3 Altcoins Reach Record Scarcity as Exchange Supply Falls to Multi-Year Lows

Ethereum, Chainlink, and PEPE are seeing multi-year lows in exchange supply, signaling strong accumulation and investor confidence despite market declines.

Several altcoins appear to have defied market fear over the past month. Despite declining prices, investors did not rush to sell on exchanges. Instead, they accumulated more aggressively.

This accumulation has driven the exchange supply of some altcoins to their lowest levels in years. Such scarcity is a critical factor that supports potential price increases. Which altcoins are showing this pattern?

1. Ethereum (ETH)

It comes as no surprise that Ethereum remains one of the most sought-after altcoins among both institutions and retail investors.

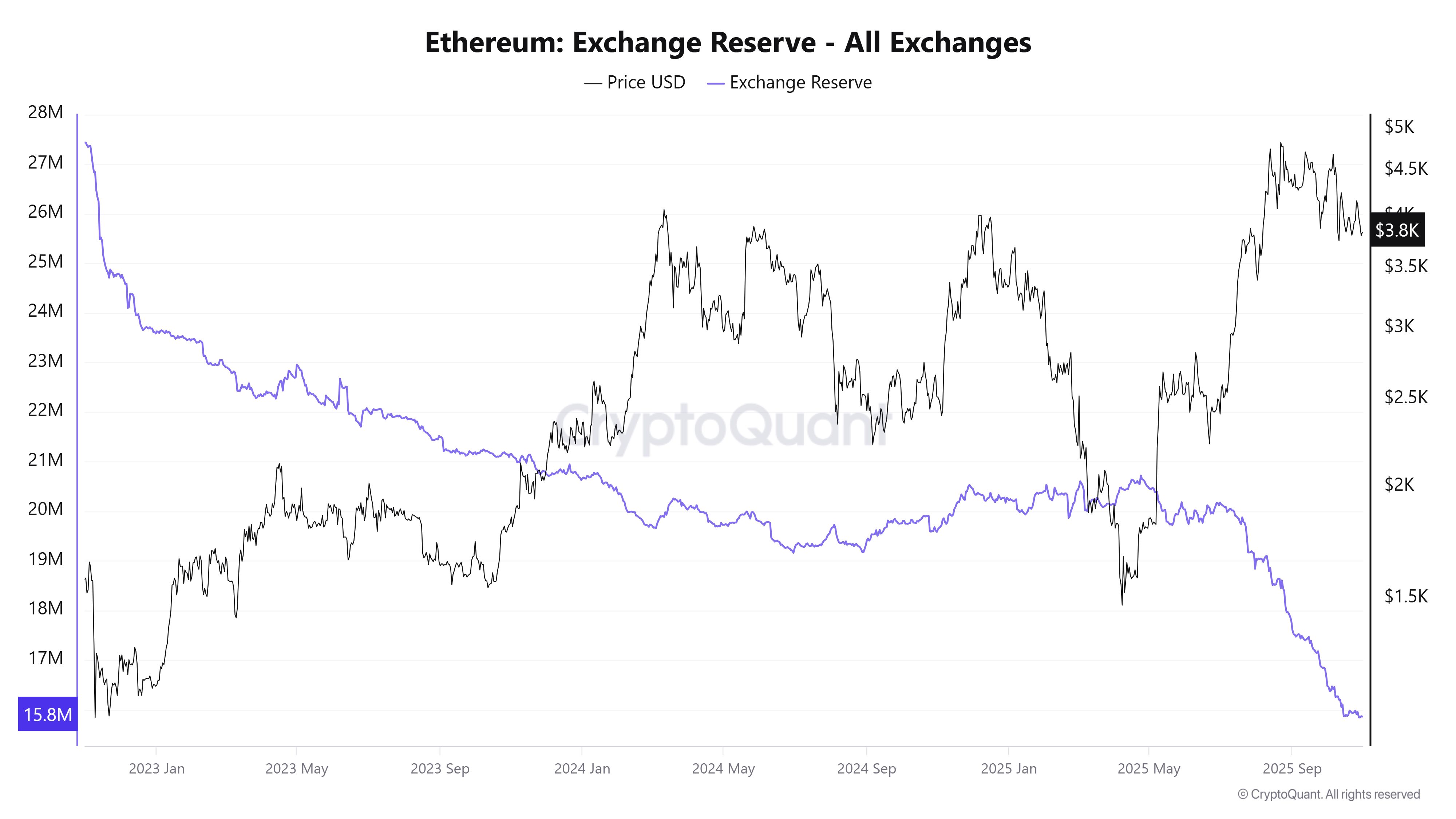

What may surprise many, however, is the degree of scarcity ETH is currently showing on exchanges. Data from CryptoQuant reveals that Ethereum’s exchange supply fell to 15.8 million in October — the lowest level in three years.

