ZEC ‘Bubble’ Bigger Than 2021, CryptoQuant Data Shows

Zcash (ZEC) is signaling a bubble phase, with current trade volume exceeding 2021 highs, CryptoQuant reports. The analyst warns new retail buyers may face a sharp correction.

Zcash (ZEC) is exhibiting signs of entering an extreme bubble phase, according to a recent on-chain analysis. Current trading metrics exceed those recorded during its 2021 bull run peak.

On Tuesday, Ki Young Ju, CEO of on-chain data platform CryptoQuant, posted the sobering analysis on his X account. In doing so, he warned retail investors about the risks. He bluntly stated, “Sorry, but you’re retail if you’re buying Zcash now.”

CryptoQuant CEO Issues Stark Warning

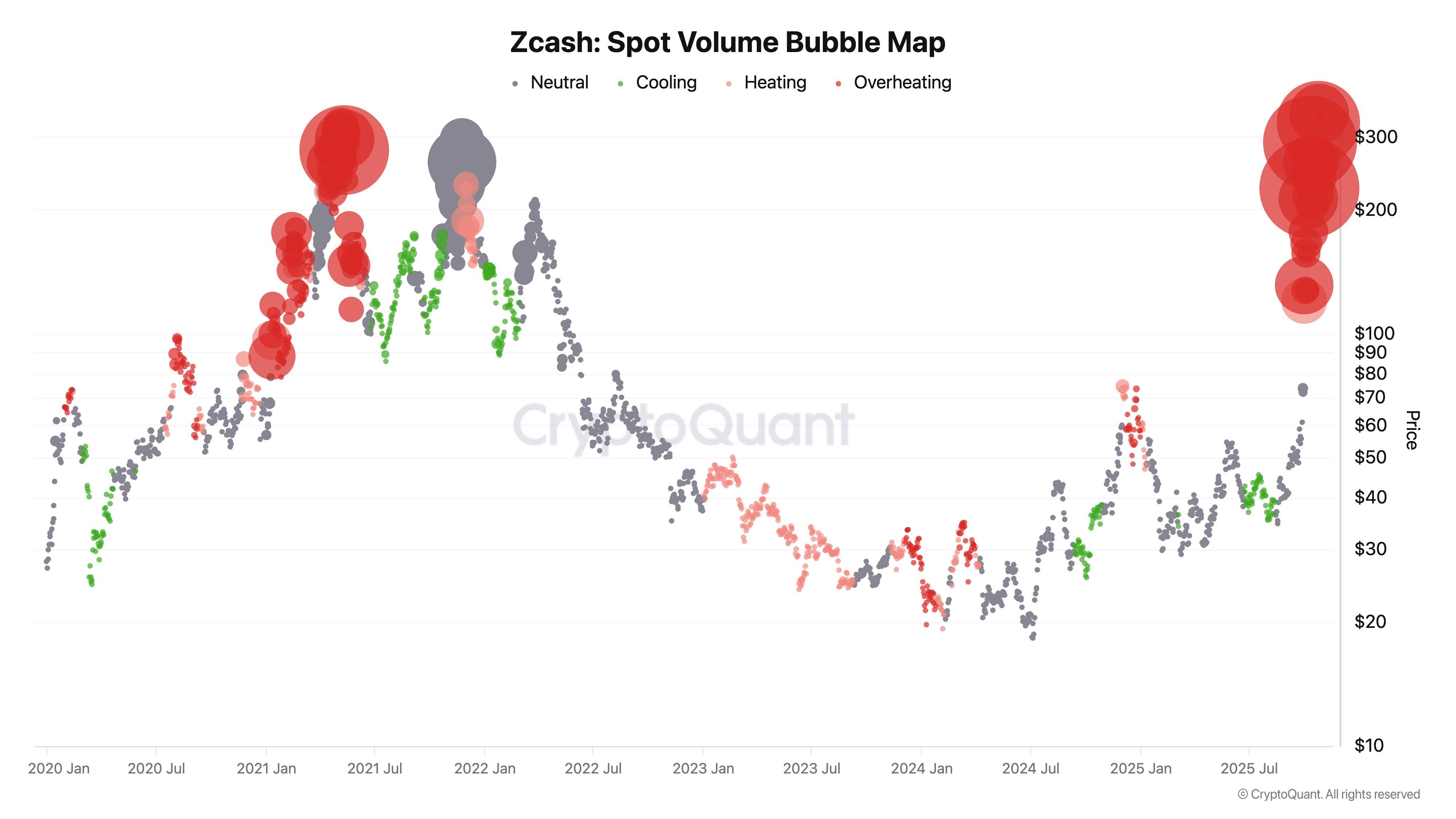

The CEO shared a chart titled ‘Zcash: Spot Volume Bubble Map’ which tracks ZEC’s trading volume against its price since January 2020. In this visualization, the size of the circles indicates trading volume, while the color reflects the volume change rate (cooling, neutral, heating, or hyper-heating).

Zcash: Spot Volume Bubble Map. Source: CryptoQuant

Zcash: Spot Volume Bubble Map. Source: CryptoQuant

The chart’s core interpretation relies on spotting a Distribution Phase. This phase is late in a bull cycle when trading volume is exceptionally high, but price appreciation is slow. This signifies that new investors are entering the market, leading to a massive turnover, or “handover,” of tokens from seasoned holders.

The chart shows a sharp period of high turnover that lasted about six months during the first half of 2021, when ZEC surged toward $300 per coin. This phase ultimately preceded a market-wide downcycle, which led to a price collapse and major losses for investors who bought ZEC at the end of the rally.

Current Metrics Surpass 2021 Peak

The most alarming finding is that the latest ZEC trading volume and price action register a larger bubble size than the one seen in the first half of 2021. If the broader cryptocurrency market is indeed in the final stage of its cycle, the analyst warns that a repeat of the 2021 collapse is highly possible.

ZEC has attracted massive attention recently, soaring by over 750% in the last three months. The cryptocurrency’s seemingly inexplicable rally has spurred price increases across the entire privacy coin sector.

