Solana’s User Drop Meets $50M Western Union Bet: Bold Adoption Play or Expensive PR?

As Solana faces a steep decline in active users, its $50 million Western Union partnership divides the crypto community. While some see strategic potential ahead of a possible Solana ETF, others warn the network must prove it can turn partnerships into genuine, lasting adoption.

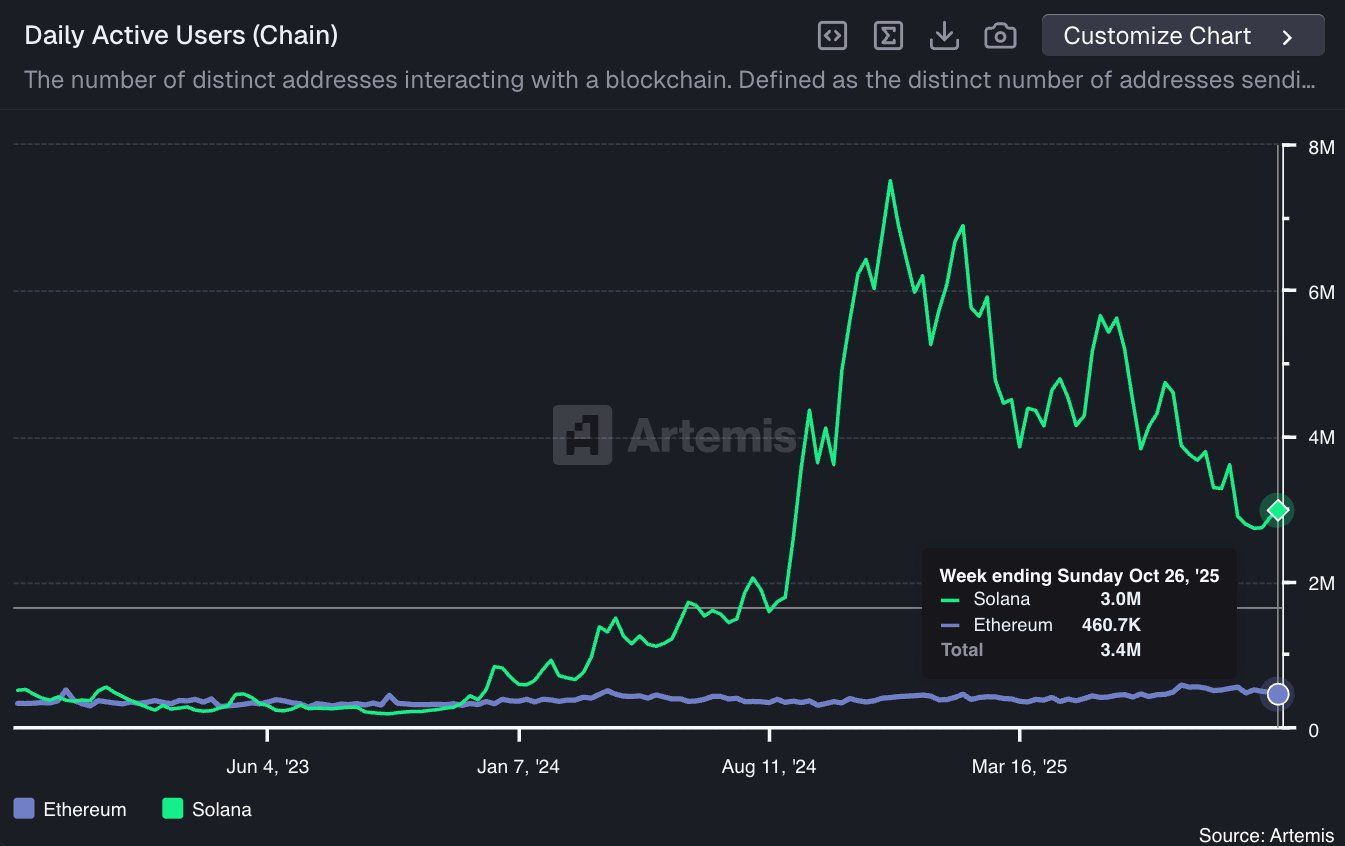

After a year of impressive growth in 2024 and a subsequent 60% drop in the network’s daily active addresses, Solana is now facing one of its most turbulent periods since rising to the ranks of top-tier blockchains.

Now, rumors of a $50 million deal with Western Union for a six-month partnership have split the community. Is this a strategic move to expand real-world payment adoption — or just an expensive PR play as Solana’s on-chain activity cools off?

The Reality Behind the 60% Decline: What Is Solana Losing?