Ethereum Exchange Reserve. Source:

CryptoQuant

Ethereum Exchange Reserve. Source:

CryptoQuant

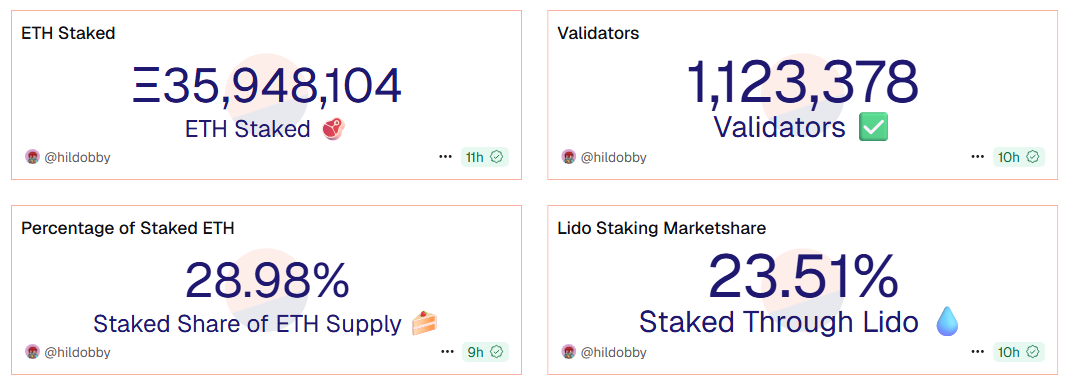

In addition, ETH available for purchase on the open market is becoming even scarcer as more tokens are staked. According to Dune, the total amount of staked ETH has increased steadily over the past five years and now stands at nearly 36 million ETH, or roughly 29% of the total supply.

Percentage of Staked ETH. Source:

Dune.

Percentage of Staked ETH. Source:

Dune.

Although bearish sentiment in October pushed ETH below $4,000, the increasing scarcity suggests that a recovery remains likely.

2. Chainlink (LINK)

Chainlink (LINK) has also surprised many. Its exchange supply dropped to 143.5 million LINK, the lowest level since October 2019.

Since the start of the year, exchange balances have fallen from over 220 million LINK, meaning about 80 million LINK, roughly 11% of the circulating supply, have been withdrawn in 2025 alone.

LINK Supply on Exchange. Source:

Santiment.

LINK Supply on Exchange. Source:

Santiment.

