Institutional Bitcoin Demand Cools as Bull Market Roars Elsewhere | US Crypto News

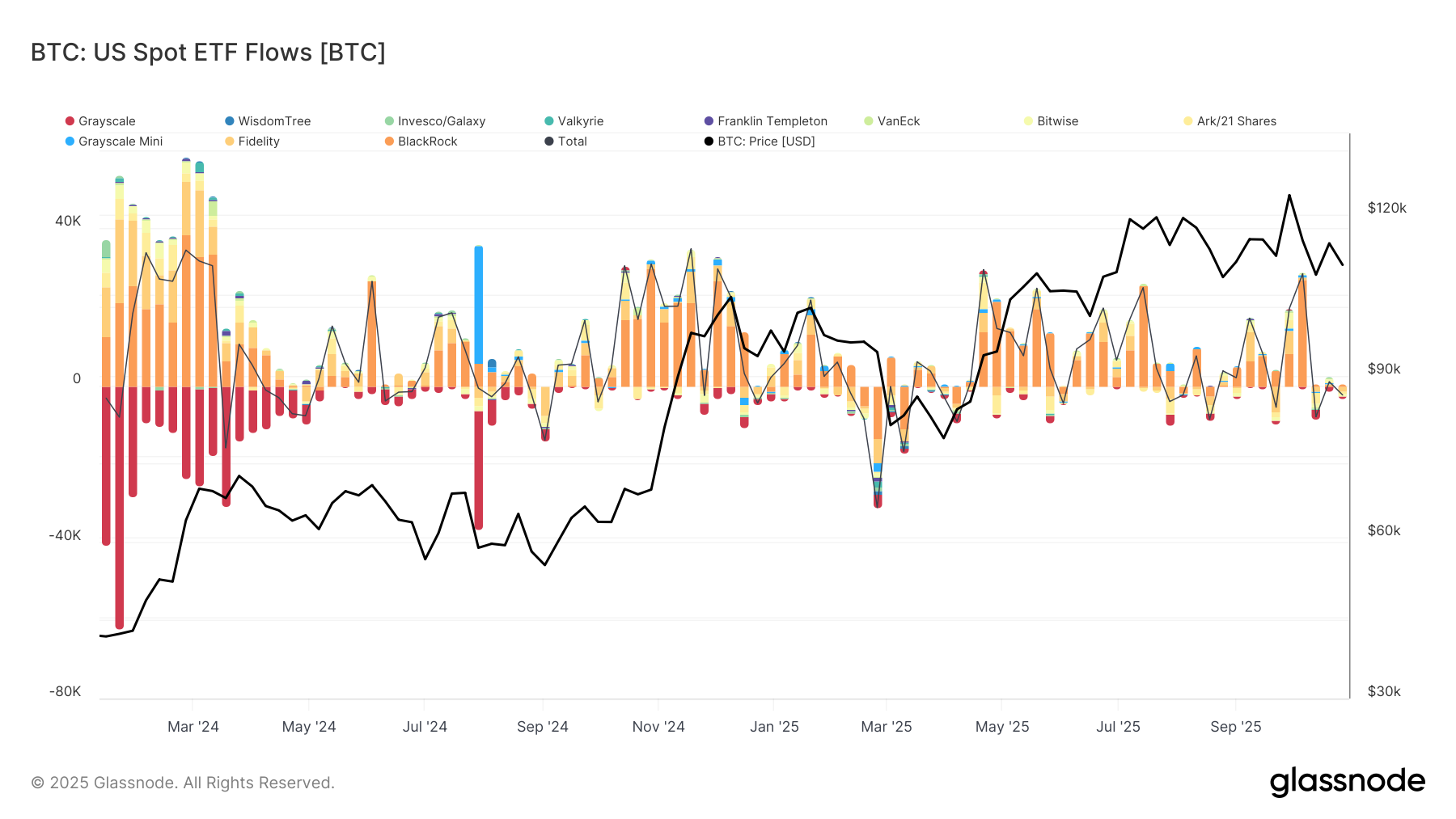

Institutional appetite for Bitcoin is fading, according to Glassnode data showing BlackRock’s spot Bitcoin ETF attracting fewer than 600 BTC in net weekly inflows over the past three weeks — a stark contrast to the 10,000 BTC surges that preceded previous rallies.

