BitMine Acquires 202k Ethereum Amid Market Volatility

- BitMine’s 202,000 ETH purchase strengthens institutional holdings.

- Tom Lee leads ambitious ETH acquisition strategy.

- Large purchases during volatility boost market confidence.

BitMine Immersion Technologies has solidified its position as the largest institutional Ethereum holder globally by purchasing over 202,000 ETH, valued at approximately $838 million. This move aligns with their strategy to pivot from Bitcoin to Ethereum in treasury reserves.

BitMine Immersion Technologies, a major player in the cryptocurrency sector, has acquired 202,000 Ethereum tokens, valued at $838 million. The significant purchase was made amid a market downturn, exemplifying BitMine’s aggressive strategy under Chairman Tom Lee.

BitMine’s strategic acquisition signals a profound shift in its treasury approach towards Ethereum, amid a broader institutional embrace. The purchase stabilizes market sentiment, highlighting the growing institutional confidence in Ethereum’s long-term value.

Strategic Acquisition amid Market Downturn

With a purchase exceeding 202,000 Ethereum tokens, BitMine now holds over 3 million ETH, cementing its position as the largest institutional holder globally. Tom Lee, Chairman, spearheads the strategic treasury realignment focusing more on Ethereum while reducing Bitcoin reserves.

The acquisition occurred during a significant market sell-off, exemplifying BitMine’s navigational prowess amidst volatility . While Ethereum’s price faced a brief drop, such institutional buys provided stability, fueling a notable rebound and growth in investor confidence.

Influence on Institutional Sphere

BitMine’s substantial ETH buy highlights the increasing shift towards Ethereum within the institutional sphere, potentially influencing related financial and business landscapes significantly. The event integrates with ongoing trends of crypto market stabilization following large-scale institutional interventions.

Historically, similar large-scale acquisitions have prompted positive market reactions. BitMine’s move may bolster Ethereum’s standing as a preferred digital asset for institutional investments, further driving crypto adoption and enhancing market frameworks. Such activities are monitored by regulators and analysts, who see them as indicators of crypto market maturity.

“We acquired 202,037 ETH tokens over the past few days pushing our ETH holdings to over 3 million, or 2.5% of the supply of ETH.” – Thomas “Tom” Lee, Chairman, BitMine Immersion Technologies

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Soros predicts an AI bubble: We live in a self-fulfilling market

The article uses Brian Armstrong's behavior during the Coinbase earnings call to vividly illustrate George Soros' "reflexivity theory," which posits that market prices can influence the actual value of assets. The article further explores how financial markets actively shape reality, using examples such as the corporate conglomerate boom, the 2008 financial crisis, and the current artificial intelligence bubble to explain the workings of feedback loops and their potential risks. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively improved.

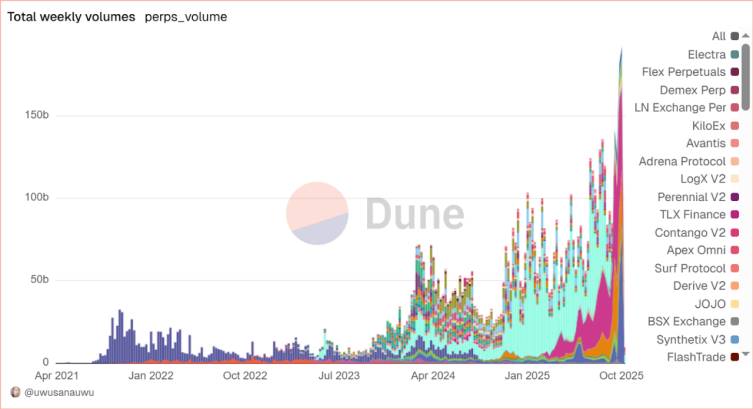

In-depth Research Report on Perp DEX: Comprehensive Upgrade from Technological Breakthroughs to Ecosystem Competition

The Perp DEX sector has successfully passed the technology validation period and entered a new phase of ecosystem and model competition.

Space Review|Farewell to the Era of “Narrative Equals Hype”, TRON Rebuilds Market Confidence with Real Yields

As the crypto market shifts from “listening to stories” to “seeing results,” TRON demonstrates a feasible path through its solid ecosystem foundation and value circulation.

Bitcoin (BTC) Holds Key Support — Could This Pattern Trigger an Rebound?