BTC Market Pulse: Week 44

In sum, the market is stabilizing. Selling pressure has eased, leverage has reset, and profitability is improving, but participation and on-chain activity remain muted.

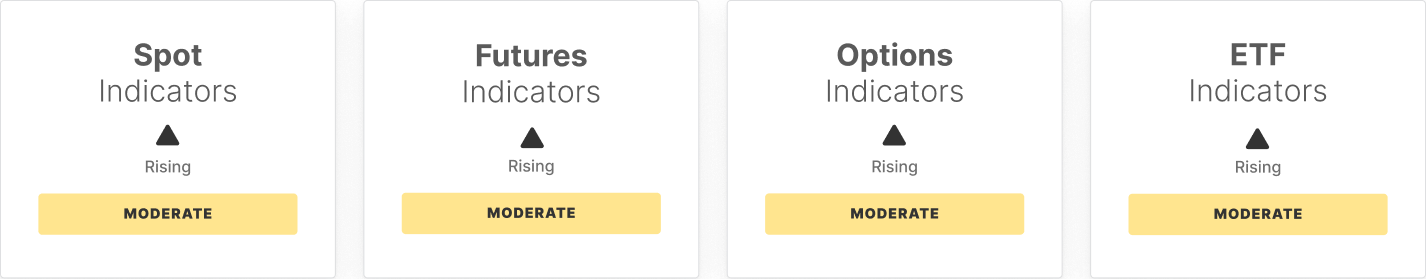

Bitcoin staged a modest recovery over the past week, with price momentum improving after the prior drawdown. Markets remain cautious, but several indicators show stabilization beneath the surface. The RSI has rebounded sharply from oversold conditions, while a significant improvement in both Spot CVD and Perpetual CVD reflects easing sell pressure and the early return of buy-side interest. However, spot volumes have cooled, suggesting that renewed momentum is not yet supported by broad participation.

On the derivatives side, open interest declined further, underscoring a reduction in leverage and a more defensive posture among traders. Yet funding rates have flipped higher, showing that long exposure is once again in demand. Options markets remain active, with open interest expanding and skew moderating as downside hedging pressure eases. Volatility pricing has fallen below realized volatility, signaling a more complacent tone that may set the stage for sharper moves if new catalysts emerge.

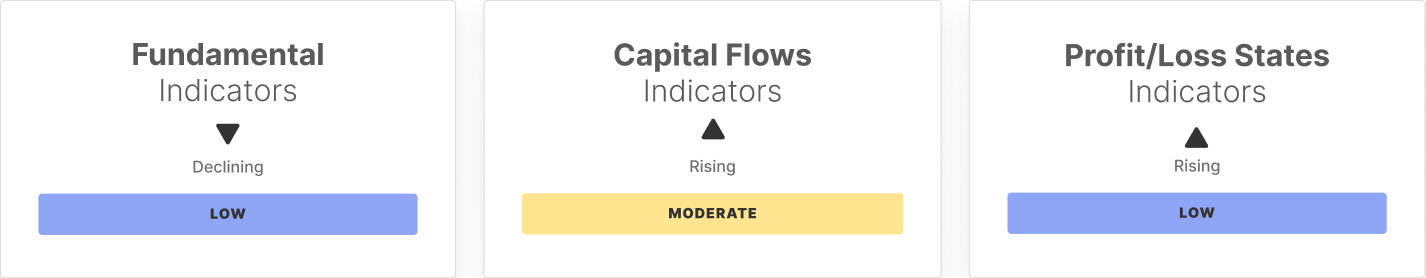

ETF trends were slightly more constructive, as netflows turned positive following last week’s heavy outflows. However, overall trade volumes declined, indicating that institutional engagement remains selective rather than aggressive. On-chain activity softened, with a dip in active addresses, transfer volume, and fees, pointing to a quieter network environment and a consolidating user base.

Profitability metrics improved, highlighted by rising MVRV and a strong rebound in the Realized Profit and Loss ratio back above 1.0. This reflects renewed profit-taking and a healthier market tone. Meanwhile, supply dynamics remain stable, with only a marginal uptick in short-term holder dominance and steady levels of hot capital.

In sum, the market is stabilizing. Selling pressure has eased, leverage has reset, and profitability is improving, but participation and on-chain activity remain muted. Until conviction deepens and demand broadens, Bitcoin is likely to remain in a rangebound consolidation, with cautious optimism beginning to replace defensive positioning.

Off-chain Indicators

On-chain Indicators

🔗 Access the full report in PDF

Don't miss it!

Smart market intelligence, straight to your inbox.

Subscribe now- For on-chain metrics, dashboards, and alerts, visit Glassnode Studio

Please read our Transparency Notice when using exchange data .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Holds Strong Above $2.60 as Buyers Maintain Upward Momentum

Shiba Inu Holds Firm Above $0.00001029 as Market Stability Strengthens

SEI Aims for 50% Gain After Breakout Above $0.2050—Here’s Why

XRP Maintains Stability Near $2.54 as Liquidity Concentration Builds Toward $3.6