JPMorgan to Accept Bitcoin, Ethereum as Loan Collateral

- JPMorgan Chase integrates Bitcoin, Ethereum for loan collateral use.

- Shift indicates institutional acceptance of digital assets.

- BTC and ETH gain ground in mainstream financial applications.

JPMorgan Chase plans to allow institutional clients to use Bitcoin and Ethereum as collateral for loans by late 2025, confirmed through business communications and Bloomberg reports.

The move marks a significant shift in JPMorgan’s approach to digital assets, potentially increasing Bitcoin and Ethereum’s integration into institutional finance, despite prior skepticism.

In a pivotal shift, JPMorgan Chase will allow institutional clients to use Bitcoin and Ethereum as collateral for loans by late 2025. This decision marks a significant step in integrating digital assets into traditional financial structures.

The move involves JPMorgan Chase and its partners, setting a precedent for BTC and ETH in mainstream finance. No official announcement yet, but multiple business communications and Bloomberg reports have verified this progress.

The decision to include digital assets impacts both financial markets and institutional investment strategies. BTC and ETH are positioned alongside traditional assets like stocks, bonds, and gold, potentially leading to increased adoption and liquidity.

Financially, the integration creates new credit lines for holders, potentially unlocking additional liquidity. With loan-to-value ratios for ETFs at 25%, a similar framework might apply to direct crypto collateral, impacting credit practices.

Analysts note potential changes for the crypto lending market , with BTC and ETH gaining traction in financial frameworks. Despite limited regulatory commentary, experts suggest this might lead to broader acceptance of digital assets in traditional finance.

Crucially, integrating crypto with JPMorgan’s offerings could boost market stability. Historical parallels with Swiss banks’ practices confirm institutional normalization trends, potentially influencing future regulatory and financial landscapes.

Jamie Dimon, Chairman & CEO, JPMorgan Chase & Co., “I don’t think we should smoke, but I defend your right to smoke… I defend your right to buy Bitcoin, go at it.” Source 1

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

IOSG Weekly Brief|x402 - A New Standard for Crypto Payments by Digital Agents

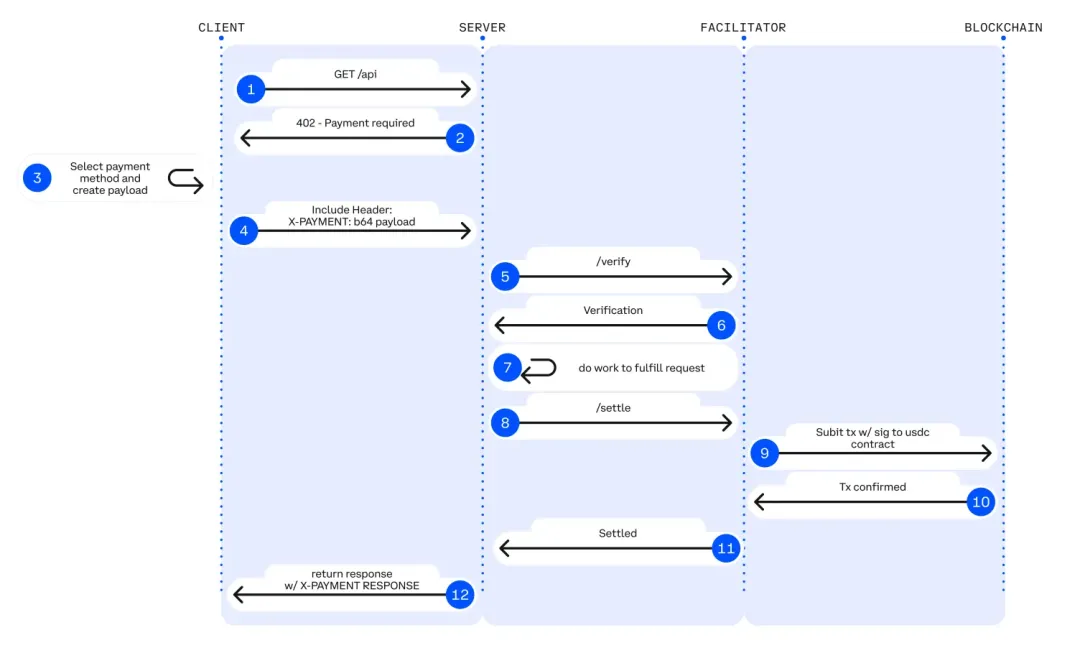

x402 is a revolutionary open payment standard that activates the HTTP 402 status code to embed payment functionality at the Internet protocol layer. This enables native payment capabilities between machines, driving the transformation of the Internet from an information network to a machine economy network, and creating a value transfer infrastructure for AI agents and automated systems without the need for human intervention.

Exclusive Interview with Aptos Founder Avery Ching: Not a General-Purpose L1, Focusing on a Global Transaction Engine

Aptos is not positioned as a general-purpose L1, but rather as a home for global traders, focusing on being a global trading engine.

Pharos adopts Chainlink CCIP as cross-chain infrastructure and utilizes Data Streams to empower the tokenized RWA market

Pharos Network, a programmable open finance Layer-1 blockchain, announced the adoption of Chainlink CCIP as its cross-chain infrastructure and the use of Chainlink Data Streams to provide sub-second low-latency market data. Together, they aim to build a high-performance, enterprise-grade tokenized RWA solution to drive the large-scale development of institutional asset tokenization.

XRP Holds Strong Above $2.60 as Buyers Maintain Upward Momentum