Whales Accumulate LINK: On-Chain Data Confirms Strong Buying Pressure

Chainlink’s on-chain data shows a massive whale accumulation phase, with exchange balances plunging and nearly all holders turning net buyers. As technicals align and institutional adoption rises, LINK may be gearing up for a breakout toward $46.

Chainlink is entering an “ideal accumulation zone” as technical indicators, market sentiment, and on-chain data align for a potential breakout.

If the current trend holds, LINK could soon target $23.61 in the short term and $46 in the mid-term, reaffirming its leadership position in the global DeFi oracle sector.

Whales Accumulate LINK, Exchange Supply Hits Record Low

The market is witnessing an unprecedented wave of accumulation from Chainlink (LINK) whales, marking one of the strongest on-chain accumulation phases in recent years.

According to recent on-chain data, massive amounts of LINK have been withdrawn from centralized exchanges.

Over the weekend, a newly created wallet withdrew another 490,188 LINK, worth around $9 million, from Binance. Just one day earlier, the same address had already withdrawn 280,907 LINK. This wallet now holds 771,095 LINK, valued at over $14 million, and may continue accumulating.

Furthermore, a cluster of 39 new wallets has collectively withdrawn 9.94 million LINK, equivalent to $188 million, from Binance. Earlier in the week, the same group also moved 6.2 million LINK (about $117 million) right after the market crash, when LINK briefly dipped to the $15 zone.

This whale activity coincides with the Chainlink Foundation’s recent buyback of 63,000 LINK (worth roughly $1.15 million) on October 24, 2025, as part of its reserve expansion strategy, as previously reported by BeInCrypto.

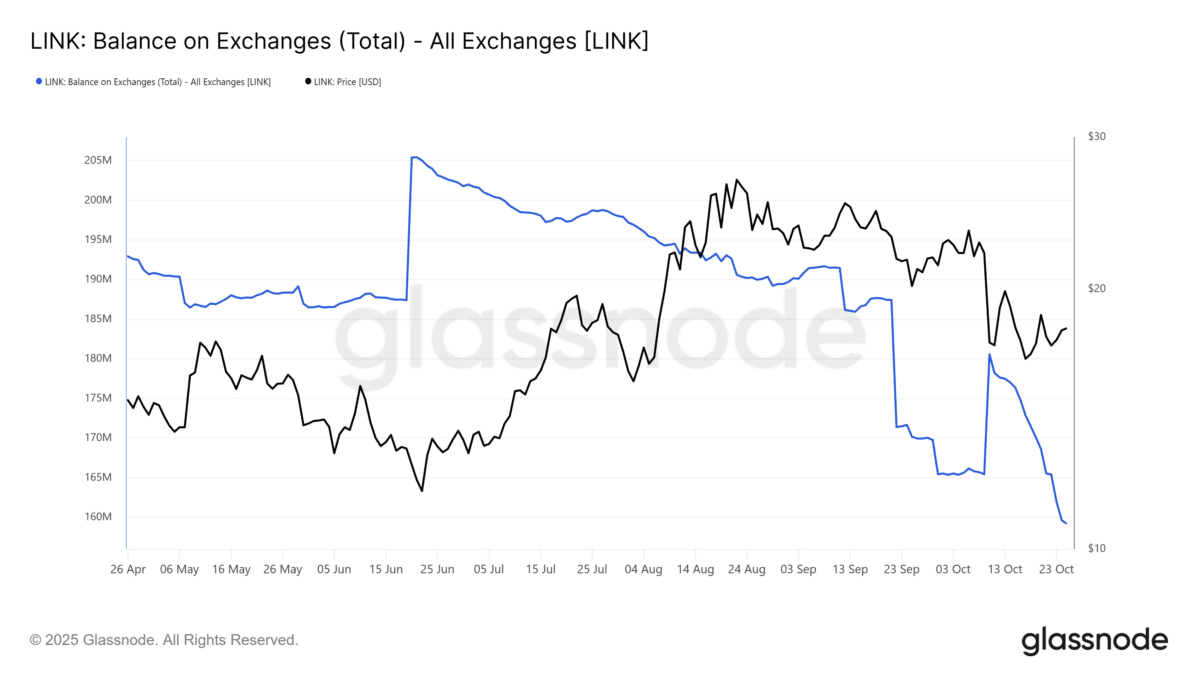

LINK Balance on Exchanges. Source:

LINK Balance on Exchanges. Source:

On-chain data from Glassnode shared on X reveals that LINK’s exchange balance has dropped from 205 million to 160 million tokens since April 2025. The LINK Percent Balance on Exchanges has been at its lowest since December 2022, following the FTX collapse.