From a technical perspective, the 60% drop in daily active users is more than a statistical dip; it signals deeper structural issues. The decline may stem from higher fees during network congestion, a still-clunky wallet experience, and increasingly aggressive MEV (Maximal Extractable Value) attacks targeting retail users.

Solana daily active addresses. Source:

X

Solana daily active addresses. Source:

X

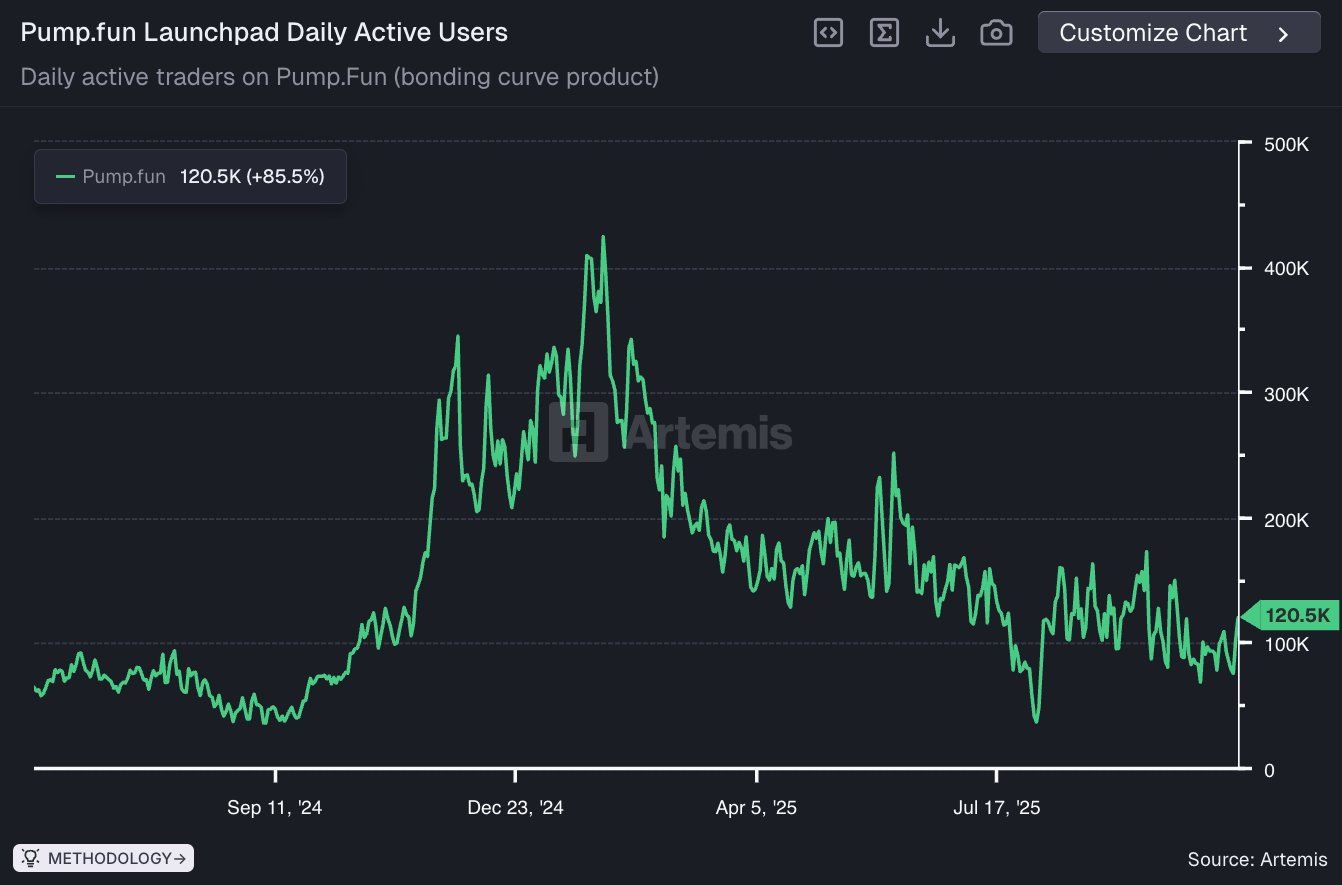

According to Haseeb, this decline may also be linked to Solana‘s fading meme coin frenzy. Daily active users on Pump.fun (PUMP), once the center of Solana’s meme coin boom, has fallen to around 120,000.

Pump.fun daily active user. Source:

X

Pump.fun daily active user. Source:

X

In this context, some users argue that SOL’s recent price strength is merely bot-driven rather than backed by real network growth. In their view, Solana is “running on hype” and could lose momentum once actual usage data is revealed. Haseeb partially agrees but remains optimistic about the long-term shift.

