October 30th Market Key Insights -- How Much Did You Miss?

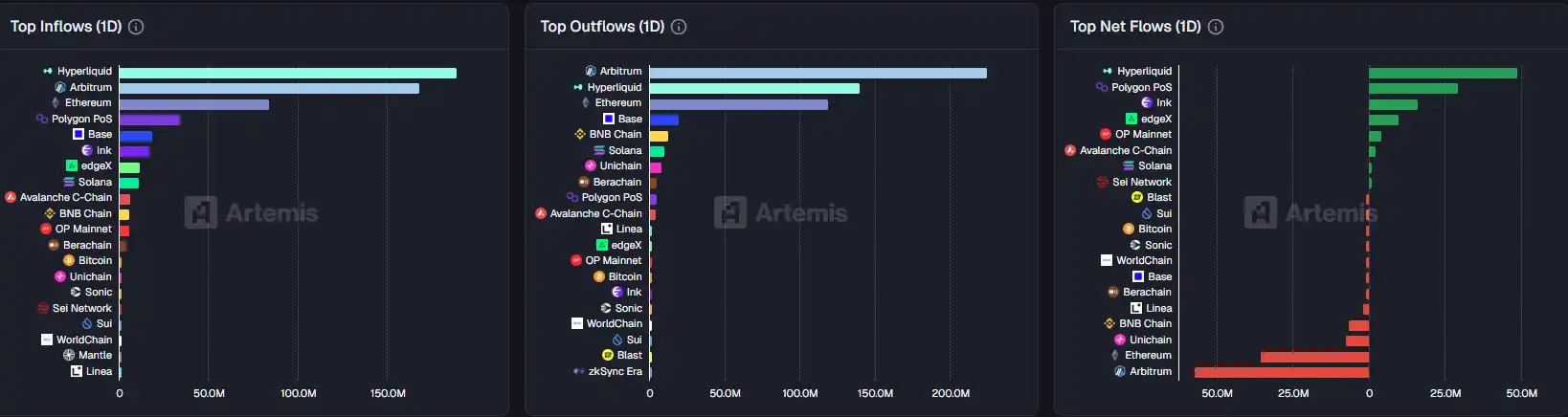

1. On-chain Fund Flows: $48.9M USD has flown into Ethereum today; $57.1M USD has flown out of Arbitrum. 2. Largest Price Swings: $JELLYJELLY, $PEPENODE 3. Top News: MegaETH Public Sale has raised over $1 billion, with oversubscription reaching 20x.

Top News

1. MegaETH Public Sale Fundraising Amount Surpasses $1 Billion, Oversubscribed 20x

2. Pre-market Crypto Concept Stocks in the U.S. Soar, with Strategy Up by 0.96%

3. $590 Million Liquidated Across the Network in the Past 24 Hours, Mainly Long Positions

4. Binance Alpha Airdrop Scheduled for Today at 20:00, Score Threshold at 240 Points

5. Pacifica's Weekly Trading Volume Exceeds $50 Billion, User Balances Receive a 20x Points Bonus

Featured Articles

1. "Earning and Distributing Money at the Same Time: A Look at the Recent Developments of Top Perp DEXes"

According to the latest on-chain data, the market landscape of decentralized perpetual contract exchanges (Perp DEXes) has become relatively clear. In terms of 24-hour trading volume, Aster leads with $121.2 billion, Lighter ranks second with $86.16 billion, Hyperliquid ranks third with $59.58 billion, while edgeX and ApeX Protocol hold the fourth and fifth positions with $50.6 billion and $21.22 billion, respectively. For investors and traders looking to delve deeper into the Perp DEX race, keeping an eye on the dynamics of these top five platforms should provide insights into the overall direction of the race.

2. "CZ Invests in a Chinese College Junior, $11 Million Seed Round, Venture into Education as an Agent"

Chinese third-year student, $11 million seed round, the highest-funded product by a Silicon Valley student entrepreneur. The flagship product is VideoTutor, an educational agent product targeting K12 education, which can generate personalized teaching/explanatory videos with just one sentence. VideoTutor announced today that it has completed a $11 million seed round of financing. The round was led by YZi Labs, with participation from Baidu Ventures, JinQiu Fund, Amino Capital, BridgeOne Capital, and several well-known investors.

On-chain Data

On-chain Fund Flow Last Week on October 30

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Aave News Today: Connecting DeFi and Traditional Finance: Aave and Chainlink Propel Institutional Integration

- Bitcoin hit $104,000 in Nov 2025 amid institutional interest and dollar weakness, signaling crypto market maturity. - Aave integrated Chainlink's ACE compliance tool to verify institutional transactions, bridging DeFi and TradFi with $35B TVL. - Chainlink expanded to TON blockchain via CCIP, enabling Toncoin cross-chain transfers and real-time data access for 900M Telegram users. - Telegram's Cocoon AI network added GPU rentals to TON, diversifying use cases while prioritizing infrastructure over hype. -

Regulatory challenges and market fluctuations prompt Dupay's departure as the crypto sector shifts direction

- Dupay, a crypto payment card firm, shuts down due to regulatory pressures and market volatility, reflecting broader industry challenges. - Canada's $10M stablecoin regulation mandates reserves and transparency, raising compliance costs for smaller crypto firms. - JELLYJELLY token's 224% surge triggered $13M liquidations, exposing risks of high-leverage trading in volatile crypto markets. - U.S. government shutdown disrupts social safety nets, potentially reducing demand for crypto-linked payment solution

AAVE Rises 4.85% Following $50M Buyback and $35B TVL: Will Chainlink ACE Prevent Further Decline?

- Aave's AAVE token rose 4.85% in 24 hours amid a $50M annual buyback program and $35B TVL, despite 13.66% monthly declines. - The protocol generated $98. 3M in fees and $12.6M revenue last month, supporting its position as a stable DeFi platform with strong liquidity. - Technical analysis identifies $150–$160 as a potential floor, with bullish targets at $240–$538 by year-end if key trendlines hold. - A backtesting strategy using historical data aims to validate the buyback's price-stabilizing impact amid

MSX Connects Conventional and Blockchain Financial Systems through Incentives Prioritizing Liquidity

- MSX launches S1 Points Season with M Bean incentive mechanism to boost user engagement and liquidity via blockchain-based rewards. - Non-lockup model allows users to earn rewards through trading, staking, and governance, mirroring MEXC's high-yield airdrop strategies. - Platform integrates on-chain data partnerships (e.g., Tradeweb-Chainlink) to provide institutional-grade transparency in tokenized finance. - Analysts highlight need for sustained utility and adaptive tokenomics to maintain value, leverag