3 Altcoins Facing Major Liquidations in the First Week of November

Ethereum, Aster, and Dash are leading the week’s high-risk liquidation zones as shorts dominate derivatives markets. With leverage skewed heavily to the downside, sharp rebounds could trigger billions in forced liquidations and amplify volatility.

The crypto market began the first week of November in the red, turning short-term sentiment among derivatives traders negative. Capital and leverage are now heavily positioned on short bets, increasing the likelihood of large short liquidations in the weeks ahead.

In this unbalanced liquidation landscape, certain altcoins could trigger significant losses for traders. Which ones are at risk?

1. Ethereum (ETH)

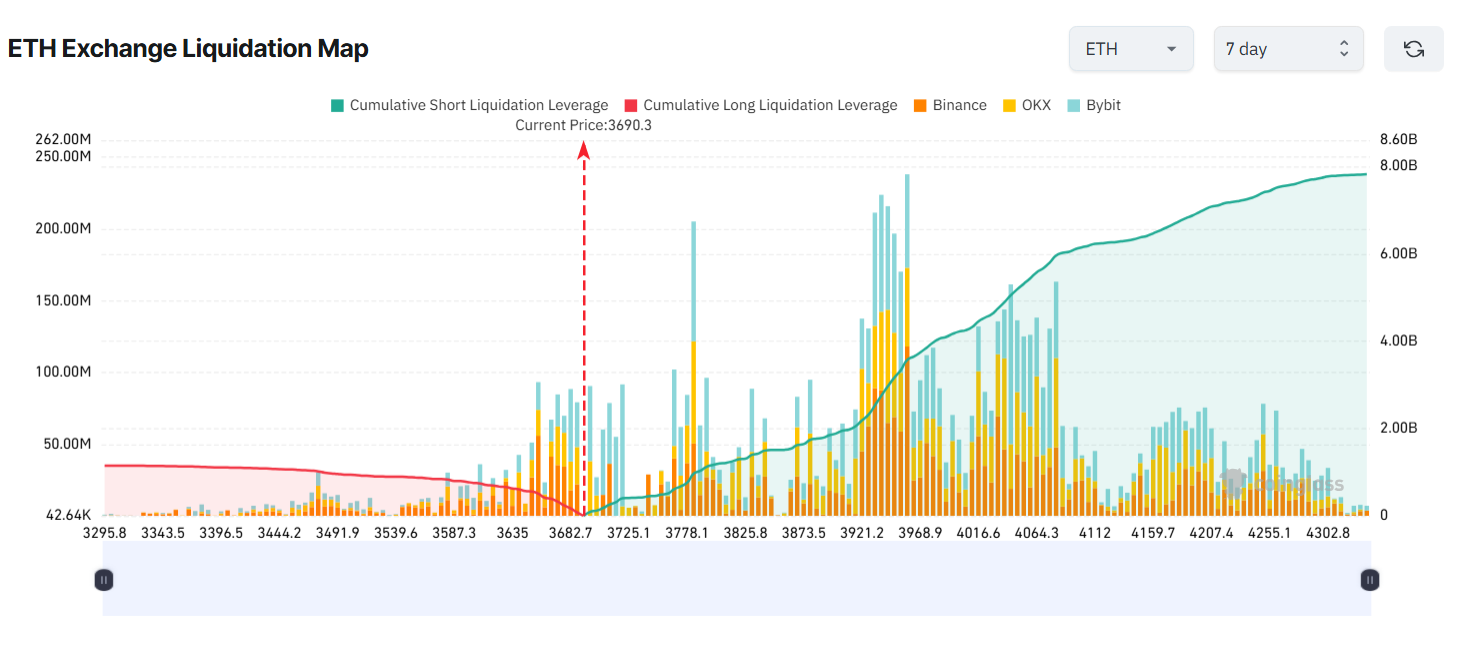

ETH’s seven-day liquidation map reveals a clear imbalance between potential liquidations on the long and short sides. The short positions dominate.

If ETH rebounds to $4,000 this week, more than $4.2 billion worth of shorts could be liquidated. A stronger recovery toward $4,300 could push total short liquidations close to $8 billion.

ETH Exchange Liquidation Map. Source:

Coinglass.

ETH Exchange Liquidation Map. Source:

Coinglass.

Recent analysis from BeInCrypto highlights a bullish divergence, signaling possible recovery momentum for ETH this week.

Analysts also noted that, despite short-term volatility, Ethereum’s network continues to set new records. These metrics reinforce strong fundamentals, encouraging investors to accumulate ETH on deep pullbacks.

