Ethereum Now Holds $165B in ‘Digital Dollars’ — Bigger Than Singapore & India’s FX Reserves

Ethereum stablecoins total US$183 billion amid falling ETH prices below US$4,000, while investors track institutional flows and on-chain metrics, weighing the potential for renewed momentum and the token’s macro reserve narrative.

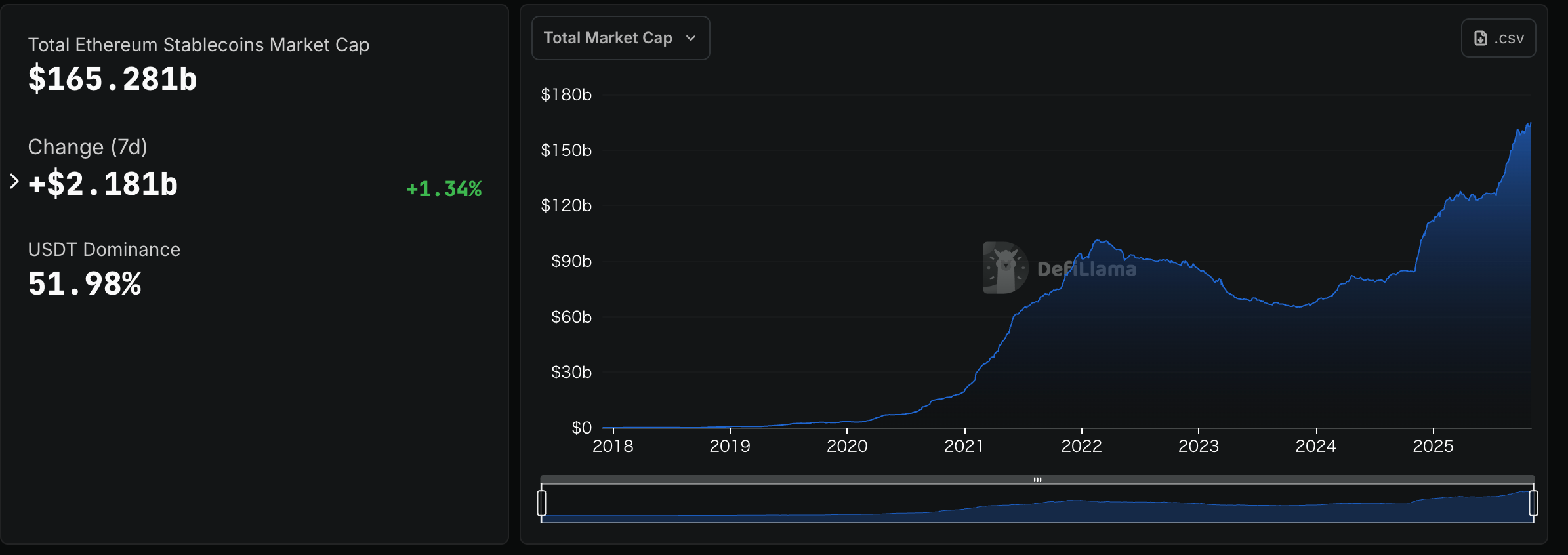

Ethereum’s ecosystem continues to draw attention as stablecoins on its blockchain reach approximately $165 billion in reserves, positioning it among the world’s largest.

However, ETH’s spot price has softened, dropping below $4,000, reflecting cautious investor sentiment. Market participants are closely watching institutional positioning and on-chain metrics. They want to see if Ethereum’s role as a macro-scale digital reserve can drive renewed price momentum soon.

Global Reserve Role for Ethereum-Based Stablecoins

Stablecoins issued on the Ethereum blockchain have now aggregated around $165 billion in reserves, ranking roughly 22nd among global foreign-exchange holdings. This exceeds some national reserve pools, including Singapore and India, underscoring Ethereum’s evolving role beyond a decentralized smart-contract platform.

Total Ethereum Stablecoins Market Cap:

DefiLama

Total Ethereum Stablecoins Market Cap:

DefiLama

Analysts say the development shows structural maturation of the Ethereum ecosystem. Stablecoins are increasingly used as collateral, settlement assets, or digital reserve instruments rather than purely speculative tokens.

“When you really look at this and realize how much $ETH is integrated into stablecoins, you have to be bullish. According to the data, $ETH stablecoins rank among the 20 largest FX reserves, just behind the US,” a crypto investor, BigBob, noted on X.