LINK: Percent Balance on Exchanges. Source:

LINK: Percent Balance on Exchanges. Source:

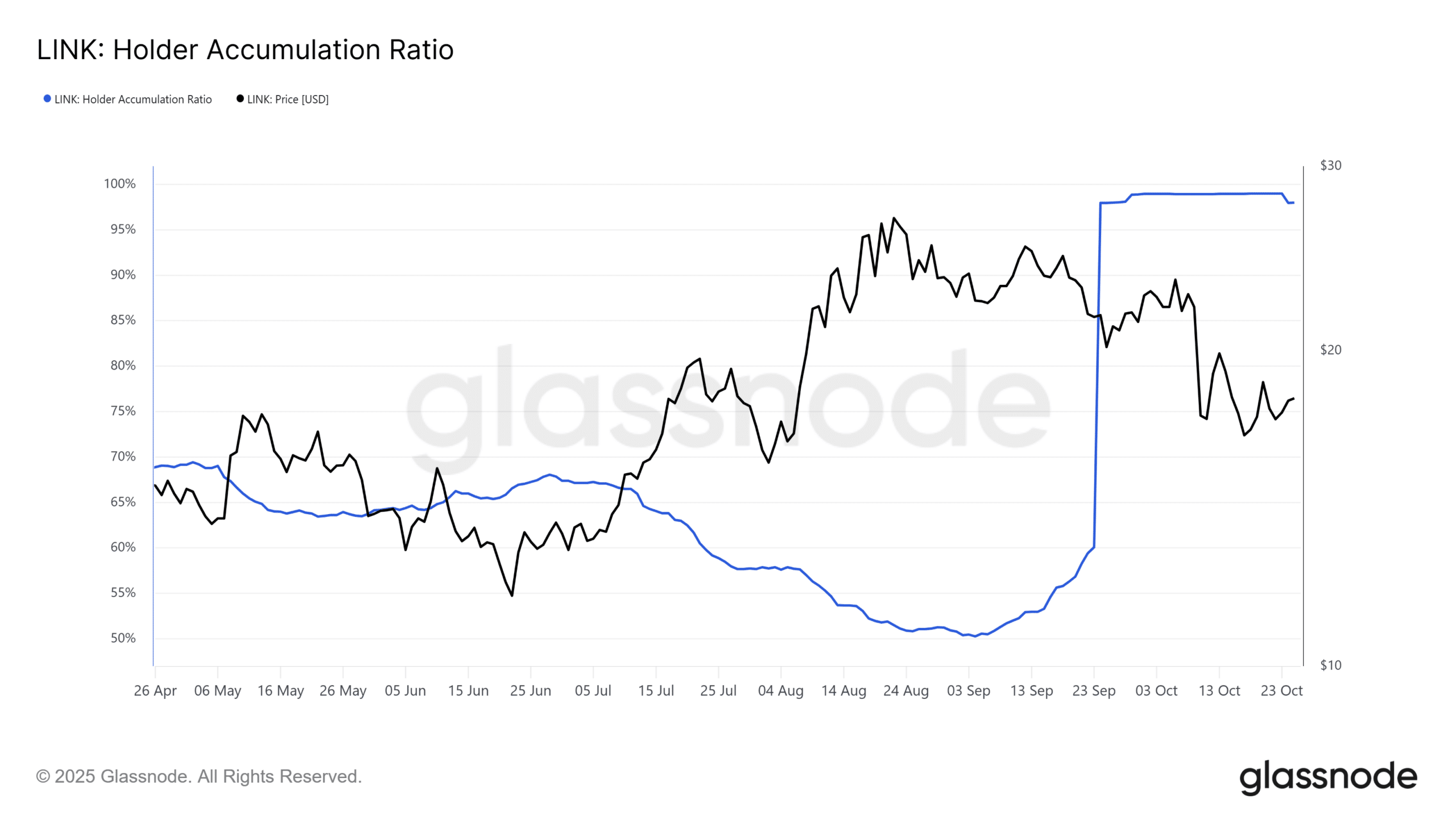

This sharp decline in exchange reserves reflects lower selling pressure and rising accumulation sentiment. The Holder Accumulation Ratio has surged to 98.9%, meaning nearly all active addresses are net buyers, an extremely bullish signal for the market’s long-term direction.

LINK Holder Accumulation Ratio. Source:

LINK Holder Accumulation Ratio. Source:

“If this trend holds, analysts see a possible move toward $46 ahead,” one analyst commented.

Short-term traders betting on a major breakout in LINK’s price view the $46 target as an ideal take-profit zone.