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee because while Wall Street partys on AI-fueled gains, Bitcoin’s biggest backers are quietly stepping back. Fresh data shows BlackRock’s Bitcoin ETF inflows have plunged, hinting that institutional enthusiasm may be cooling just as the bull market heats up.

Crypto News of the Day: Institutional Appetite for Bitcoin Weakens

The sharp decline in Bitcoin ETF inflow, reported in a recent publication, is raising eyebrows across the crypto market, even as US equities continue their AI-fueled surge.

New data from Glassnode shows that institutional demand for Bitcoin has slowed dramatically, contrasting with the growing euphoria in traditional markets led by technology and infrastructure plays.

According to Glassnode, BlackRock’s spot Bitcoin ETF has seen less than 600 BTC in net weekly inflows over the past three weeks. This represents a significant decline from the 10,000 BTC-plus inflows that have historically preceded major rallies in this cycle.

“Over the past three weeks, BlackRock’s spot BTC ETF has seen less than 0.6k BTC in weekly net inflows. This represents a sharp decline from the > 10,000 BTC net inflow per week that preceded each major rally this cycle, signaling a notable slowdown in institutional demand,” wrote analysts at Glassnode.

The slowdown marks one of the weakest periods of institutional accumulation since the ETF’s launch. The figures suggest that large investors may be taking a breather after months of heavy accumulation.

Bitcoin’s price has struggled to maintain momentum, but has slipped below $110,000, trading at $107,868 as of this writing.

Bitcoin (BTC) Price Performance. Source:

Bitcoin (BTC) Price Performance. Source:

ETF flows are now considered a leading indicator of sentiment among institutional investors.

Despite the soft inflow data, on-chain analysts spotted movement beneath the surface. Whale Insider reported that BlackRock transferred 1,198 BTC, worth approximately $129 million, to Coinbase, suggesting ongoing portfolio realignment or custody adjustments.

JUST IN: BlackRock deposits 1,198 $BTC ($129.09 million) and 15,121 $ETH ($56.1 million) to Coinbase within the last hour.

— Whale Insider (@WhaleInsider)

Such movements do not necessarily indicate selling. However, they highlight how major asset managers are actively managing exposure amid volatile macro conditions. ETF providers often rebalance or consolidate holdings across custodians as liquidity and demand fluctuate.

Stocks Surge as Crypto Stalls

While Bitcoin demand cools, traditional markets are powering higher. Evercore ISI maintains a bullish outlook on US equities, projecting the S&P 500 to reach 7,750 by 2026.

The firm reportedly cites strong leadership from AI-driven sectors like tech, communications, and consumer discretionary. Evercore strategist Julian Emanuel said the current bull market remains intact, although he warned of near-term volatility tied to shifts in Fed policy and tariffs.

EVERCORE: U.S. BULL MARKET STILL STRONG, BUY STOCKSEvercore ISI advised buying U.S. stocks, saying the S&P 500 could hit 7,750 by end-2026 as key signs of a market top are missing. Analyst Julian Emanuel said gains are being led by AI-driven sectors like tech, communication…

— *Walter Bloomberg (@DeItaone)

With the VIX near year-to-date lows, Emanuel recommended using SPY strangles as hedges in a “still-healthy” uptrend.

ETF analyst Eric Balchunas echoed this optimism, calling it a market that’s “forgotten how to fall.” He noted that the -3x S&P ETF has reverse-split five times, a sign of how punishing this cycle has been for bears.

