Trump brothers’ American Bitcoin snaps up $160 million in BTC, vaulting into top-25 public treasuries

Quick Take The miner and accumulation platform plans to publish “Satoshis per Share” updates to show how much bitcoin backs each share of stock. Executive Chair Asher Genoot said American Bitcoin’s in-house mining gives it a cost edge over firms that only buy bitcoin on the open market.

American Bitcoin Corp., a Nasdaq-listed bitcoin mining and accumulation firm co-founded by Eric and Donald Trump Jr., has added 1,414 bitcoins , worth more than $160 million, to its reserves, pushing it into the top 25 public holders of the asset, according to a release.

As of Oct. 24, the company holds 3,865 BTC, worth nearly $450 million, obtained through mining output and market purchases, some of which are pledged for miner acquisitions under a deal with Bitmain. The total places American Bitcoin just behind Gemini Space Station and ahead of OranjeBTC, according to BitcoinTreasuries data .

The firm also said it will begin publishing updates on a new transparency metric called Satoshis per Share, which divides total satoshis held by shares outstanding to show investors how much bitcoin backs each share.

"We believe one of the most important measures of success for a bitcoin accumulation platform is how much bitcoin backs each share,” said Eric Trump, who posted on X that the team is “just getting warmed up."

Executive Chairman Asher Genoot said integrated mining operations help lower the firm’s average cost per bitcoin compared with peers that buy solely on the open market.

American Bitcoin, which debuted on Nasdaq in September, is majority-owned by Hut 8 Mining and aims to combine mining output with treasury accumulation to grow bitcoin exposure per share.

Shares of ABTC rose nearly 12% on Monday to $6.28, though the stock remains below its Nasdaq debut price of around $8 in early September.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

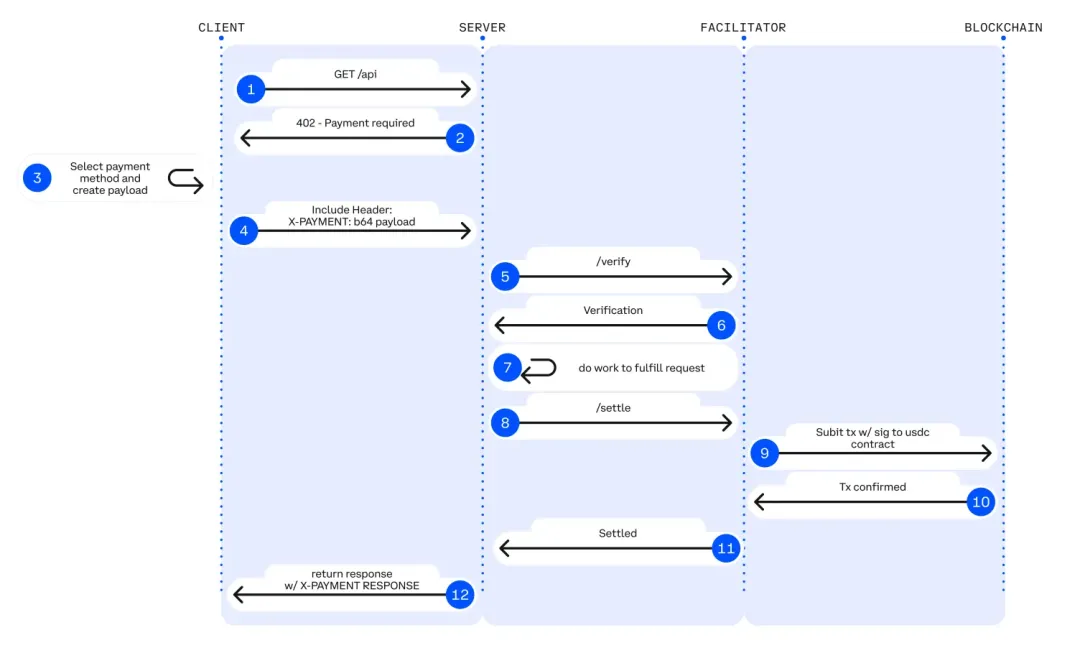

IOSG Weekly Brief|x402 - A New Standard for Crypto Payments by Digital Agents

x402 is a revolutionary open payment standard that activates the HTTP 402 status code to embed payment functionality at the Internet protocol layer. This enables native payment capabilities between machines, driving the transformation of the Internet from an information network to a machine economy network, and creating a value transfer infrastructure for AI agents and automated systems without the need for human intervention.

Exclusive Interview with Aptos Founder Avery Ching: Not a General-Purpose L1, Focusing on a Global Transaction Engine

Aptos is not positioned as a general-purpose L1, but rather as a home for global traders, focusing on being a global trading engine.

Pharos adopts Chainlink CCIP as cross-chain infrastructure and utilizes Data Streams to empower the tokenized RWA market

Pharos Network, a programmable open finance Layer-1 blockchain, announced the adoption of Chainlink CCIP as its cross-chain infrastructure and the use of Chainlink Data Streams to provide sub-second low-latency market data. Together, they aim to build a high-performance, enterprise-grade tokenized RWA solution to drive the large-scale development of institutional asset tokenization.

XRP Holds Strong Above $2.60 as Buyers Maintain Upward Momentum