Analyst Says Ethereum Will Soon Explode, But Shares Why He Thinks XRP May Outperform

A market analyst has suggested that while Ethereum would soon explode, XRP will likely outperform the king altcoin in the near future.

This daring commentary came from CryptoBull, a prominent market watcher, on the back of the latest market recovery push. Notably, while Ethereum (ETH) recovered 9.57% to over $4,200 on Oct. 27, XRP saw a more substantial 11% rebound to $2.69 within the same period.

However, following their respective highs, both assets have since collapsed considerably. As a result, ETH is only up 1.4% from its Oct. 22 lows, while XRP has maintained a 6.1% gain, still holding firm above the pivotal $2.5 level.

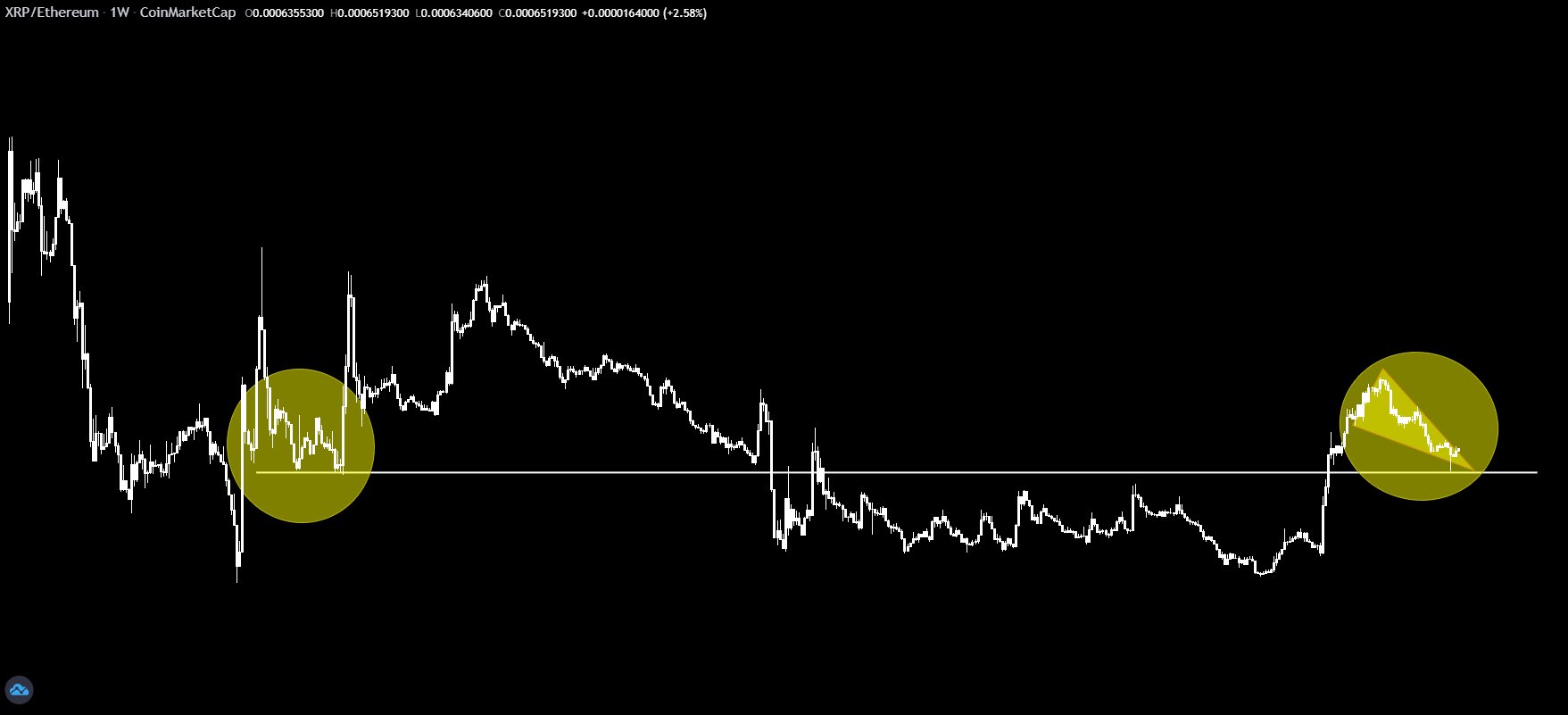

Data from the accompanying chart shows that the XRP dropped against Ethereum in late November and early December 2017, leading to a test of this support trendline twice when the XRPETH pair collapsed to lows around 0.00048 at the time.

Interestingly, this test was actually a bullish indicator, as XRP recovered against Ethereum almost immediately after it occurred. With XRP price soaring to new heights in the following months, the XRPETH pair skyrocketed, reaching a peak of 0.003850 by late December 2017. This coincided with an XRP price of $2.85 at the time.

Despite a correction from this peak, the XRPETH pair remained above the support trendline until December 2020, when XRP collapsed on the back of the SEC lawsuit against Ripple. The pair dropped below this trendline as XRP underperformed compared to ETH.

XRP Retests Support Trendline Against Ethereum

However, in November 2024, XRP recovered, leading to the XRPETH pair rebounding above the trendline for the first time in two years. Interestingly, the pair has remained above the line since then, but recently witnessed another retest during the latest market pullback. This retest was similar to the one observed in November and December 2017.

As a result, CryptoBull suggests that XRP may be on track to replicate the December 2017 rally against Ethereum. He also called attention to the fact that the recent retest of the trendline occurred with XRP reaching the apex of a falling wedge against Ethereum. Such falling wedges often break to the upside.

“XRP may outperform in the near future with Ethereum following,” the market analyst remarked, considering these indicators. However, he insisted that only time will tell. Interestingly, another analyst, CryptoInsightUK, also highlighted a bullish divergence for XRP against Ethereum in August, suggesting that a breakout was close.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Is dropping below $100,000 just the beginning? Bitcoin "whales" have dumped $4.5 billions in one month, and the sell-off may continue until next spring

This wave of sell-offs may continue until next spring, and bitcoin could further drop to 85,000 dollars.

Galaxy Research Report: What Is Driving the Surge in Zcash, the Doomsday Vehicle?

Regardless of whether ZEC's strong price momentum can be sustained, this market rotation has already succeeded in forcing the market to reassess the value of privacy.

Soros predicts an AI bubble: We live in a self-fulfilling market

When the market starts to "speak": an earnings report experiment and a trillion-dollar AI prophecy.

Soros predicts an AI bubble: We live in a self-fulfilling market

The article uses Brian Armstrong's behavior during the Coinbase earnings call to vividly illustrate George Soros' "reflexivity theory," which posits that market prices can influence the actual value of assets. The article further explores how financial markets actively shape reality, using examples such as the corporate conglomerate boom, the 2008 financial crisis, and the current artificial intelligence bubble to explain the workings of feedback loops and their potential risks. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively improved.