Cardano Whale Holdings Rise To 5-Month High Even As Price Falls To $0.60

Cardano’s price dip hasn’t deterred large investors—whales have added 70 million ADA, pushing holdings to a five-month high and hinting at a possible recovery from the $0.60 support zone.

Cardano’s price has struggled to find a footing over the past few days, failing to sustain recovery attempts and slipping toward the $0.60 mark.

Despite the decline, on-chain data suggests optimism may be brewing. Large holders, known as whales, appear to be quietly accumulating ADA, potentially signaling confidence in a rebound.

Cardano Whales Are Buying

As Cardano’s price continues forming lower lows, whales have stepped in to accumulate. Addresses holding between 1 million and 10 million ADA have added roughly 70 million tokens over the last 48 hours, valued at around $42 million. While modest compared to past accumulations, the move indicates growing confidence among large investors.

This buying spree has pushed whale holdings to a five-month high, suggesting they view the current price as a strong entry point. Their activity often serves as a precursor to broader market optimism.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Cardano Whale Holdings. Source:

Cardano Whale Holdings. Source:

From a technical perspective, the Moving Average Convergence Divergence (MACD) indicator shows signs of improving momentum. The red bars on the histogram are receding, indicating bearish pressure is easing. This shift aligns with the recent whale activity and suggests Cardano could be nearing a potential reversal zone.

Over the past two months, Cardano has come close to forming a bullish MACD crossover but failed to sustain momentum each time. However, with strong accumulation from major holders and fading bearishness, ADA could finally confirm a bullish crossover, signaling a possible short-term uptrend.

Cardano MACD. Source:

Cardano MACD. Source:

