Canada advances stablecoin framework ahead of next week's federal budget update: Bloomberg

Quick Take Canada has reportedly accelerated work on a stablecoin rulebook and may unveil details in the Nov. 4 federal budget. The push follows broad policy efforts on fiat-pegged cryptocurrencies in areas like the United States, Japan, Hong Kong, and Europe.

Canada is moving swiftly to build a regulatory framework for stablecoins, aiming to include it in the federal budget to be tabled on Nov. 4, Bloomberg reported on Monday, citing sources with knowledge of the matter.

According to the outlet, officials at the Department of Finance Canada and other agencies have held intensive talks over recent weeks with industry stakeholders and regulators.

Discussions have reportedly centered on tackling the bottleneck in classifying stablecoins — whether as securities or derivatives — and on avoiding capital flight to U.S. dollar-backed tokens.

Before today's news, industry voices have been outspoken on the need for clear laws. For example, John Ruffolo, co-chair of the tech lobby group the Council of Canadian Innovators, has warned that delays could erode demand for Canadian bonds, raise interest rates, and weaken the Bank of Canada's control over money supply dynamics. In other words, without domestic options and regulatory clarity, Canadian capital may flow south.

Indeed, clarifying rules for fiat-pegged cryptocurrencies would also undo a long-standing regulatory knot in Canada, as stablecoins have at times been treated as securities or derivatives absent bespoke legislation.

At the same time, U.S. lawmakers have now characterized compliant stablecoins as payment instruments under the GENIUS Act, signed by President Trump in July. Yet, the federal framework still faces opposition. Democratic Senator Elizabeth Warren slammed America's stablecoin rulebook, calling it a "light-touch regulatory framework for crypto banks." Also, Federal Reserve Governor Michael argued that significant gaps exist in the recently passed laws.

Global stablecoin rush

Canada's newfound urgency on stablecoins coincides with global interest in the sector. Europe's Markets in Crypto-Assets Regulation (MiCA) has already implemented rules for issuers, although some market players have labeled the guidelines as stringent. Meanwhile, countries in Asia, from Japan to Hong Kong , are accelerating their own stablecoin policy work.

Amid surging regulatory activity, the stablecoin sector recently neared $300 billion in supply, dominated by U.S. dollar-pegged products from Tether and Circle, The Block's data dashboard shows.

While the new high signals steady demand, experts predict an even bigger expansion in the coming years. Standard Chartered estimates that as much as $1 trillion could exit emerging market bank deposits into U.S. stablecoins by 2028.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Unmissable: Quack AI’s Builder Night Seoul Summit Unites AI and Web3 Leaders on Dec 22

SIA: From a super AI trading platform to a functional on-chain AI ecosystem

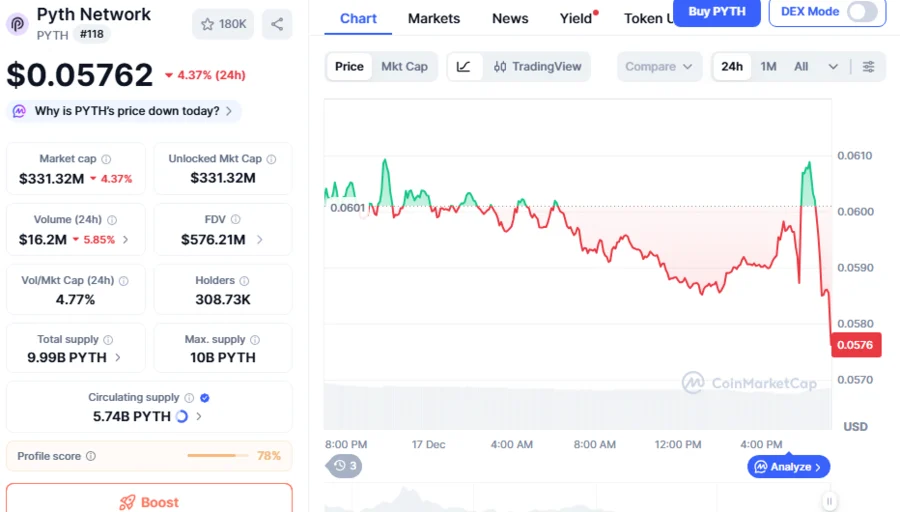

PYTH Drops 76% As Crypto Weakness Persists, Can New PYTH Network Reserve Trigger Market Rally?

Stunning Success: Sport.Fun’s FUN Token Sale Smashes 100% Target in One Day