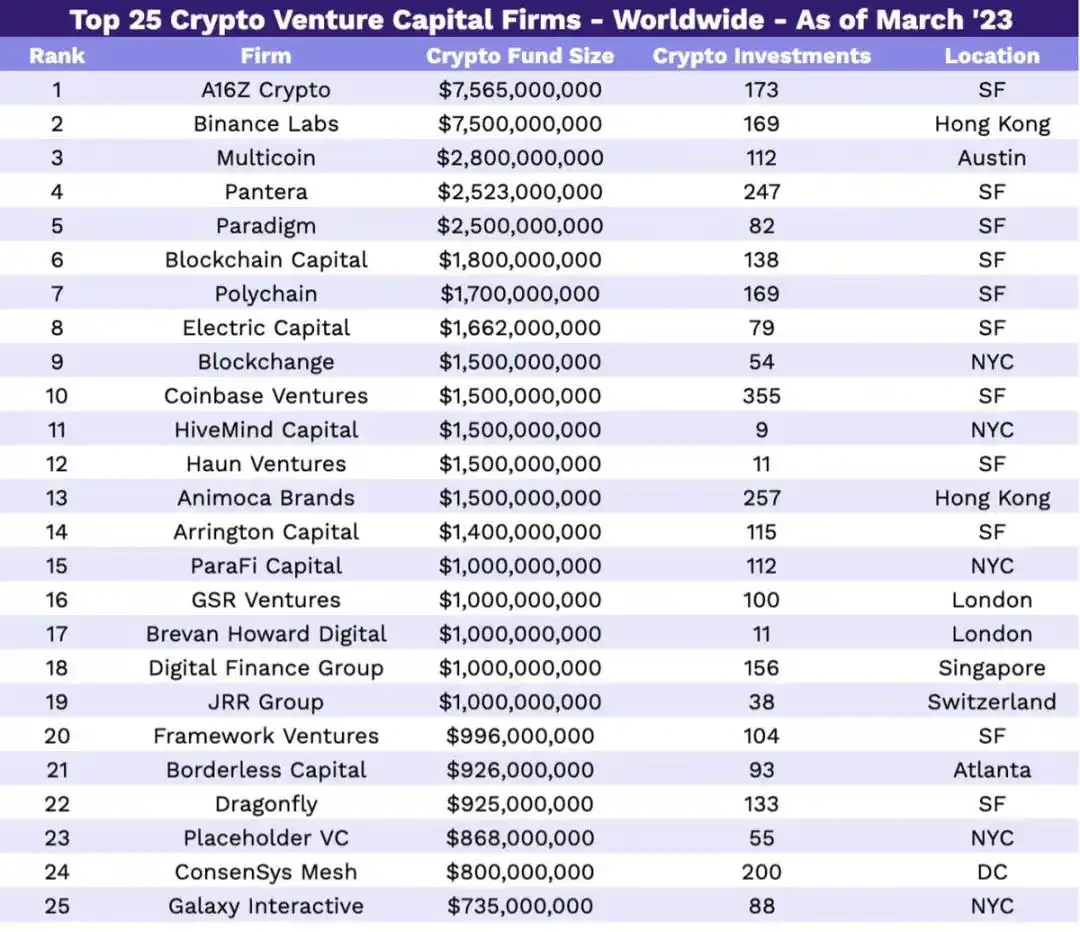

Today, many people are averse to the term 'venture capital' and prefer projects that self-fund. However, the fact is: If a project lacks excellent products, has a mediocre team, and is not the leader in any narrative, it needs reliable investors to drive its development.

My most frequently used platform to look up project investors is CryptoFundraising, which can display all key information about a project's investors, team, social accounts, official website, and more, all completely free of charge.

Operating steps:

2. Search for the target project;

3. Check the funding amount and venture capital level.

I have found that projects with lower funding amounts, supported by only 2-3 VCs, usually perform better than those with 20 or more VCs. It’s like a cake being divided among too many people; the team needs to get approval from all VCs when making decisions, which can be restrictive.

The VC level is also crucial. I personally prefer projects supported by VCs such as Coinbase VC, a16z, Polychain Capital, Paradigm, and GSR.

