New crypto ETFs tracking Litecoin, Hedera and Solana generate $65 million in day-one trading volume

Quick Take The first ETFs to track the spot price of Litecoin and HBAR made their debuts on Tuesday, along with a new staked SOL fund. As of Oct. 20, there were 155 cryptocurrency-based ETP filings tracking 35 different digital assets, led by Solana and Bitcoin.

Three altcoin exchange-traded funds made their Wall Street debuts on Tuesday amid the land rush of crypto filings waiting to hit the market.

Canary Capital's Canary Litecoin ETF (ticker LTCC) and Canary HBAR ETF (HBR) — the first funds to track the spot price of the Litecoin and Hedera tokens — along with the Bitwise Solana Staking ETF (BSOL), went live for trading. The latter is the first U.S. ETP with 100% direct exposure to SOL, according to the firm, which aims to stake 100% of its SOL holdings in-house.

The funds generated a cumulative trading volume of $65 million, with BSOL accounting for the majority. Within the first hour of trading alone, BSOL hit $10 million in volume, HBR $4 million, and LTCC $400,000, Bloomberg senior ETF analyst Eric Balchunas said in a post on X.

In fact, BSOL's $56 million volume is the most of any ETF launch this year.

"And what's amazing is it seeded with $220m. It could have invested seed on Day One, which would have resulted in $280m-ish, would be even more than $ETHA's debut. Strong start either way," Balchunas said.

Last month, the first two U.S. ETFs to offer spot exposure to XRP and Dogecoin generated $55 million in combined day-one volume. Last year, nine spot ETH ETFs generated over $1 billion in trading volume on the first day.

Before the U.S. government shutdown that went into effect Oct. 1, dozens of crypto ETFs were gearing for the final SEC sign-off. The SEC released new guidance following the shutdown, outlining how companies can go public. The SEC said firms can now file an S-1 registration without a "delaying amendment," which normally prevents an offering from automatically taking effect after 20 days. Under the new process, the S-1 must be final, and any changes restart the 20-day countdown. Companies must also file a Form 8-A.

As of Oct. 20, there were over 150 cryptocurrency-based ETP filings tracking 35 different digital assets, according to Bloomberg . Leading the list are SOL- and BTC-based proposals at 23 apiece, followed by XRP and Ethereum. "Could easily end up seeing over 200 hit mkt in next 12mo. Total land rush," Balchunas said.

HBAR is the native token of Hedera, a decentralized public network that utilizes the Hashgraph consensus algorithm to facilitate fast and secure transactions. The token was up 11% over the past 24 hours, according to The Block's HBAR price data , and at one point was up nearly 30%. Meanwhile, the price of LTC was down about 2.6%.

Spot crypto ETFs first hit Wall Street in January 2024 with the debut of Bitcoin funds , followed in July by Ethereum funds . Those ETFs have accumulated a combined $175 billion in assets under management.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Base Founder Jesse Pollak Reveals His Bitcoin Price Prediction for 2026

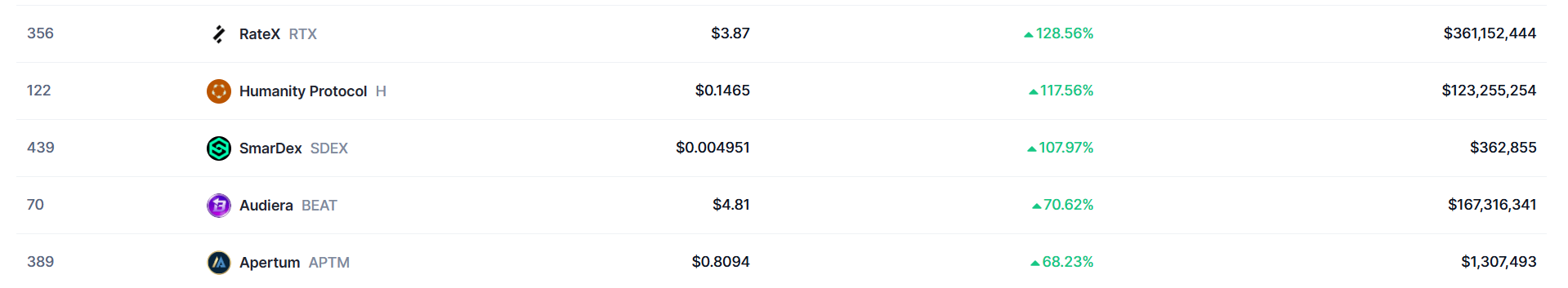

Top 5 gainers of the week (December 15-22): RTX, H, SDEX, BEAT, APTM

Brazil’s Crypto Market Surges 43% in 2025 as Adoption Skyrockets