Technical Outlook and LINK Price Scenario

LINK is trading around $18.22 at the time of writing, showing strong signs of a breakout formation. According to market analysts, a sustained break above the descending trendline would be the first confirmation of a bullish reversal.

Once LINK clears $20.19, momentum could expand toward $23.61, aligning with wave 3 of the Elliott Wave structure.

LINK price analysis. Source:

LINK price analysis. Source:

In the short term, the $19.20–$19.70 range remains the nearest resistance area. LINK could aim for the psychological level at $20 and beyond if broken.

This accumulation trend reflects institutional investors’ growing confidence in Chainlink’s decentralized oracle ecosystem. The recent partnership between S&P Global and Chainlink to develop a stablecoin risk rating framework further strengthens the project’s credibility in traditional finance.

However, Chainlink’s next major challenge lies in increasing real token demand through institutional incentive programs and expanded marketing efforts — a key step toward converting its proven technology into sustainable capital inflows.

“The product is a done deal — they’ve already won. Now they need to figure out how to increase demand for the token, or how to attract more retail interest. But the team is full of geniuses and visionaries. They’ll get there,” one analyst remarked.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

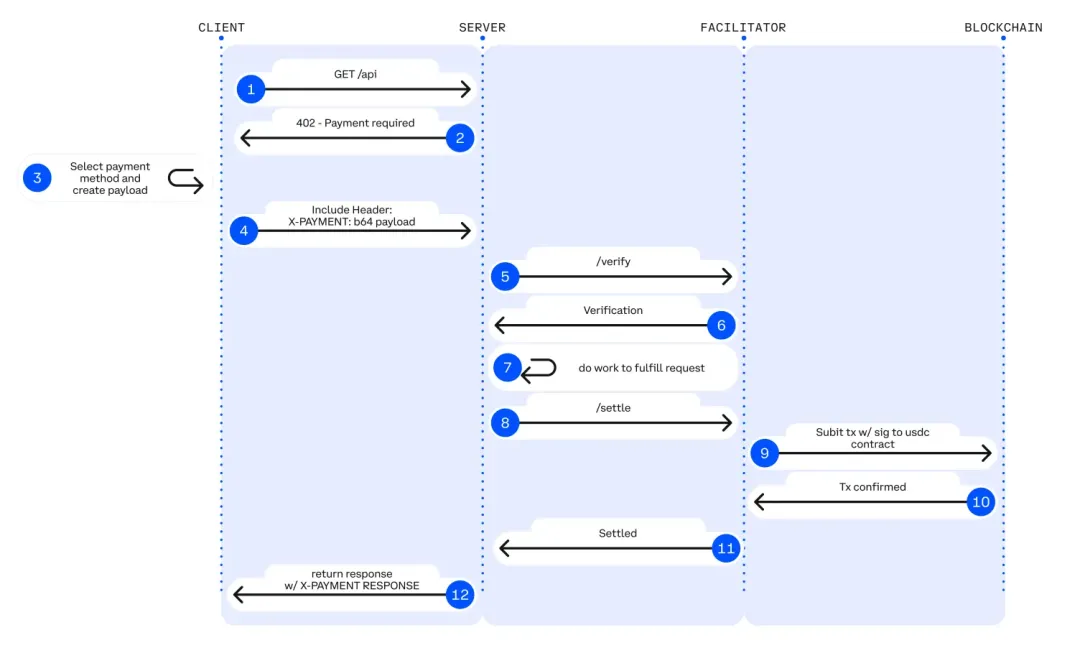

IOSG Weekly Brief|x402 - A New Standard for Crypto Payments by Digital Agents

x402 is a revolutionary open payment standard that activates the HTTP 402 status code to embed payment functionality at the Internet protocol layer. This enables native payment capabilities between machines, driving the transformation of the Internet from an information network to a machine economy network, and creating a value transfer infrastructure for AI agents and automated systems without the need for human intervention.

Exclusive Interview with Aptos Founder Avery Ching: Not a General-Purpose L1, Focusing on a Global Transaction Engine

Aptos is not positioned as a general-purpose L1, but rather as a home for global traders, focusing on being a global trading engine.

Pharos adopts Chainlink CCIP as cross-chain infrastructure and utilizes Data Streams to empower the tokenized RWA market

Pharos Network, a programmable open finance Layer-1 blockchain, announced the adoption of Chainlink CCIP as its cross-chain infrastructure and the use of Chainlink Data Streams to provide sub-second low-latency market data. Together, they aim to build a high-performance, enterprise-grade tokenized RWA solution to drive the large-scale development of institutional asset tokenization.

XRP Holds Strong Above $2.60 as Buyers Maintain Upward Momentum