Bitcoin Treasury Firm Nakamoto Holdings Suffers Major Stock Decline

According to CoinTelegraph, Nakamoto Holdings stock fell over 98 percent. The price dropped from a May high of 25 dollars to about 0.9480 dollars. This event took place on Nasdaq.

David Bailey heads the company. He serves as CEO of Bitcoin Magazine. Nakamoto merged with Utah-based KindlyMD earlier this year. The firm operates as a Bitcoin treasury entity.

The decline followed 563 million dollars in PIPE deals. These involved sales of discounted shares to private investors. Shares became eligible for resale in September. Investors then executed large sell orders. Nakamoto holds 5,765 Bitcoin tokens. These are valued at around 653 million dollars.

Why This Matters

The stock drop affects Nakamoto Holdings directly. It reduces market capitalization by billions. Shareholders face losses from the rapid decline. The company plans to integrate other ventures like Bitcoin Magazine.

Private investors from PIPE deals gained from sales. This created pressure on the stock price. Nakamoto ranks as the 19th largest public Bitcoin holder. Readers with exposure to similar firms may see risks in funding models.

Bloomberg states that shares in some treasuries traded down as much as 97 percent below issue. This reflects challenges after PIPE financing. As we covered, crypto infrastructure remained resilient during the October 2025 market wipeout. Matt Hougan noted no major institutional failures occurred.

Industry Implications

This event questions the Bitcoin treasury model in public markets. Other firms may face similar sell-offs after financing. Corporate Bitcoin purchases fell 76 percent from July to September 2025.

The competitive landscape shifts for treasury entities. Metaplanet, a Tokyo-listed firm, launched a 500 million dollar share repurchase. This aims to address discounts to net asset value. Traditional institutions observe these developments. They assess risks in crypto adoption.

Reuters reports a 19 billion dollar liquidation in October 2025. Bitcoin fell 14 percent due to trade tensions. Positive views highlight quick recoveries in platforms. Skeptical perspectives point to leverage vulnerabilities. Global trends show reduced treasury buying. This may slow sector growth.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Soros predicts an AI bubble: We live in a self-fulfilling market

The article uses Brian Armstrong's behavior during the Coinbase earnings call to vividly illustrate George Soros' "reflexivity theory," which posits that market prices can influence the actual value of assets. The article further explores how financial markets actively shape reality, using examples such as the corporate conglomerate boom, the 2008 financial crisis, and the current artificial intelligence bubble to explain the workings of feedback loops and their potential risks. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively improved.

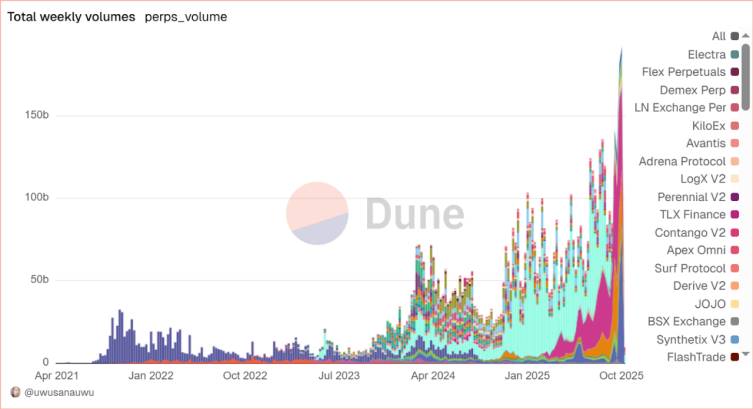

In-depth Research Report on Perp DEX: Comprehensive Upgrade from Technological Breakthroughs to Ecosystem Competition

The Perp DEX sector has successfully passed the technology validation period and entered a new phase of ecosystem and model competition.

Space Review|Farewell to the Era of “Narrative Equals Hype”, TRON Rebuilds Market Confidence with Real Yields

As the crypto market shifts from “listening to stories” to “seeing results,” TRON demonstrates a feasible path through its solid ecosystem foundation and value circulation.

Bitcoin (BTC) Holds Key Support — Could This Pattern Trigger an Rebound?