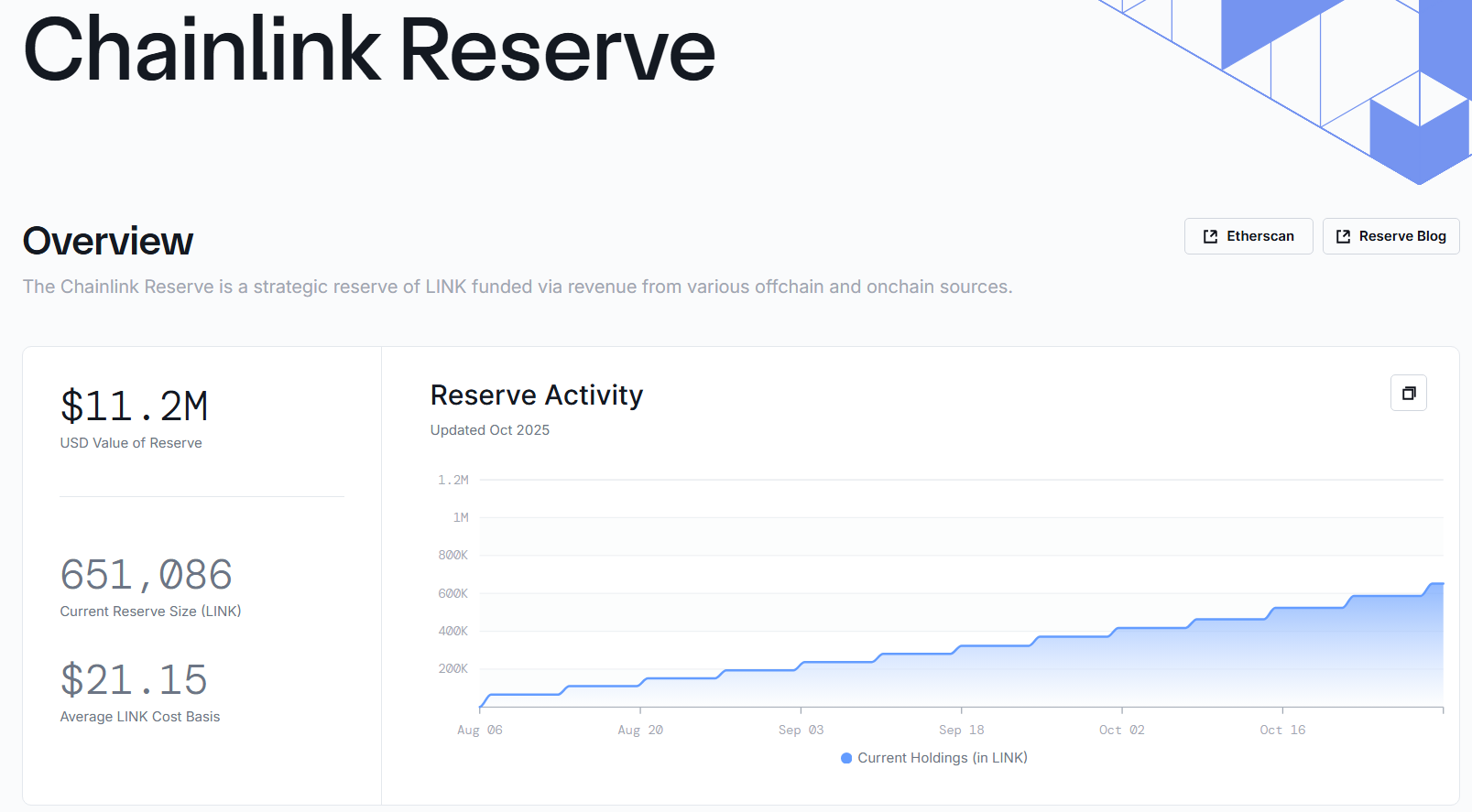

A recent report highlighted that LINK has entered one of its strongest accumulation phases by whales in years.

The latest update from Chainlink Reserve reveals that over $11 million worth of LINK has been accumulated since the program launched in August.

Holdings (in LINK) of Chainlink Reserve. Source:

Chainlink Reserve.

Holdings (in LINK) of Chainlink Reserve. Source:

Chainlink Reserve.

Although the LINK amount in Chainlink Reserve is still small compared to the total supply, it demonstrates the project’s commitment to its long-term strategy.

This behavior reinforces scarcity sentiment among holders. Community discussions around LINK remain positive despite a 25% price drop in October.

3. Pepe (PEPE)

PEPE, an Ethereum-based meme coin, remains one of the most liquid meme tokens in the market.

Over the past month, investor interest shifted away from meme coins toward privacy coins and perpetual DEX tokens, yet PEPE managed to retain its own appeal.

Data from Santiment shows PEPE’s exchange supply has dropped to its lowest level since 2023, with 86.39 trillion PEPE currently held on exchanges, about 20% of its circulating supply.

PEPE Supply on Exchange. Source:

Santiment.

PEPE Supply on Exchange. Source:

Santiment.

This long-term decline in exchange balances reflects the strong loyalty of holders to the token.

