Government Shutdown, White House Renovation: Who Is Footing the Bill for Trump's $300 Million “Private Banquet Hall”?

The reissued money comes from a "private fundraiser," involving some crypto companies.

Original Article Title: "Government Shutdown, White House Demolition: Trump's $300 Million 'Private Banquet Hall' and Its Crypto Backers"

Original Article Author: Ding Dang, Odaily Planet Daily

While the U.S. government is in a shutdown, the excavator in the White House East Wing is roaring day and night.

U.S. President Trump personally approved this grand demolition operation, not for national security or to make "America Great Again," but to build a privately financed 80,000-square-foot banquet hall next to the White House.

A "Demolish and Rebuild" Ceremony

The White House East Wing, built in 1942, was originally the entrance symbolizing the system and power: the First Lady's Office, the White House Military Office, and the Social Secretary's Office were all located in that modest yet dignified building. For decades, it has been the first door for countless visitors to step into the center of American power. Now, that door is temporarily closed. The White House announced last month, citing banquet hall construction, an indefinite suspension of all public tour activities.

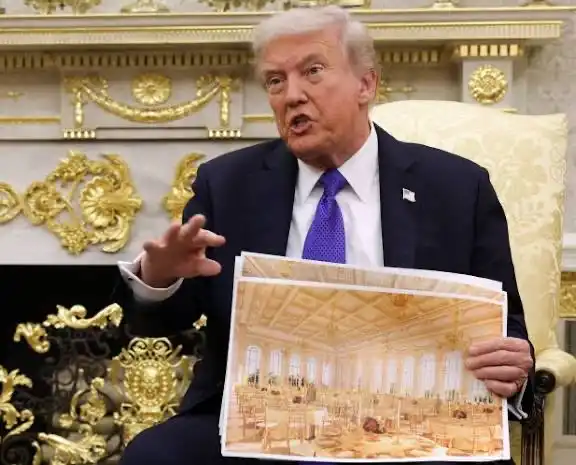

As early as August of this year, Trump proposed to build a new banquet hall at the White House. At that time, he said that the new banquet hall would be "next to but not touching" the existing structure. By October 22, he personally confirmed in the Oval Office: "To correctly complete this work, we must demolish the existing structure," because consulting with architects revealed that demolishing the entire White House East Wing would be more effective than partial demolition. Otherwise, it would damage the new banquet hall, a "very, very expensive, beautiful building." As he spoke, a model of the White House was placed on the table in front of him, with him holding a rendering of the White House banquet hall.

Therefore, the originally planned new banquet hall, designed to accommodate 650 people, ended up being expanded to accommodate nearly a thousand, with the cost increasing from the initial $200 million to around $300 million. A White House spokesperson stated that the East Wing would be "completely" modernized and rebuilt in the end.

Where Is the Money Coming From?

This is not a federal budget expenditure but a "private crowdfunding" event. Trump stated that the $300 million cost would not be borne by taxpayers but by private donors, including himself.

It makes sense, as according to the latest survey by the Financial Times, the Trump family's crypto business has generated over $1 billion in pre-tax profits over the past year. When accounting for mark-to-market gains, their net worth may have increased by billions of dollars. In the face of such financial strength, donations are probably just a public relations expense to "leave a mark in history."

Last week, Trump held a fundraising dinner, stating that he had received donations from some "generous patriots, extraordinary American companies." According to the list of donors released by the White House on October 23, the list includes some of the largest U.S. tech companies, including Amazon, Apple, Google, Meta, and Microsoft. Google's subsidiary YouTube has agreed to contribute over $20 million to the project. Additionally, defense and telecom giants such as Lockheed Martin, Comcast, T-Mobile, and Palantir are also on the list.

Of particular note, the cryptocurrency industry has also made its way onto the White House's donor list. Ripple, Tether America, Coinbase, and the Winklevoss brothers (both Cameron and Tyler appear on the list) are all mentioned. Ripple has become a symbol of the cryptocurrency industry's "anti-regulation" stance due to its long-running legal battle with the SEC; Coinbase has long been navigating the lobbying system in hopes of earning the label of "legitimacy."

Over the past decade, the cryptocurrency industry has touted itself as a "decentralized revolution," opposing the monopoly of traditional power. Now, they have entered a corner of history with a "donation" and have proven through a single bill:

The decentralized future ultimately also needs a center.

Of course, not everyone is thrilled about this reconstruction. "To my mind, this grand banquet hall is a moral nightmare," said Richard Painter, a veteran attorney who served as White House legal counsel in the George W. Bush administration. "It's about raising money through the channels to power... These companies all want something from the government."

The brick wall of the White House East Wing is coming down, and a new hall is being built. In this "rebuilding ceremony," new benefactors are entering the scene. The rules of the Washington game have not changed—it's just that this time, crypto capital has finally received its ticket to enter.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From Spotlight to the Sidelines: The Bubble Burst of 8 Star VC-Backed Projects

Is it because the model is unsustainable, the ecosystem has yet to launch, the competitors are too strong, or is there simply insufficient market demand?

The Next "Black Swan": "Tariff Refund Mega Deal", Wall Street and Individual Investors Are Placing Bets

Individual investors are participating in this game through emerging prediction markets such as Kalshi and Polymarket.

Since the U.S. legislation in July, stablecoin usage has surged by 70%!

After the "Genius Act" was passed in the United States, stablecoin payment volumes surged, with August transactions exceeding 10 billion USD. Nearly two-thirds of this amount came from inter-company transfers, making it the main driving force.

BlackRock Shifts $500 Million Funds to Polygon Network

In Brief BlackRock transfers $500 million to Polygon, enhancing blockchain integration in finance. The move shows increased trust in blockchain-based financial structures. It indicates a trend towards decentralization and long-term structural change in finance.