Fed and ETF Boost Cryptocurrency Market! Institutional Investors Sell Ethereum (ETH), Rush to Bitcoin and These Two Altcoins!

This week, Bitcoin and altcoins are focused on the Fed's October interest rate decision and the meeting between US President Donald Trump and Chinese President Xi Jinping.

At this point, while it is almost certain that the FED will cut interest rates by 25 basis points, BTC and the market started the critical week with an increase.

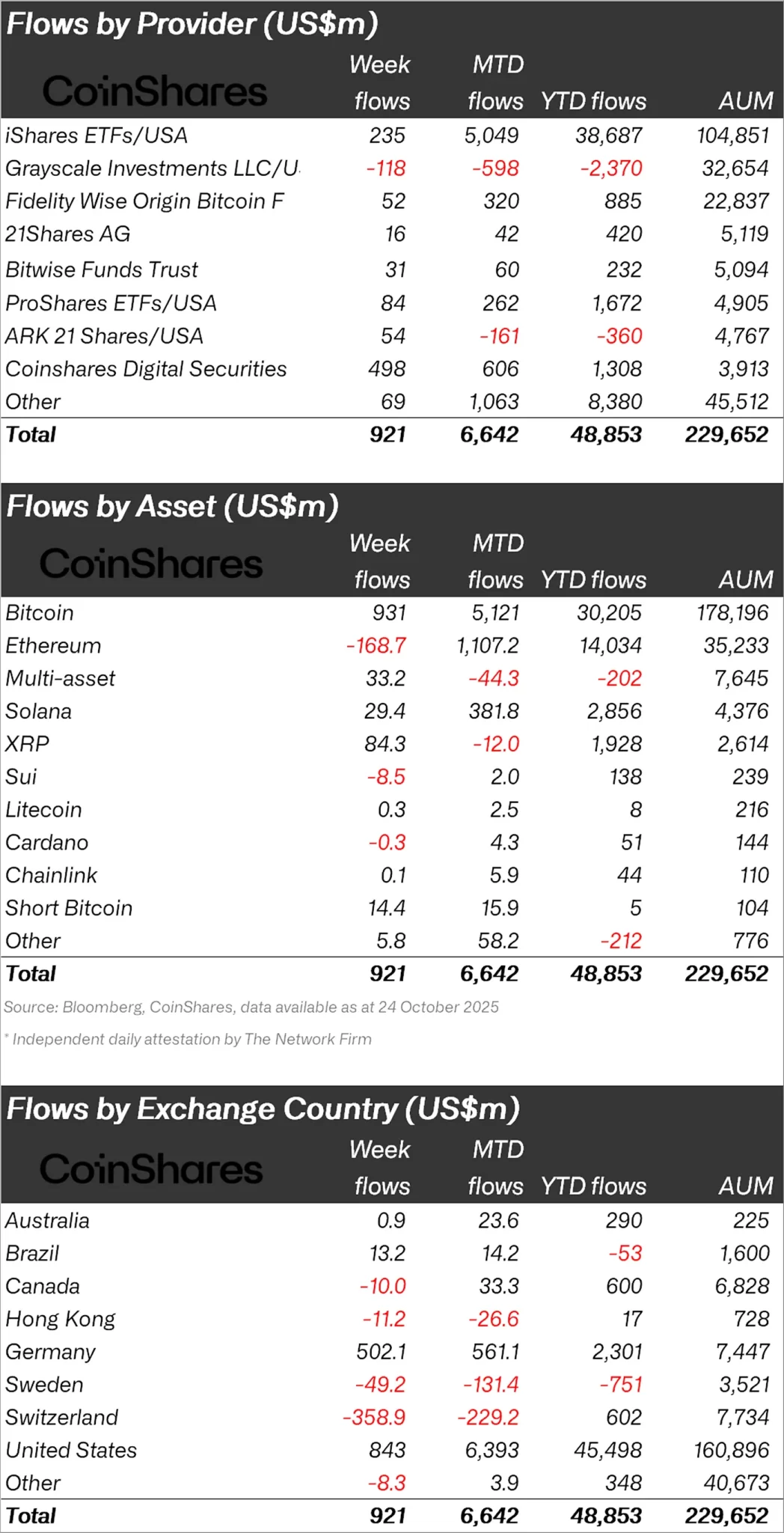

As investors continue to closely monitor market developments with the recovery, CoinShares released its weekly cryptocurrency report and stated that $921 million in inflows occurred last week.

“Following lower-than-expected US Consumer Price Index (CPI) data, investor confidence increased, resulting in an inflow of $921 million into cryptocurrency investment products.”

Bitcoin Enters, Ethereum Exits!

When looking at individual crypto funds, it was seen that the majority of inflows were in Bitcoin.

While Bitcoin experienced an inflow of $931 million, Ethereum (ETH) experienced an outflow of $168.7 million.

When we look at other altcoins, Solana (SOL) experienced an inflow of $29.4 million and XRP $84.3 million, while Sui (SUI) experienced an outflow of $8.5 million.

“A total of $931 million inflows have been made into Bitcoin, bringing cumulative inflows since the US Federal Reserve (Fed) began cutting interest rates to $9.4 billion.

Ethereum saw total outflows of $169 million for the first time in 5 weeks, and daily outflows remained stable throughout the week.

Solana and XRP saw outflows of $29.4 million and $84.3 million, respectively, ahead of their US ETF launches.

When looking at regional fund inflows and outflows, the USA ranked first with an inflow of $843 million.

Following the USA, Germany had an inflow of $502 million and Brazil $13.2 million.

In the face of these inflows, Switzerland experienced an outflow of $358.9 million and Sweden $49.2 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump Wants Interest Rates at 1% by 2026

Trump says interest rates should be 1% or lower by 2026, signaling a major shift if he's re-elected.Trump Pushes for Ultra-Low Interest RatesPlans for a New Fed Chair in 2026Current Fed Policy Points in a Different Direction

Massive $90B Drop Shocks Crypto Market

A sudden crypto market crash wiped out $90B in under an hour, shaking investor confidence and sending prices tumbling.What Happened in the Crypto Market?Why Did the Crash Occur?What It Means for Investors

Firms Now Hold Over 1M BTC in Massive Adoption Shift

Public and private firms boosted Bitcoin holdings from 197K to 1.08M BTC since January 2023.Corporations Are Accumulating Bitcoin at Record PaceWhat’s Fueling the Bitcoin Adoption by Firms?The Road Ahead: Institutional Bitcoin Holdings Could Keep Growing

US Keeps Nasdaq 100 Strategy Intact

Reuters reports that the US strategy remains in the Nasdaq 100, signaling continued confidence in tech‑heavy markets.Continued Confidence in Nasdaq 100What This Means for InvestorsTechnology Stocks Still Driving the Market