Zcash Rally Gains Steam, Can ZEC’s 4.5M Shielded Supply Push It Back Into the Top 20?

Zcash (ZEC) is stealing the spotlight once again. The privacy-focused asset has surged more than 50% in the past week, climbing above $350 and fueling talk of a potential return to the top 20 digital assets by market capitalization.

Behind this rally lies a mix of technical strength, institutional catalysts, and renewed global demand for digital privacy.

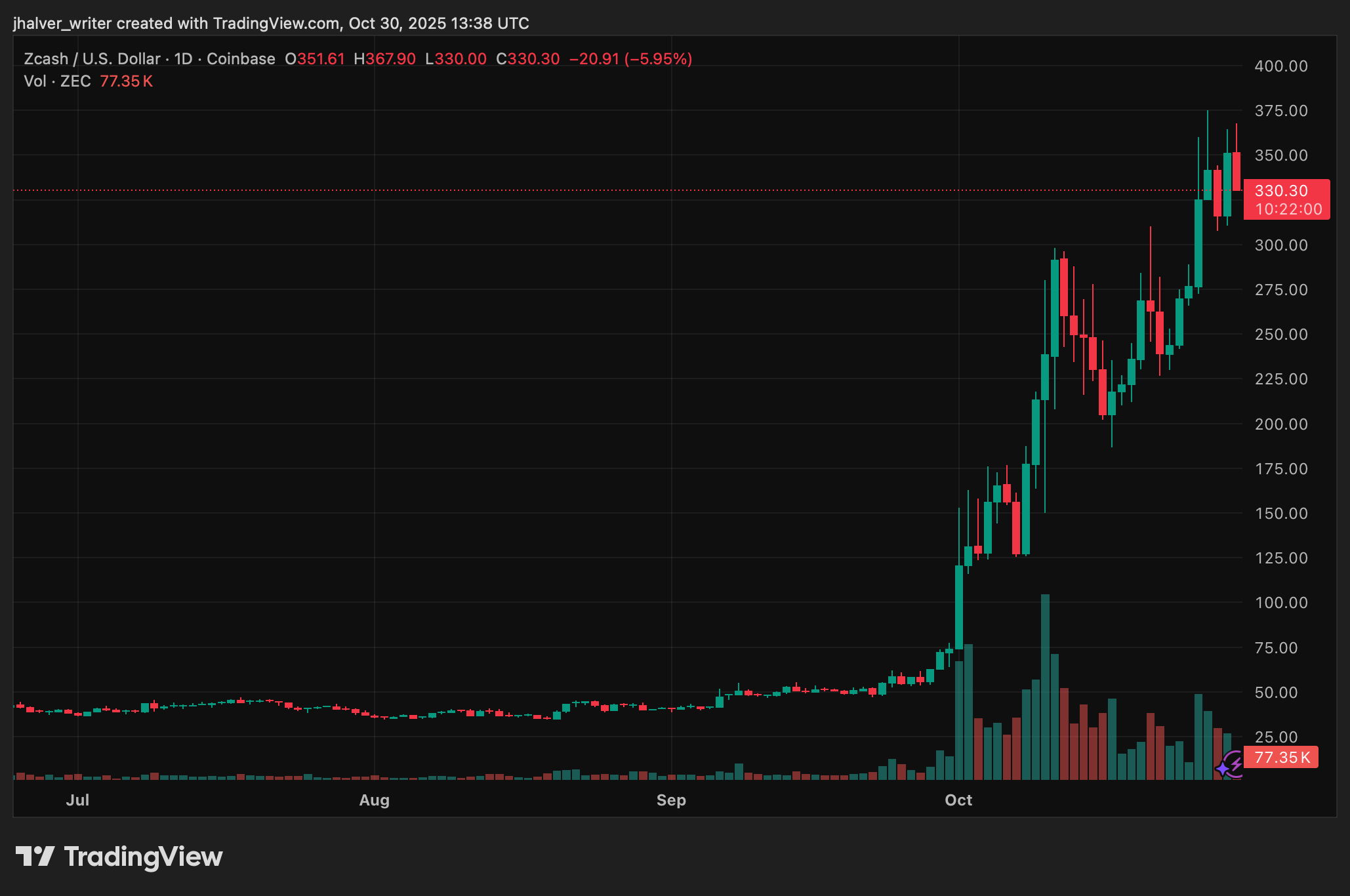

ZEC's price trends to the upside with recent small losses on the daily chart. Source: ZECUSD on Tradingview

Zcash’s Shielded Supply Hits 4.5 Million

Supporting Zcash’s resurgence is a major milestone. 4.5 million ZEC are now stored in shielded addresses, representing roughly 28% of total supply.