High-profile figures have amplified the speculative frenzy surrounding ZEC. Former BitMEX CEO Arthur Hayes posted on X on October 26 that he expects the ZEC price to climb to as high as $10,000 per coin. At the time of this report on Tuesday, ZEC is trading around $328, up from $308 when Hayes made his prediction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fueling the Expansion of DeFi: Three Initiatives Transforming Perp DEX Airdrop Strategies

- Perp DEX airdrops drive liquidity and engagement via tokenomics, yield, and community incentives. - StandX's DUSD stablecoin automates yield generation through staking rewards and futures fees while maintaining USD peg. - Bitget's referral program offers 80,000 USDT in rewards to incentivize copy trading and user acquisition. - LoRa Alliance's network upgrades enhance IoT efficiency, indirectly supporting DeFi infrastructure scalability. - These projects demonstrate how innovative airdrop strategies and

Solana News Today: Investors Abandon Bitcoin ETFs in Favor of Solana's Attractive Staking Returns

- Bitcoin ETFs saw $488M outflows led by BlackRock's IBIT , while Solana ETFs gained $44.48M as investors rotated into staking yields. - Coinbase reported $1.9B Q3 revenue driven by trading volumes and expanded staking services, contrasting ETF volatility. - Zynk secured $5M seed funding to develop stablecoin-based cross-border payment infrastructure, targeting USD/EUR/AED corridors. - Analyst Peter Brandt warned Bitcoin could test $60K support, but IBIT's $88B AUM suggests long-term ETF demand remains str

Ferrari's 499P Token: Enhancing Customer Loyalty in the Digital Era

- Ferrari launches Token 499P NFT with fintech Conio, targeting Hyperclub members for auction bids and exclusivity. - Q3 2025 results show €382M net income and €670M EBITDA, surpassing forecasts amid strong high-end model demand. - Strategy emphasizes loyalty through digital assets, with EU regulatory approval pending for the limited-edition token. - Project combines heritage with innovation, reflecting Ferrari's resilience after September market skepticism and regained investor confidence.

Noomez's Presale: Creating Rarity to Survive Meme Coin Volatility

- Noomez ($NNZ) launches 28-stage presale with fixed pricing and liquidity locks to mitigate meme coin risks. - 15% liquidity locks and third-party audits enhance trust, while real-time on-chain tracking ensures transparency. - Stage-based airdrops and referral bonuses incentivize participation, aligning with 2025 crypto trends. - Despite volatility concerns, structured deflationary design aims to sustain value, with 50% supply allocated to presale success.