Key Notes

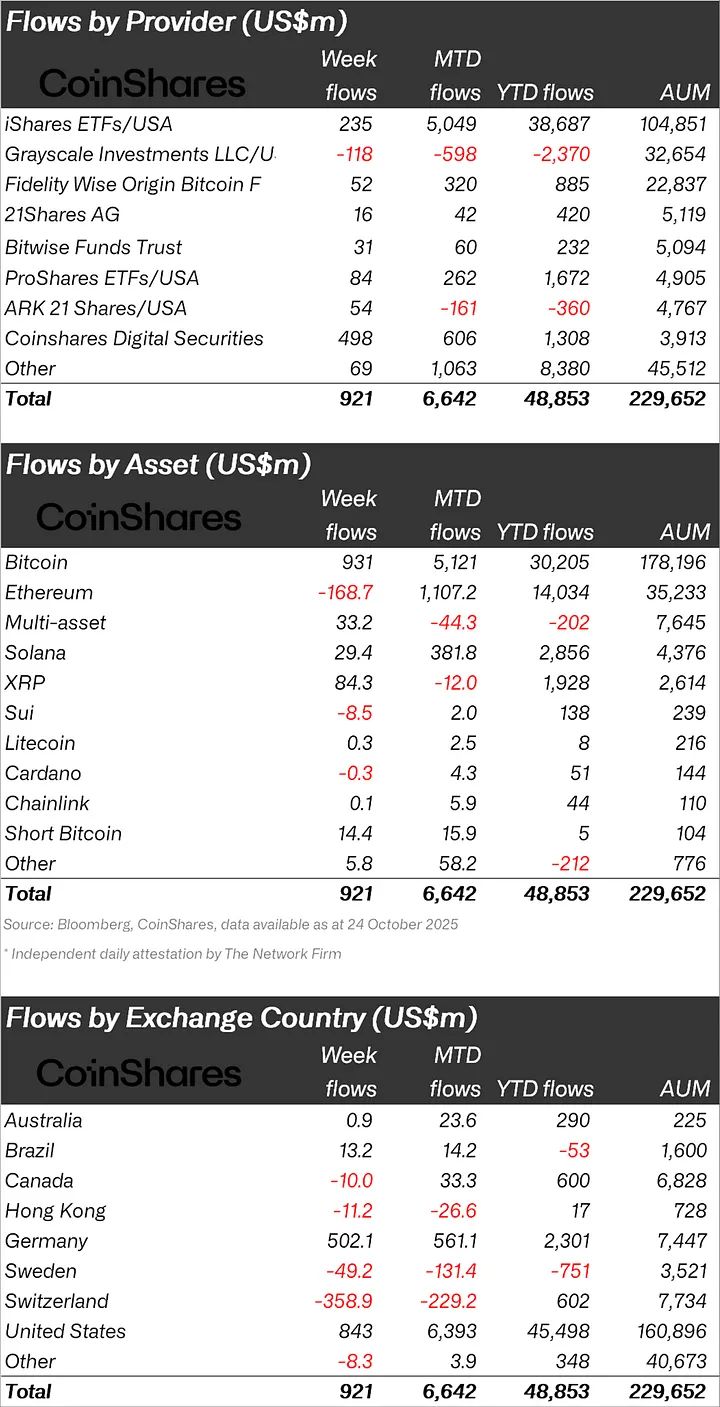

- Digital asset products attracted $921M in inflows last week, reversing the previous week's $513M outflow streak.

- Bitcoin recorded $931M in inflows while Ethereum saw its first outflows in five weeks, totaling $169M.

- The US led regional flows with $843M, while Germany recorded $502M, one of its largest weekly inflows on record.

Digital asset investment products recorded $921 million in inflows last week, marking a reversal from the previous week’s $513 million in outflows.

The figure reflects improved investor confidence following the release of September inflation data, which showed core price increases slowing from prior months.

According to a CoinShares weekly report released October 27, the inflows were driven by lower-than-expected inflation figures that strengthened expectations for additional interest rate cuts this year.

The September 2025 CPI report , released October 24, showed core inflation rose 0.2%, a deceleration from the 0.3% increases recorded in July and August.