“Solana is moving from being memecoin-centric to focusing more on DeFi like every other successful chain. Healthy transition.” Haseeb commented.

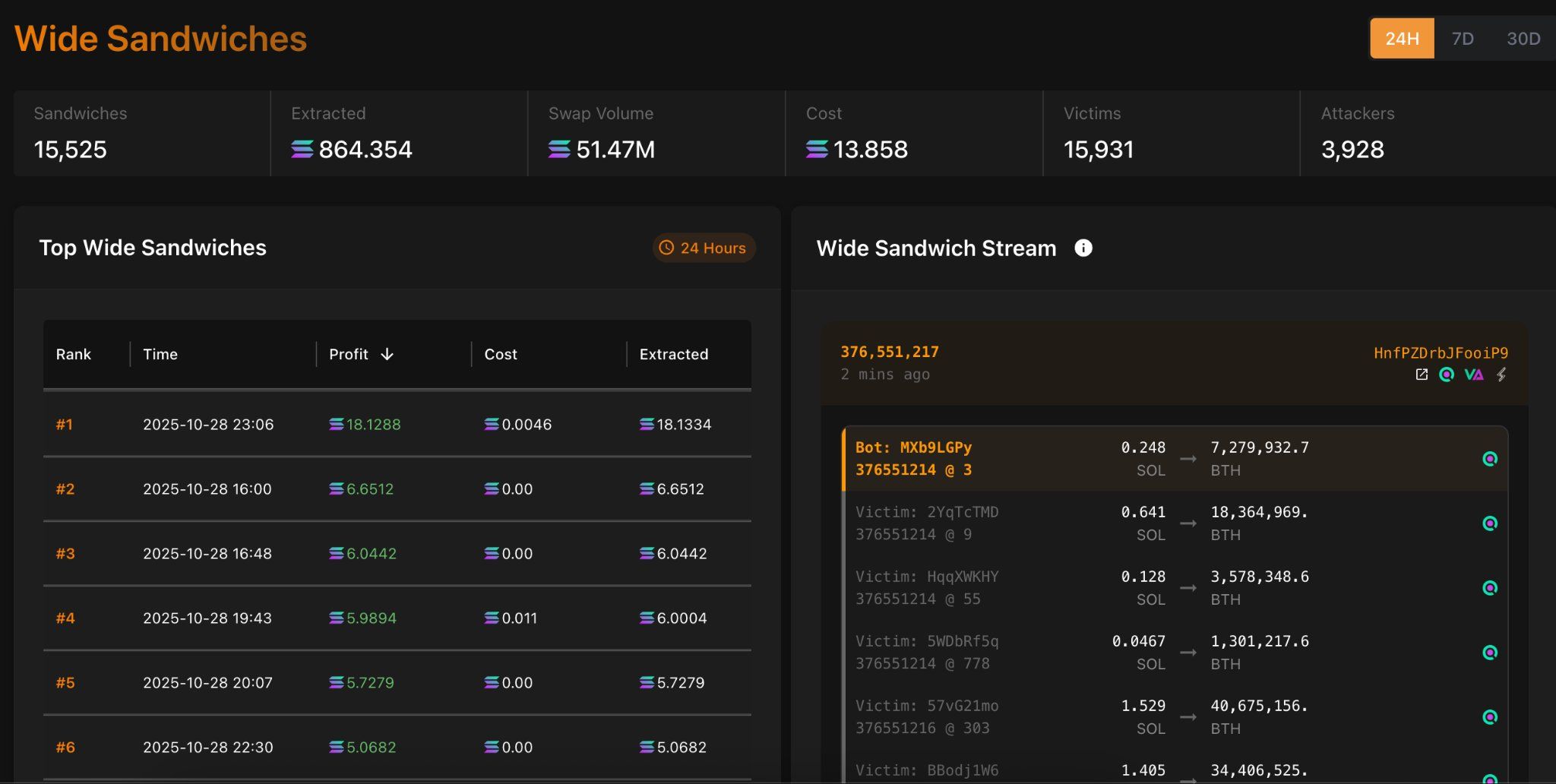

Still, another analysis on X highlighted the rise of sandwich attacks on Solana, a type of MEV exploitation where bots front-run trades, manipulate prices, and capture user slippage. This undermines trust and creates a perception that the network favors sophisticated actors over regular users. For Solana, rebuilding retail trust is now as critical as its technical roadmap.

Sandwich attacks on Solana. Source:

X

Sandwich attacks on Solana. Source:

X

The $50M Solana Western Union Deal: Strategic Leap or Mistimed Move?

