S&P assigns Strategy a junk-bond B-minus rating as analysts see MSTR shares doubling

Quick Take S&P put Strategy in the same speculative-grade bracket as stablecoin issuer Sky Protocol, reflecting shared exposure to liquidity and market-volatility risks. TD Cowen analysts remain upbeat, projecting that Strategy could hold nearly 900,000 BTC by 2027 as bitcoin’s role in traditional finance continues to expand.

S&P Global Ratings has assigned Strategy Inc. — the bitcoin-treasury company formerly known as MicroStrategy — a B-minus issuer credit rating with a stable outlook, placing it squarely in junk-bond territory.

The agency said Strategy’s balance sheet is overwhelmingly tied to bitcoin and that its low dollar liquidity and negative risk-adjusted capital outweigh strong access to capital markets and prudent debt management.

"The company is able to service debt for now, but vulnerable to shocks," Matthew Sigel, head of digital assets research at VanEck, posted on X, reacting to the rating.

S&P said the company's structure creates an inherent currency mismatch, with most assets held in bitcoin while debt and dividend obligations are denominated in U.S. dollars.

The rating matches that of stablecoin issuer Sky Protocol (formerly MakerDAO), which S&P also rated B-minus in August, grouping both entities among high-risk crypto-linked issuers exposed to liquidity and market-volatility shocks.

Despite the speculative tag, TD Cowen reaffirmed its "Buy" rating and $620 price target for MSTR, implying about 114% upside from Friday's close. Analysts Lance Vitanza and Jonnathan Navarrete said Strategy continues to "convert market appetite for volatility and return into bitcoin," noting that bitcoin per diluted share keeps climbing as issuance slows.

TD Cowen expects the firm to hold nearly 900,000 BTC by 2027, more than 4% of the total supply, and said bitcoin’s mainstream integration, from major banks’ collateral programs to a friendlier tone from the Federal Reserve, remains a powerful tailwind.

Earlier Monday, Strategy disclosed the purchase of 390 BTC for $43.4 million, funded through ongoing at-the-market sales of its perpetual preferred stock, bringing total holdings to 640,808 BTC worth roughly $74 billion. The company remains the largest public holder of bitcoin, ahead of Marathon, Twenty One Capital, and Metaplanet.

Shares of Strategy were trading near $298, up 3% on the day, according to The Block's price page .

Strategy MSTR Stock Price Chart. Source: The Block Price Page

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Borrowing the Fake to Achieve the Real: A Web3 Builder's Self-Reflection

Honeypot Finance’s AMM Perp DEX addresses the pain points of traditional AMMs through structural upgrades, including issues such as zero-sum games, arbitrage loopholes, and capital mixing problems. These upgrades achieve a sustainable structure, layered risk control, and a fair liquidation process.

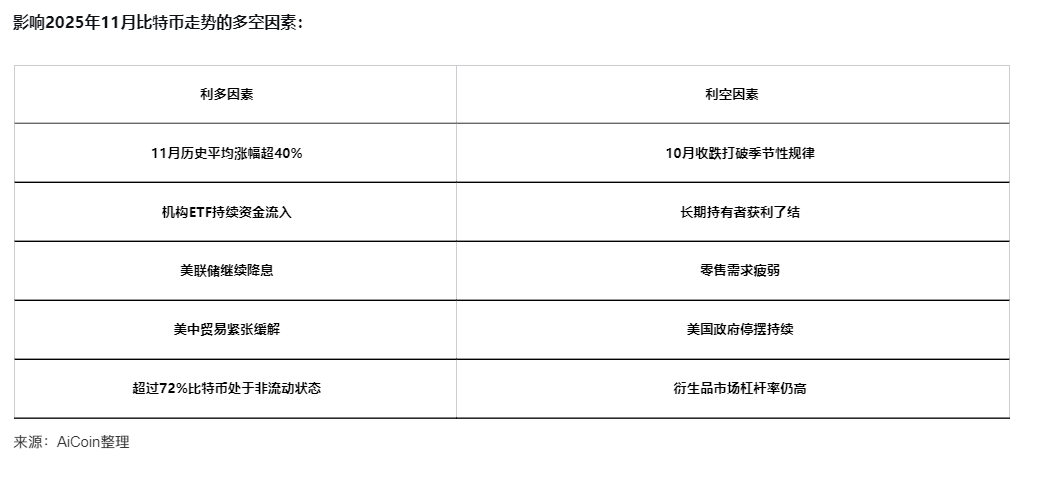

Bitcoin closed lower in October—can November bring a turnaround?

Trump’s Crypto Magic: From “Don’t Know” to a $2 Billion Pardon Spectacle