- 7M users have migrated to Pi mainnet, boosting market confidence.

- PI Network price is nearing a $0.30 breakout amid tight exchange supply and strong demand.

- ISO 20022 integration could link Pi to SWIFT and global banking systems.

The Pi Network price has staged a strong rebound, with the PI coin surging above key resistance levels amid renewed market optimism.

This rally comes on the heels of a major mainnet migration involving 2.7 million users and growing anticipation ahead of the network’s ISO 20022 financial integration scheduled for November 22, 2025.

Bulls regain control as Pi Network adoption surges

Pi Network’s market momentum has accelerated in recent days, with the token’s price climbing more than 25% in 24 hours and over 30% over the week.

The price currently hovers near the $0.28 mark, just shy of the psychological $0.30 breakout target eyed by bullish traders.

The price surge follows the completion of mass Know Your Customer (KYC) verification that enabled 2.69 million “Pioneers” to migrate their tokens to the mainnet.

🚨Welcome to the Mainnet! A massive 2.69 million Pioneers have migrated their Pi in the last week alone after a huge KYC verification wave. The ecosystem is expanding rapidly as we approach the Nov 22 ISO 20022 integration. The future of finance is being built now🚀 #PiNetwork pic.twitter.com/zU1Myw7oGJ

— PiNetwork DEX⚡️阿龙 (@fen_leng) October 27, 2025

The migration marks one of the largest transitions in Pi’s history and signals growing confidence in the network’s long-term viability.

This migration has triggered a surge in market demand, particularly as millions of tokens were moved into circulation while exchange supplies tightened.

