Balancer Hit by $110 Million Exploit in Latest DeFi Security Breach

Balancer has fallen victim to a major $110 million exploit sparking new questions about DeFi security as attackers drain assets from key liquidity pools.

Decentralized exchange and liquidity protocol Balancer has reportedly fallen victim to a major security breach, with losses exceeding $110 million in digital assets. On-chain data indicates that the attack remains ongoing.

This exploit highlights ongoing vulnerabilities in DeFi infrastructure, despite increasing regulatory scrutiny and enhanced security efforts across the sector.

Balancer Exploit Drains Over $110 Million as Attack Continues

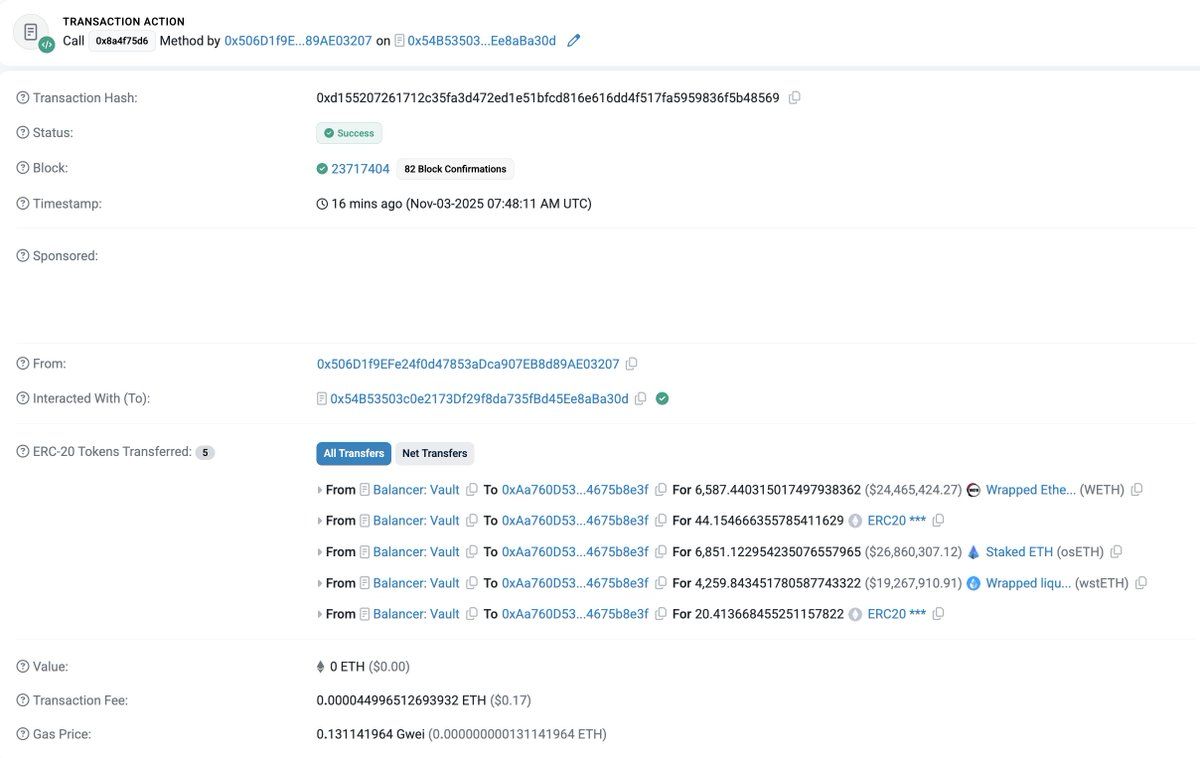

According to data shared by Lookonchain on X (formerly Twitter), the attackers transferred roughly 6,587 WETH, worth around $24.46 million, 6,851 osETH, valued at nearly $26.86 million, and 4,260 wstETH, worth approximately $19.27 million, from Balancer to a new wallet.

Hackers Transferring Assets From Balancer. Source:

Hackers Transferring Assets From Balancer. Source:

The attack hasn’t stopped yet. Lookonchain reports that losses from the Balancer exploit have already exceeded $110 million.

“Absolutely insane — the total stolen funds from the Balancer exploit have now surged to $116.6 million,” Lookonchain added.

This isn’t the first time the network has faced such an incident. In 2023, bad actors managed to steal around crypto assets from the protocol. The Balancer team has not yet issued an official statement regarding the incident.

This is a developing story.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: XRP Fibonacci Levels Under Scrutiny as Bulls and Bears Face Off in a Crucial November Battle

- Ripple's monthly XRP unlock of 1 billion tokens ($2.5B value) renews focus on supply dynamics amid 70-80% re-locking framework. - XRP trades near $2.50 with bulls targeting $3.25 via Fibonacci levels, while bears watch $2.40 support amid declining open interest. - U.S. retail access to XRP futures via Webull and Coinbase expands derivative exposure as broader crypto markets show modest recovery. - Market debates escrowed tokens' impact on liquidity metrics, with technical indicators showing mixed bearish

Bitcoin News Update: Bitget’s PoolX Connects Conventional Finance and Blockchain Through BAY Rewards

- Bitget launched PoolX, a VIP program offering BTC locking for 1.32M BAY tokens and 5% BTC interest coupons, with a Nov 8 deadline. - BGBTC, a Bitcoin synthetic asset, was integrated as a margin coin for USDT-M Futures, enhancing trading flexibility for high-net-worth users. - The initiatives align with post-FOMC market trends, as Bitcoin trades near $109K amid Fed rate cuts and regulatory uncertainties. - PoolX's 10%+ APR reflects DeFi yield strategies, but risks persist due to crypto volatility and regu

Global authorities adjust cryptocurrency regulations to strike a balance between fostering innovation and maintaining stability

- Global regulators are adjusting crypto frameworks to balance innovation and risk management, with Hong Kong, Switzerland, Brazil, and the EU implementing new measures. - Hong Kong’s SFC allows local exchanges to access global liquidity pools but faces low adoption compared to India and Japan. - Switzerland’s AMINA secures EU MiCA compliance, highlighting maturing markets amid calls for stricter oversight. - Brazil’s 30% tax on undeclared crypto aims to formalize the sector but risks burdening small inves

XRP News Today: Enhanced Custody Solutions Propel Ripple’s Institutional Blockchain Expansion

- Ripple acquires Palisade to enhance institutional crypto custody and payments, announced on Nov 3, 2025. - Palisade's WaaS technology integrates into Ripple's solutions, supporting multi-chain assets and DeFi. - The $4B expansion includes key acquisitions like Hidden Road and Rail, targeting institutional compliance. - Post-SEC settlement, Ripple focuses on growth, with RLUSD exceeding $1B and XRP as top-4 crypto. - The move aligns with traditional finance's blockchain adoption, leveraging 75+ global lic