When you really look at this and realize, how big not only stablecoin’s are but how much $ETH is being integrated into stablecoin’s. You have to be fucking bullish, according to the website I linked, $ETH stablecoin’s are the 20th largest FX reserve. Behind the US BFF 💀…

— bigbob (@bigbobinvests) October 28, 2025

The reserve accumulation illustrates growing confidence in Ethereum’s underlying infrastructure as a foundational component of digital finance.

Institutional and Trader Positioning Signals

On-chain data and trading activity indicate that institutional participants and large traders strategically positioned for potential ETH rebounds. Long positions have increased, reflecting investor interest in spot exposure and stablecoin-linked liquidity. For example, specific whale wallets hold roughly 39,000 ETH ($150 million) as long-term positions, signaling significant accumulation by major market participants.

Market observers note that these trends resemble traditional reserve asset behavior, highlighting Ethereum’s potential as a macro-level instrument for capital allocation. Investor confidence is growing, but execution remains critical. Tokenomics, staking yields, regulatory clarity, and network performance will determine whether Ethereum can sustain its reserve-level narrative.

In the derivatives market, funding rates have recently turned negative, suggesting a balance between long and short positions and indicating potential for short-term price squeezes. This dynamic, combined with institutional inflows and stablecoin issuance, will likely shape ETH’s trajectory in the coming weeks and months.

ETH Price Trends and Outlook

Amid these developments, Ethereum’s spot price has shown weakness. On October 29, ETH fell below US$4,000; at the time of writing, it stood at $3,912.90. The market appears to be waiting for confirmation of macro narratives, including continued stablecoin flows and increased network activity, before accelerating upward.

Investors remain cautious, with price consolidation reflecting both short-term profit-taking and broader market sentiment. While on-chain metrics suggest accumulation is ongoing, further catalysts—such as institutional inflows or regulatory clarity—may be required to restore upward momentum. Analysts note that if Ethereum continues to prove real-world utility and stablecoin integration, it could reinforce its role as a digital reserve. This may support a price recovery toward $4,200–4,500 in the medium term.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates Today: Institutions Face Off Against Bears in the $3,200 Ethereum Battle

- Ethereum's price fell over 10% to $3,170, testing critical $3,200 support amid bearish technical indicators. - Institutional investors accumulated 500,000 ETH in October, contrasting with $136M ETF outflows signaling mixed demand. - Market hinges on $3,500 defense: break above could target $3,750-$8,000, while failure risks descent to $3,000-$2,200. - Analysts split between bullish long-term projections ($8,000) and bearish warnings of potential $1,700 by mid-2026.

Solana News Update: Privacy-Focused GHOST Soars 229% Amid Institutional Surge Despite Bitcoin Decline

- Legendary trader "LeBron" invested $23.5K in Solana to buy 2M GHOST tokens, as privacy coin GHOST surged 76.1% in 24 hours. - Privacy coins grew 71.6% in 2025 market cap, outpacing Bitcoin and Ethereum , driven by demand for anonymity tools and institutional buying. - GhostwareOS offers privacy tools like GhostMask and GhostScrub, but faces scrutiny over scalability despite attracting whale investors and high-profile traders. - GHOST's 229.5% weekly gain made it second-best privacy coin performer, contra

Ethereum News Update: Unbroken Winning Run Ends as Whale Faces $19M Loss on $64M BTC/ETH Wager

- "Cool-headed Whale" shifted from ETH/SOL short-term profits to $64M BTC/ETH long positions, triggering $19.63M floating losses amid market declines. - Whale's 100% win streak ended as BTC/Ethereum dropped below $99k, reflecting broader liquidity tightening and investor uncertainty. - Market watchers track whale's strategy amid $116M total exposure, with Bitcoin's 4.63% 24-hour decline raising questions about bull market sustainability.

Mamdani's Emphasis on Social Issues Surpasses Cuomo's Cryptocurrency Advocacy in New York City Race

- Zohran Mamdani, a democratic socialist, won NYC's 2025 mayoral race with 50.6% of votes, defeating ex-Governor Andrew Cuomo (41.2%) and Republican Curtis Sliwa. - Mamdani's focus on social issues like housing and childcare overshadowed Cuomo's pro-crypto agenda, which included blockchain initiatives and an Innovation Council. - Outgoing Mayor Eric Adams' pro-crypto legacy (first bitcoin paychecks, digital assets office) faded as Mamdani's social priorities dominated voter concerns. - Despite crypto advoc