Examine Project Social Dynamics

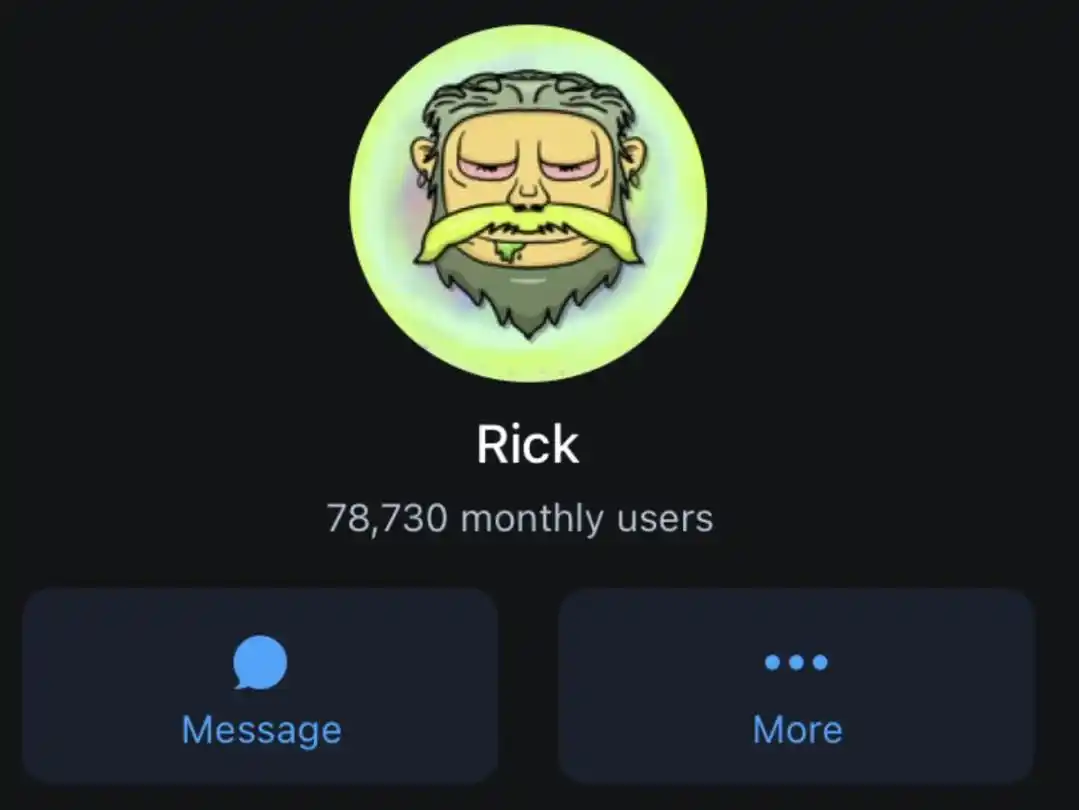

This step is very crucial. If a project disables comments or frequently changes its social account nickname, it’s best to avoid it directly.

The "number of well-known individuals who follow each other" is also worth considering: If there are over 20 industry celebrities following the project, it is usually a positive sign.

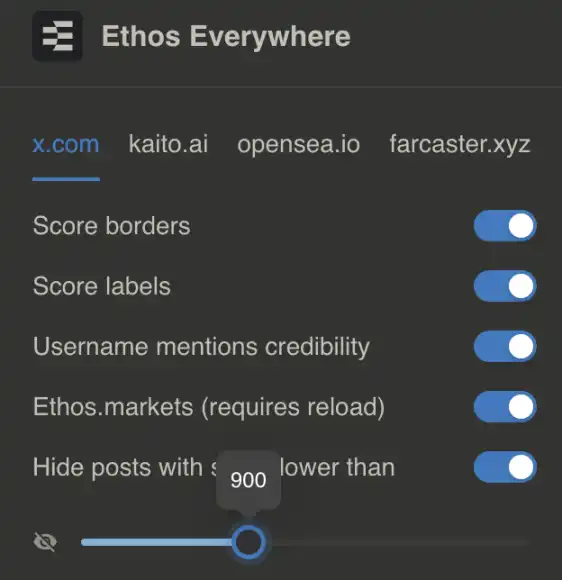

To verify the legitimacy of a project, you can also use some network platforms with information verification features.