NEW: Bears Face Extinction in a Market That's Forgotten How to Fall.. The -3x SPX ETF has reverse split 5 times, a crazy data point showing just how brutal this mkt has been for bears. While they'll get their moment (pullbacks are part of life) we also show that long term it pays…

— Eric Balchunas (@EricBalchunas)

The diverging trends highlight a key tension in global markets. AI and equity exuberance are absorbing liquidity, while Bitcoin’s institutional narrative temporarily cools.

As macro liquidity tightens and investor enthusiasm tilts toward AI infrastructure, Bitcoin’s next leg may depend more on when big money returns to the digital frontier than on policy signals.

Chart of the Day

Bitcoin Spot ETF Flows. Source:

Bitcoin Spot ETF Flows. Source:

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Trump denies knowing Binance founder CZ after pardon for money laundering.

- Why Bitcoin treasuries matter: Key takeaways from Bitwise CEO Hunter Horsley.

- Arthur Hayes’ Maelstrom exec exposes 44% loss in top crypto VC bet even as BTC doubles.

- New rule could bring Binance-level liquidity to Hong Kong.

- Could Zcash replace Bitcoin? Experts say yes.

- Fake news floods Pi Network community as exchange supply hits a new high.

Crypto Equities Pre-Market Overview

| Company | At the Close of October 31 | Pre-Market Overview |

| Strategy (MSTR) | $269.51 | $265.15 (-1.62%) |

| Coinbase (COIN) | $343.78 | $341.25 (-0.55%) |

| Galaxy Digital Holdings (GLXY) | $35.01 | $36.51 (+4.26%) |

| MARA Holdings (MARA) | $18.27 | $18.63 (+1.97%) |

| Riot Platforms (RIOT) | $19.78 | $20.46 (+3.44%) |

| Core Scientific (CORZ) | $21.54 | $22.86 (+6.13%) |

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Update: Individual Investors Accumulate ETH Despite Institutional Withdrawals and Market Turmoil

- Ethereum (ETH) dropped below $3,400 on November 4, triggering $1.1B in liquidations and erasing 2025 gains. - Whale activity included a $24.48M short-covering move and $386M ETH transfer, signaling potential market bottom. - Bitcoin neared $100,000 as ETH/RSI hit oversold levels, while retail traders defied institutional exits to accumulate ETH. - Macroeconomic pressures and leveraged position unwinds drove the selloff, though some analysts highlight dip-buying opportunities.

XRP News Today: XRP's Strategic Phases: Functionality, Confidence, and Market Flow Propel Institutional Integration

- Ripple's Monica Long outlined XRP's strategic focus on institutional integration, technical innovation, and expanding DeFi use cases via a new lending protocol. - The XRP Ledger's asset-backed lending framework aims to attract institutional investors while RLUSD stablecoin enables instant cross-border aid payments. - India's Madras High Court recognized XRP as legal property, aligning with global trends and enhancing institutional trust in digital asset ownership rights. - Global firms hold $11B in XRP a

Compliance and artificial intelligence propel NewFire's Bitfire to the forefront of digital asset innovation

- NewFire launches Bitfire, a digital asset platform integrating compliance, AI, and blockchain to address global market demands. - Competitors like Utoch (MSB registration) and Poain (AI-driven risk models) highlight rising industry focus on regulatory alignment and intelligent automation. - Market forecasts project $6.1B in compliance-AI opportunities by 2025, while Hong Kong's bond slump underscores macroeconomic challenges for digital asset platforms. - Bitfire aims to leverage AI for dynamic asset all

GIGGLE's Rapid Ascent Sparks Discussion While Giggle Academy Denies Any Association

- GIGGLE, a BNB Chain memecoin, surged to $130M market cap before crashing, sparking debates over its legitimacy amid Giggle Academy's disclaimers. - Binance pledged to donate 50% of GIGGLE trading fees to Giggle Academy's charity, raising concerns about exchange influence on token valuations. - Analysts warn memecoins' extreme volatility risks retail investors, while regulators scrutinize compliance with securities laws following SEC's memecoin crackdown. - The token's trajectory mirrors Dogecoin's, highl