The Consumer Price Index for all items rose 0.3% in September on a seasonally adjusted basis. The report noted this data helped restore confidence that further rate cuts remain likely.

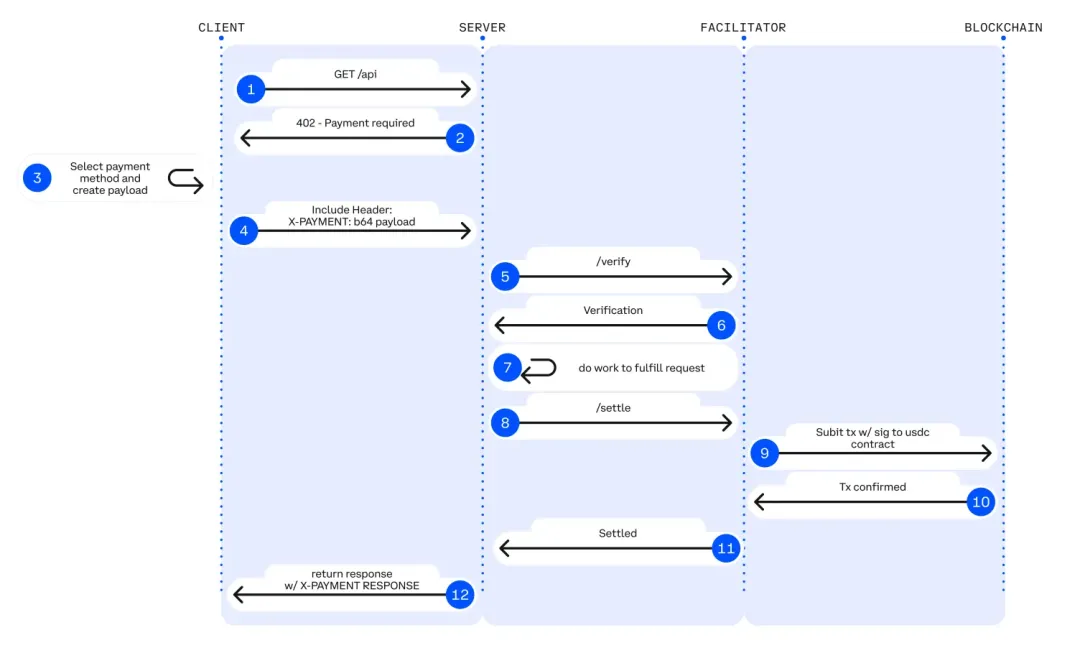

Data released by CoinShares. | Source: CoinShares Report

Bitcoin Dominates While Ethereum Reverses

Bitcoin BTC $114 973 24h volatility: 1.0% Market cap: $2.29 T Vol. 24h: $61.52 B led the week with $931 million in inflows. Cumulative inflows since the Federal Reserve began cutting rates have reached $9.4 billion, with year-to-date flows now standing at $30.2 billion.

Ethereum ETH $4 155 24h volatility: 1.8% Market cap: $501.80 B Vol. 24h: $35.49 B , however, recorded its first outflows in five weeks, totaling $169 million.

Daily flow data from Farside showed Bitcoin ETPs attracted $477.2 million on October 21, followed by $20.3 million on October 23 and $90.6 million on October 24. Global trading volumes remained elevated at $39 billion for the week.

Regional Flow Patterns Show Divergence

The US dominated regional activity with $843 million in inflows. Germany recorded $502 million, identified in the report as one of the country’s largest weekly inflows on record.

Switzerland saw $359 million in outflows, though the analysis clarified this primarily reflected an asset transfer between providers rather than genuine selling pressure.

These institutional flows contrast with recent exchange-level activity, including Binance’s Q3 inflow milestone of $14.8 billion.

The latest flows indicate recovering confidence after mid-October volatility that saw Bitcoin decline from $123,800 to $103,500 between October 10 and October 17.

Coinspeaker analysts tracking the Bitcoin price forecast noted the asset has since rebounded above $113,000, despite a recent Bitcoin price dip on October 22. Year-to-date inflows remain below 2024’s $41.6 billion total.

next