2. Install the Chrome browser extension;

3. Make the following settings: If a project has negative feedback, block it to avoid seeing related disruptive data on X.

No invitation code is needed, you can also use this plugin for free.

Deep Research Core Dimensions

Founder

I prefer to invest in projects where the founder is actively involved in the cryptocurrency community on a daily basis and engages with the community. Outstanding founders have a strong belief in their project and are willing to admit mistakes.

Avoid founders who claim that the community is everything but then behave arrogantly, are disconnected from users, or are anonymous.

The founder's actions often determine the project's direction after launch.

Product

Usability is the key metric I value the most. Only a simple, user-friendly product can attract real users and generate revenue.

Even the most amazing concept (like "Quantum Blockchain Solves Global Hunger") will not receive attention if it is complex to operate and challenging to use.

Tokenomics

For projects with issued tokens, be cautious if the following situation occurs: distributing tokens to groups not related to the project (e.g., distributing tokens to platforms like Binance Alpha for short-term hype without receiving any substantial support). This behavior often leads to a failed Token Generation Event (TGE) and a dismal price trend thereafter.

A tokenomics model does not need to allocate all tokens to the community, but it must establish a clear, transparent unlocking schedule for all stakeholders (including the team). Team transparency is always paramount.

To investigate a project's tokenomics and unlocking schedule, you can use certain progress tracking tools to search for the target project; examine the price trend after the project's last token unlock to assess the unlocking's impact on the price.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dogecoin News Update: As Dogecoin Falls Under $0.20, Investors Turn to Rapidly Growing Altcoins

- Dogecoin (DOGE) fell below $0.20 as investors shift to high-growth altcoins like Mutuum Finance and $LYNO in DeFi and AI trading. - A drop in DOGE's SOPR metric below 1.00 signals break-even selling, with analysts eyeing a potential rebound above $0.21 resistance. - Institutional interest grows via Bit Origin's Nasdaq listing, while regulatory risks and U.S.-China trade talks add market volatility. - Bybit's expanded derivatives for DOGE and XRP aim to boost liquidity, but macroeconomic uncertainties del

Ferrari’s Electric-Blockchain Fusion: Redefining Prestige in a Transformed Automotive Age

- Ferrari accelerates EV transition via SK On battery partnership and blockchain-powered 499P auction, targeting 2026 EV launch with 530 km range. - Tokenized Hyperclub auction with Conio accepts crypto payments, expanding luxury access for 100 elite clients while leveraging 2025 crypto wealth growth. - Strategic balance of heritage and innovation includes Hot Wheels F1 models, €2B share buybacks, and hybrid EV approach to counter Porsche's 99% profit drop. - CEO Vigna emphasizes redefining luxury ownershi

XRP News Today: Ripple's Prime Brokerage Initiative Drives Increased Institutional Interest in XRP

- XRP maintains $2.60 support amid mixed markets, with U.S. inflation data likely to drive next price direction. - Ripple's $1.25B acquisition of Hidden Road (Ripple Prime) accelerates institutional adoption through RLUSD integration and XRPL operations. - Evernorth's 261M XRP holdings ($639M) and planned SPAC IPO in 2026 could create largest public XRP treasury, boosting institutional demand. - Technical indicators show bullish momentum above $2.45, but 15% monthly decline and regulatory uncertainty persi

1inch and Innerworks' AI Predicts Cyber Attacks, Stopping Threats in Advance

- 1inch partners with Innerworks to deploy AI-driven "immune system" for proactive DeFi threat neutralization. - The solution uses synthetic threat intelligence to predict and counter AI-powered attacks before execution. - This collaboration addresses DeFi's vulnerability to AI-mimicked human behavior attacks with 99% bypass rate in trials. - The "invisible defense" model aims to set new security standards while maintaining frictionless transactions for 25M users.