The community’s latest flashpoint is the $50 million Solana Western Union deal, reportedly split between $25 million in cash and $25 million in liquidity incentives over six months. Some observers call it a “marketing gamble,” given that Western Union, a legacy financial giant, is viewed by many in the crypto space as a fading relic of centralized finance.

“Western Union is a centralized predator that is slowly dying, a dinosaur that built its empire on friction and exorbitant fees, and we didn’t spend a decade building onchain financial infrastructure just to hand the keys back to them.” One user commented.

Others even predict that Western Union could go bankrupt before moving any meaningful volume on Solana, reflecting the crypto community’s skepticism toward traditional institutions entering blockchain.

However, some analysts take a more balanced stance. As Ryan pointed out, every ecosystem spends capital to activate partnerships, grow user bases, and generate visibility.

In that light, the Solana’s Western Union deal could be a calculated move, especially as Fidelity recently filed its final S-1/A with the SEC for a Solana ETF, signaling growing institutional attention toward the network. Collaborating with a globally recognized payment brand might lend Solana greater legitimacy ahead of potential ETF approvals and future inflows.

“The whole Solana paid Western Union is tiresome. Foundations have treasures to activate partners within their network. You have no idea what the deliverables are, so you’re unable to measure the ROI of these deals. Let me tell you: EVERY ecosystem is competing and putting $ up.” Analyst shared.

Still, the fundamental question remains: Will this deal bring real users and sustainable volume? Suppose it ends as a PR campaign without measurable on-chain traction. In that case, Solana’s core problem, shrinking user engagement, will persist, exposing it to competition from newer, faster-growing blockchains like Sui, Aptos, and Base.

Technical Momentum and the Crossroads Ahead

From a technical analysis standpoint, SOL remains structurally bullish in the medium term. Analysts note that Solana’s chart resembles its setup from Q4 2023, with strong support near $194 and potential upside toward $295–$400, provided the trend holds. Adding Solana to institutional ETF portfolios could further boost sentiment and liquidity.

SOL analysis. Source:

X

SOL analysis. Source:

X

Yet, beneath the bullish narratives lies a more brutal truth. Solana is at a crossroads — balancing big-ticket partnerships like Western Union against the Reality of declining organic users. The blockchain’s next phase will depend on whether it can turn hype into sustainable adoption, attract genuine retail activity, and reinforce trust in its ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trade Pause Prevents Further Tensions, Yet U.S.-China Technology Dispute Remains Unsettled

- U.S. and China announce "Busan Truce" at APEC summit, agreeing to cut tariffs, stabilize supply chains, and resume U.S. agricultural exports to China. - Tech tensions persist as U.S. maintains AI chip export bans on China, while China suspends investigations into U.S. semiconductor firms. - Global markets rise on trade optimism, but analysts warn past agreements like 2020's Phase One deal have failed due to noncompliance and geopolitical friction. - U.S. farmers gain short-term relief with China pledging

Walmart’s performance-based compensation approach ensures that managers’ interests are closely tied to the company’s achievements

- Walmart offers top U.S. store managers up to $620k annually, including stock grants, to align their interests with company performance and boost retention. - The 2024 compensation overhaul raised regional manager salaries to $160k and contributed to a 10% improvement in hourly worker retention over a decade. - CEO John Furner emphasized "owner-like" incentives, with shareholding influencing profit management, as Harvard Business School studies the strategy's business outcomes. - Walmart's approach mirror

Bitcoin Updates Today: Bitcoin Reaches Critical Juncture: Can Fed Rate Reductions Ignite a Surge or Lead to Further Decline?

- Bitcoin fell below $110,000 amid Fed’s 25-basis-point rate cut and end of quantitative tightening, sparking macroeconomic concerns despite expected 2026 easing. - Coinbase’s $1.05B Q3 profit highlights sector resilience, but Bitcoin’s technical outlook remains fragile with critical support at $105,400–$103,800. - Analysts predict two short-term scenarios—post-FOMC rebound to $109,000–$110,000 or pre-meeting retracement toward $120,000—amid diverging views on Fed’s 2026 trajectory. - Market uncertainty pe

Ethereum News Update: Ethereum's Triangle Formation Hits Critical Juncture: Bulls and Bears Face Off in Intense Battle

- Analysts predict Ethereum could reach $4,500 by year-end as it consolidates in a tightening symmetrical triangle pattern. - Price oscillates between $3,850–$3,900, with key breakout levels at $4,200 (bullish) and $3,750 (bearish) determining next moves. - Growing institutional interest and Layer-2 adoption support Ethereum, though macro risks and profit-taking remain near-term concerns. - The triangle's apex signals imminent volatility, with bulls defending $3,850 and bears targeting $3,750 as critical t