Ethereum Updates: The Divided Path of Crypto—Ethereum Faces Challenges as TON Innovates and $BZIL Gains Momentum

- November 2025 crypto market shows divergence: Ethereum and Toncoin struggle while BullZilla's $BZIL surges past $1M. - Franklin ETF (EZET) under pressure; ETHZilla sells $40M ETH for buybacks, signaling liquidity challenges. - Toncoin (TON) partners with Chainlink for cross-chain interoperability, targeting institutional DeFi growth. - $BZIL's speculative rise reflects social media-driven hype, mirroring 2021 meme coin trends with utility focus.

As November 2025 begins, the cryptocurrency sector displays a sharp split in performance.

Both the Franklin Ethereum ETF (EZET) and the 21Shares Ethereum Core Staking ETP (ETHC) have experienced varied outcomes. Franklin's ETF, which mirrors the CME CF Ether-Dollar Reference Rate, has come under downward pressure, currently trading at $29.63 and receiving a "Strong Sell" technical assessment, according to an

On the other hand, Toncoin (TON) is gaining traction as a leader in cross-chain technology. Supporting Telegram’s vast user base of 900 million, the TON blockchain has adopted Chainlink’s Cross-Chain Interoperability Protocol (CCIP) and Data Streams, as detailed in a

Bitcoin’s recent climb to $115,000, fueled by optimism over U.S.-China trade, highlights a broader risk-on attitude, but Ethereum’s ongoing difficulties point to deeper issues. The ETH sell-off by ETHZilla and the underperformance of Franklin’s ETF suggest waning confidence in Ethereum’s near-term prospects. In contrast, TON’s strategic collaborations—including its forthcoming Cocoon AI compute network—emphasize practical applications, drawing in developers and liquidity providers who are seeking dynamic, high-growth environments.

While Ethereum benefits from institutional support and TON advances technologically, attention has shifted to BullZilla’s $BZIL token. Despite limited information on $BZIL’s underlying value, its rapid ascent past a $1 million market cap—outpacing both ETH and TON—demonstrates speculative enthusiasm and a growing appetite for tokens with strong social media momentum. This pattern is reminiscent of the 2021

As November progresses, the crypto market remains divided: Ethereum’s institutional investors are contending with liquidity issues, while TON’s interoperability efforts and tokens like $BZIL are thriving on innovation and hype. Market participants are closely monitoring whether these trends will solidify into a new market structure or eventually revert through cyclical corrections.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

U.S. Elections 2025: Democrats’ Big Wins Challenge Trump’s Pro-Crypto Agenda

India to Launch ARC Token Stablecoin Backed by Government Securities

Solana price forecast: SOL eyes $170 after sweeping the August 4 low

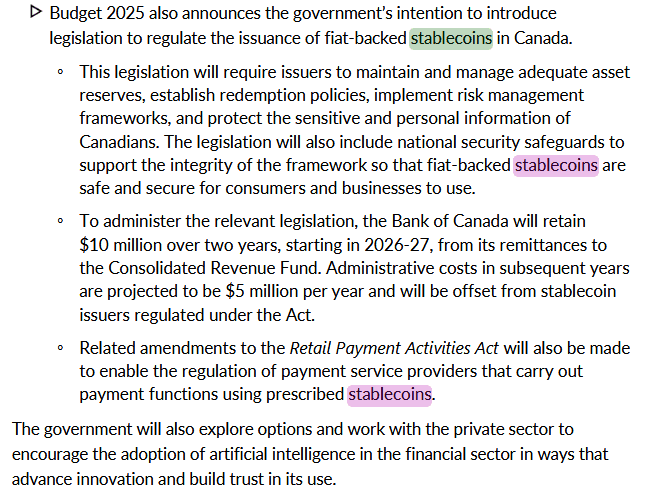

Canada Takes a Major Step Toward Regulating Stablecoins