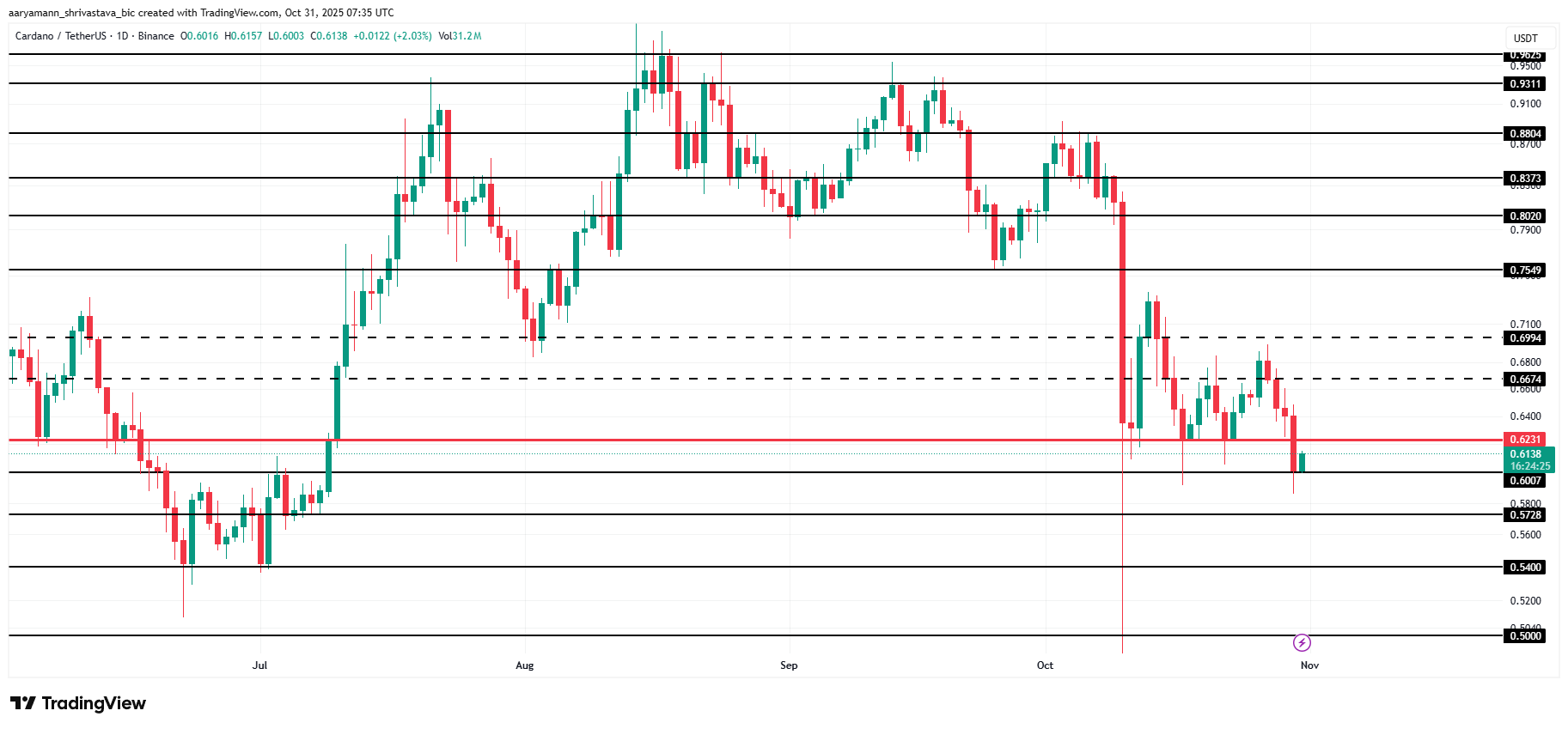

At the time of writing, Cardano’s price stands at $0.61, holding slightly above the crucial $0.60 support level. The recent stabilization coincides with renewed buying from whales, hinting that downside pressure might be weakening.

If ADA maintains this level, it could bounce off $0.60 and rally toward $0.62 before targeting $0.66. A break above these resistance zones would likely attract stronger inflows, reinforcing a bullish reversal.

Cardano Price Analysis. Source:

Cardano Price Analysis. Source:

However, if whale accumulation eases and selling pressure returns, Cardano’s price could lose its $0.60 support. Such a move may push ADA down to $0.57 or even $0.54, invalidating the bullish thesis and extending the correction phase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Federal Reserve's Quiet QE and Institutional Moves Drive Bitcoin Toward $140K Even Amid Pullbacks

- Bitcoin dips below $100,000 as experts like Arthur Hayes and Bitwise CIO remain bullish, citing structural market shifts and Fed-driven "stealth QE" liquidity injections. - Institutional demand dominates a maturing market, with miners scaling operations and corporate treasuries adopting Bitcoin amid declining retail participation. - Analysts predict a potential $140,000 rally by year-end, driven by Fed balance-sheet expansion, improved on-chain metrics, and ETF demand recovery despite geopolitical risks.

Bitcoin News Update: The Crypto Landscape Shifts as Influencers Depart and Major Institutions Enter

- BSC meme coin KOLs are liquidating holdings amid volatility, triggering market consolidation. - GIGGLE and "Binance Life" saw short-term rebounds, but most tokens face ongoing sell-offs. - Analysts link exits to macroeconomic pressures and institutional entry reshaping crypto ownership. - Bitcoin/ETH ETF outflows ($327M) and rising sell-pressure age (100 days) highlight broader risk-off sentiment.

Ethereum News Update: Transforming Blockchain Privacy: Zama and Kakarot Unite to Achieve Over 10,000 Private TPS

- Zama acquires KKRT Labs to merge FHE and ZK technologies, targeting 10,000+ confidential TPS on Ethereum and Solana . - KKRT, backed by Buterin and StarkWare, brings ZK rollup expertise to enhance blockchain scalability and privacy infrastructure. - The $1.2B-valued Zama aims to expand research teams and integrate modular systems for high-throughput confidential finance. - Industry leaders praise the merger as pivotal for advancing privacy-preserving DeFi and overcoming blockchain adoption barriers.