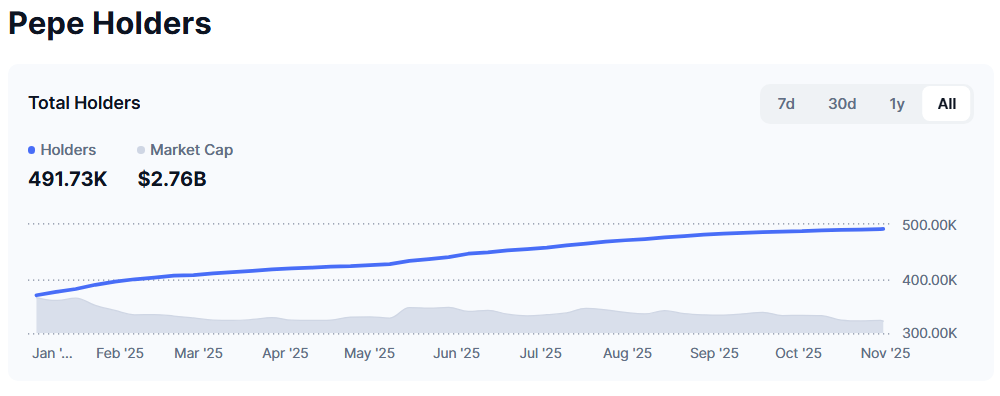

In 2025 alone, the number of PEPE holders rose from 369,000 to over 491,000, according to CoinMarketCap.

Number of Pepe Holders. Source:

CoinMarketCap

Number of Pepe Holders. Source:

CoinMarketCap

The reduction in exchange supply and the rise in holders occurred even as PEPE’s price fell back to its early-year level in October. This means most holders have yet to see profits but continue to hold their tokens.

“If you think PEPE is a bad investment, think again. You can’t reassure diamond hands. I’m one of them. This price level is too good to miss out,” investor Defizard said.

These altcoins show that even in a pessimistic market, investors continue to favor tokens they believe can preserve portfolio value.

Whether leading altcoins or meme tokens, they share common traits — resilience across market cycles, a loyal base of holders, and strong liquidity.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Swiss Crypto Lending Offers 14% Returns Alongside Bank-Backed Insurance

- Swiss crypto lender Fulcrum offers 14% APR on stablecoins with Lloyd's insurance and FINMA regulation. - Platform uses 50% LTV over-collateralization and institutional-grade security to mitigate market risks. - Targets inflation-hedging investors by bridging traditional finance gaps with insured crypto yields. - Competes with alternatives like Bitget's zero-interest loans but emphasizes regulatory compliance and capital preservation.

Bitcoin News Update: Analyst Highlights How MSTR's Convertible Bonds Prevent Forced Bitcoin Sales

- MSTR's convertible debt structure allows debt repayment via cash, stock, or both, avoiding Bitcoin sales during market downturns. - The company raised €350M through a 10% dividend-bearing euro-denominated preferred stock offering to fund Bitcoin purchases. - Q3 results showed $3.9B operating income from Bitcoin gains, driving a 7.6% stock surge to $273.68 post-earnings. - Risks persist if Bitcoin fails to rally in 2028, potentially forcing partial liquidation amid $1.01B 2027 debt obligations. - MSTR hol

Solana News Today: Solana ETFs Surpass Bitcoin as Staking Returns Attract Institutional Investments

- U.S. spot Solana ETFs (BSOL/GSOL) attracted $199M in 4 days, outperforming Bitcoin/Ethereum ETF outflows. - 7% staking yields drive institutional inflows as investors rotate capital from major crypto assets. - Despite ETF success, SOL price fell below key support levels, raising concerns about $120 price floor. - Strategic staking and treasury purchases boosted Solana's institutional appeal, with $397M in staked assets. - Market remains cautious as ETF competition intensifies, with Bitwise's BSOL outpaci

Bitcoin News Today: Bitcoin’s Fourth Quarter Surge: Impact of Trade Disputes, Stronger Dollar, and Evolving Global Economic Strategies

- Bitcoin fell nearly 15% in October 2024, its worst quarterly start since 2022, driven by U.S.-China trade tensions, dollar strength, and macroeconomic caution. - A 100% U.S. tariff on Chinese imports and Fed rate-cut delays exacerbated selloffs, triggering $1.3B in liquidations during a flash crash below $103,000. - Key support levels at $107,000 and $101,150 face retests as traders warn of further declines, with market cap dropping below $3.6T amid fragile liquidity. - Wintermute denied Binance lawsuit