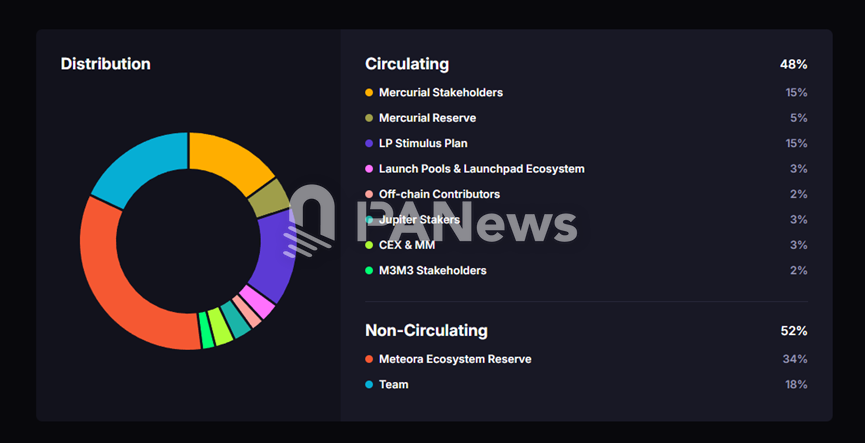

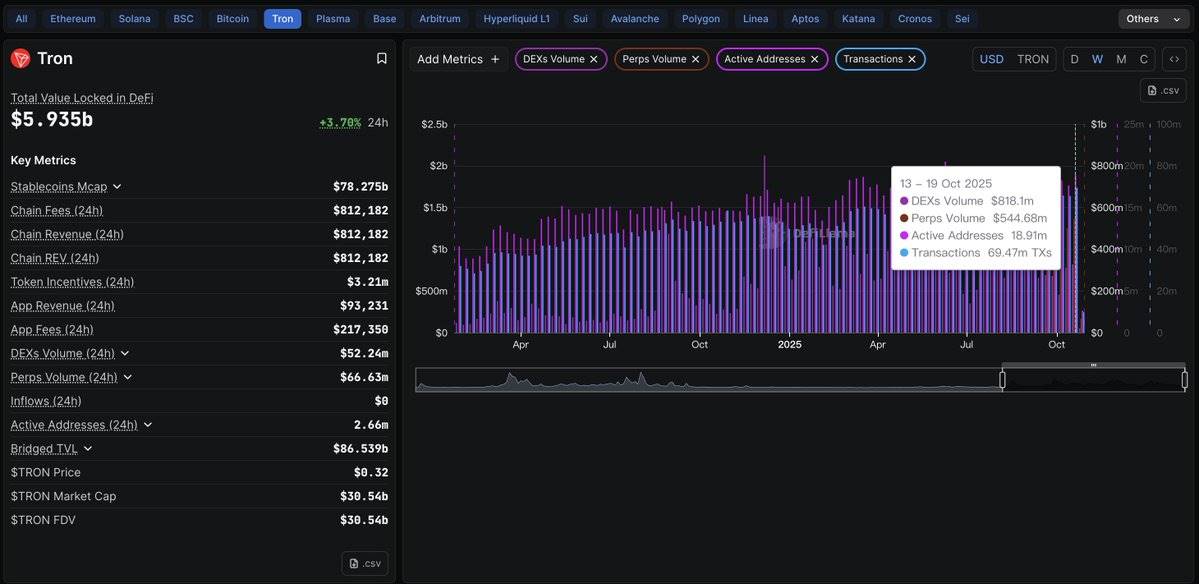

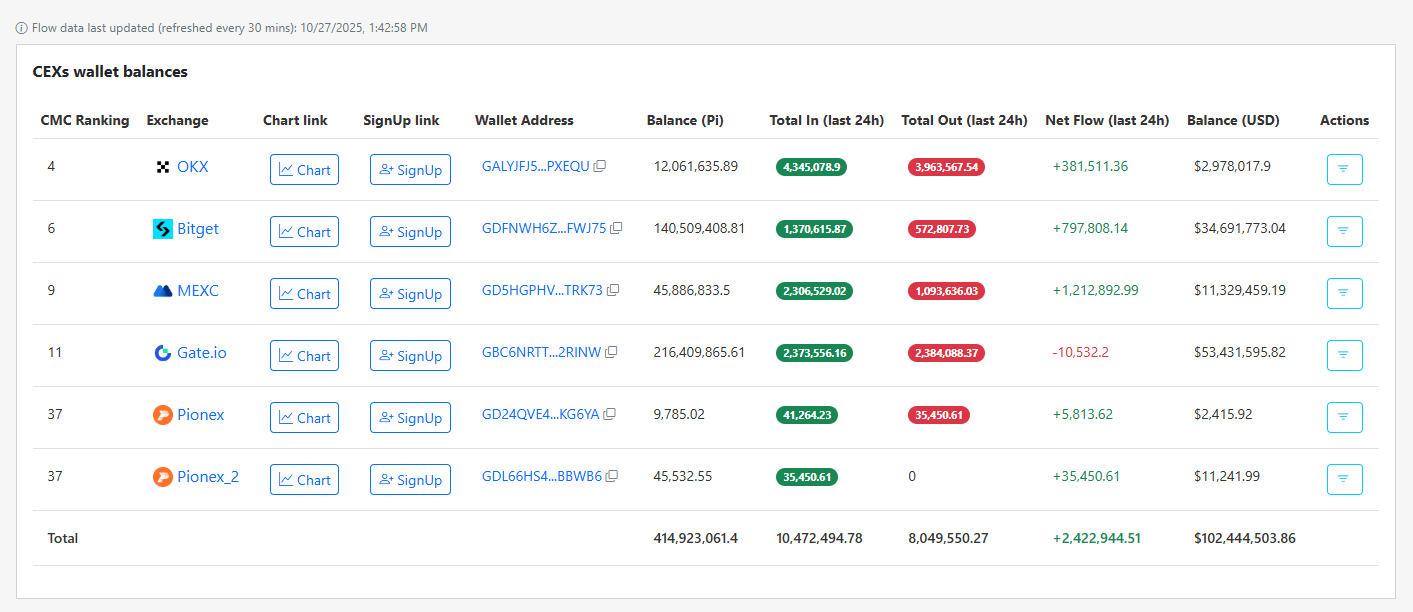

According to PiScan data , centralised exchanges (CEXs) recorded an inflow of more than 2.422 million PI tokens in the past 24 hours, but this was offset by strong accumulation activity.

Source: PiScan

Source: PiScan

In October alone, over eight million tokens exited exchanges, reducing available supply by roughly 2.4%.

This supply squeeze has been a key catalyst in Pi’s latest rally, easing sell pressure and fueling upward momentum.

Technical setup supports Pi Network price recovery

Technically, the Pi Network price is displaying a clear attempt to break out of a bullish pattern.

The token recently exceeded the 50-day Exponential Moving Average (EMA) at $0.2627, a level that previously acted as a strong resistance zone.

A sustained movement above $0.28 could be a confirmation of a breakout that could target $0.36 in the short term.

Momentum indicators, however, paint a mixed picture, with the Relative Strength Index (RSI) currently sitting above 58, suggesting the asset is approaching overbought territory.

At the same time, the Money Flow Index (MFI) hints at slowing inflows, creating the possibility of short-term consolidation before another push higher.

A failure to reclaim $0.28 could trigger a pullback toward $0.20, where strong support has held since mid-October.

Source: CoinMarketCap

Source: CoinMarketCap

Despite potential volatility, market sentiment remains upbeat.

The network’s strong fundamentals and reduced exchange supply continue to draw traders and long-term holders.

Pi’s recovery from its October low of $0.172 to recent highs around $0.29 underscores the renewed optimism surrounding the project.

ISO 20022 integration boosts real-world confidence

Beyond market charts, Pi Network’s ecosystem continues to mature rapidly.

The project’s upcoming ISO 20022 integration, aligned with the global financial messaging standard, is seen as a gateway to real-world adoption.

The move will allow Pi to connect more efficiently with banking systems, potentially enabling SWIFT compatibility for faster and cheaper cross-border transactions.

Built on the Stellar Consensus Protocol (SCP), Pi Network’s blockchain prioritises scalability, security, and energy efficiency.

This technical framework supports regulatory compliance while minimising environmental impact, positioning Pi alongside ISO 20022-compliant assets like XRP and XLM.

Community confidence has also strengthened as Pi’s automated KYC system verified over 3.36 million users, resolving one of the project’s major bottlenecks.

The growing mainnet base now stands at 2.69 million active users, reflecting sustained ecosystem expansion ahead of the November 22 milestone.

Outlook: Can Pi coin sustain its momentum?

The Pi Network price rebound reflects both technical recovery and growing ecosystem confidence.

While short-term traders eye the $0.30 resistance for signs of continuation, long-term observers point to Pi’s steady progress toward financial standardisation and global interoperability.

As the project approaches its ISO 20022 rollout, Pi Network is steadily bridging the gap between blockchain and traditional finance.

But whether the current bullish run holds or pauses for consolidation, the network’s growing user base, tighter token supply, and upcoming integrations suggest that the Pi Network price may be entering a defining phase in its evolution toward real-world adoption.