These shielded pools leverage Zcash’s zero-knowledge proof technology (zk-SNARKs), allowing users to transact privately without revealing sender, receiver, or transaction amounts.

This rise in shielded coins signals growing trust in ZEC’s privacy infrastructure, especially as wallets and exchanges improve support for shielded transactions. The move also expands Zcash’s overall anonymity set, strengthening privacy for all participants while tightening on-chain liquidity.

As one of the oldest and most advanced privacy blockchains, ZEC’s growth in shielded adoption reinforces its core mission of financial confidentiality in an increasingly monitored digital world.

Technical Indicators Point to More Upside

Zcash’s market momentum remains robust. Daily trading volume soared above $730 million, while the RSI at 71.8 and a bullish MACD crossover suggest strong buying pressure.

The token’s structure continues to make higher highs and higher lows, indicating a healthy uptrend. Analysts see resistance near $370–$400, with a potential breakout opening the path toward $450–$500 in the coming weeks.

ZEC’s recent surge also coincides with Arthur Hayes’ bold prediction that the coin could reach $1,000, as the market rotates into privacy-focused assets.

With Grayscale’s Zcash Trust surpassing $137 million in assets under management, and whispers of a possible ETF conversion, institutional exposure could further amplify this rally.

Privacy Tokens Regain Spotlight Amid Regulatory Uncertainty

Zcash’s resurgence reflects a broader renewal of interest in privacy tokens like Monero (XMR) amid heightened surveillance and KYC mandates in global markets. As governments tighten oversight, traders and institutions are rediscovering ZEC’s unique role as a bridge between compliant infrastructure and privacy rights.

If Zcash sustains its current momentum, maintains its 4.5M shielded supply growth, and breaks the $400 ceiling, a return to the top 20 cryptos by market cap could soon become reality, supporting ZEC’s comeback as the flagship privacy asset of this cycle.

Cover image from ChatGPT, ZECUSD chart from Tradingview

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana News Today: Investors Abandon Bitcoin ETFs in Favor of Solana's Attractive Staking Returns

- Bitcoin ETFs saw $488M outflows led by BlackRock's IBIT , while Solana ETFs gained $44.48M as investors rotated into staking yields. - Coinbase reported $1.9B Q3 revenue driven by trading volumes and expanded staking services, contrasting ETF volatility. - Zynk secured $5M seed funding to develop stablecoin-based cross-border payment infrastructure, targeting USD/EUR/AED corridors. - Analyst Peter Brandt warned Bitcoin could test $60K support, but IBIT's $88B AUM suggests long-term ETF demand remains str

Ferrari's 499P Token: Enhancing Customer Loyalty in the Digital Era

- Ferrari launches Token 499P NFT with fintech Conio, targeting Hyperclub members for auction bids and exclusivity. - Q3 2025 results show €382M net income and €670M EBITDA, surpassing forecasts amid strong high-end model demand. - Strategy emphasizes loyalty through digital assets, with EU regulatory approval pending for the limited-edition token. - Project combines heritage with innovation, reflecting Ferrari's resilience after September market skepticism and regained investor confidence.

Noomez's Presale: Creating Rarity to Survive Meme Coin Volatility

- Noomez ($NNZ) launches 28-stage presale with fixed pricing and liquidity locks to mitigate meme coin risks. - 15% liquidity locks and third-party audits enhance trust, while real-time on-chain tracking ensures transparency. - Stage-based airdrops and referral bonuses incentivize participation, aligning with 2025 crypto trends. - Despite volatility concerns, structured deflationary design aims to sustain value, with 50% supply allocated to presale success.

Decred Skyrockets as EU Tightens Rules on Anonymous Transactions