For example, ETH’s application revenue has reached an all-time high, while the supply of stablecoins on the network keeps climbing.

ethereum app revenue hit an ATHin october, and stablecoin supply still marching higher pic.twitter.com/sXiz3RsoBL

— rip.eth (@ripeth) November 2, 2025

Given these factors, short sellers without proper risk management could face massive liquidations if ETH prices rebound sharply.

2. Aster (ASTER)

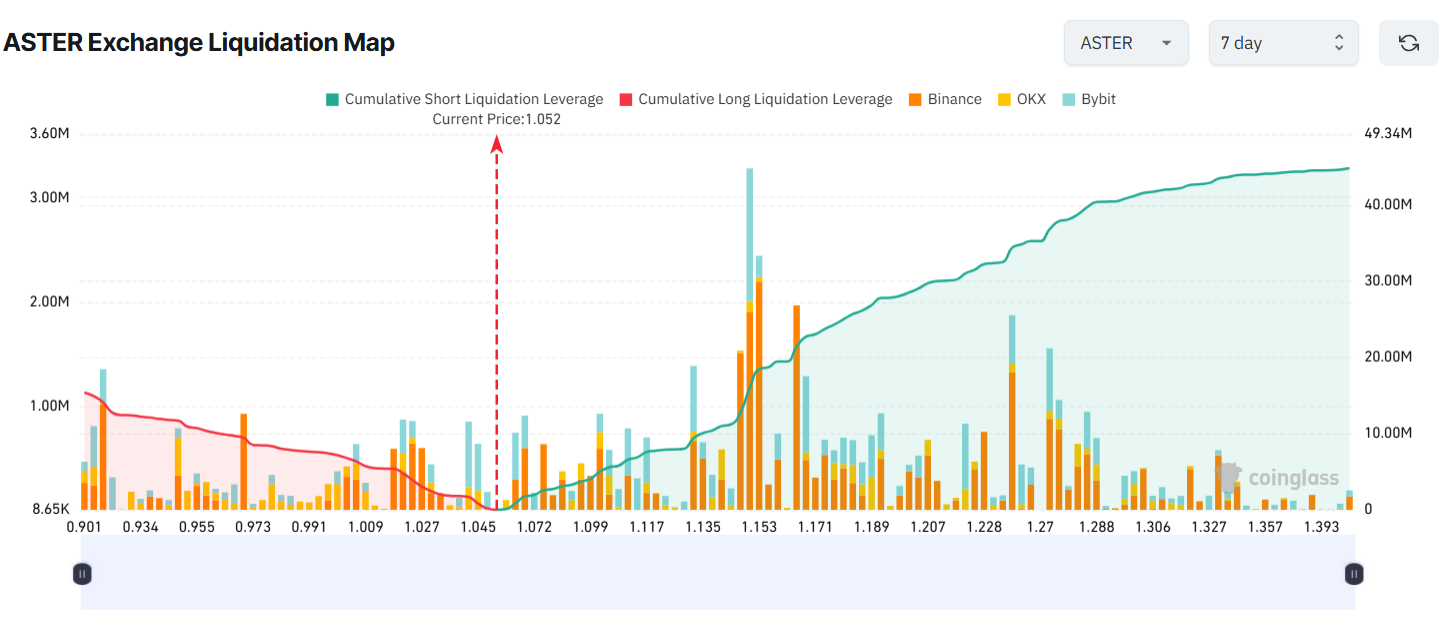

On the first Monday of November’s opening week, Aster’s liquidation map also shows a stark imbalance, with short-side liquidations outweighing long-side risks.

If ASTER rises to $1.4, roughly $44 million in short positions could be wiped out. Conversely, if it drops to $0.9, long liquidations could exceed $15 million.

ASTER Exchange Liquidation Map. Source:

Coinglass

ASTER Exchange Liquidation Map. Source:

Coinglass

What could trigger short liquidations for ASTER? The biggest risk likely stems from social media influence, particularly from CZ’s recent posts on X.

Aster surged 30% after Binance founder Changpeng Zhao revealed he had personally purchased $2 million worth of ASTER tokens for long-term holding. This announcement prompted several other KOLs to disclose their own ASTER purchases publicly.

Although the price has since corrected, uncertainty remains. If CZ releases new updates about ASTER, it could cause another short-term price pump, leading to potential short liquidations. Short traders must stay cautious in such conditions.

3. Dash (DASH)

The privacy coin narrative continues into November. This time, Dash (DASH) has taken the spotlight, surpassing Zcash (ZEC) and reaching its highest price in three years.

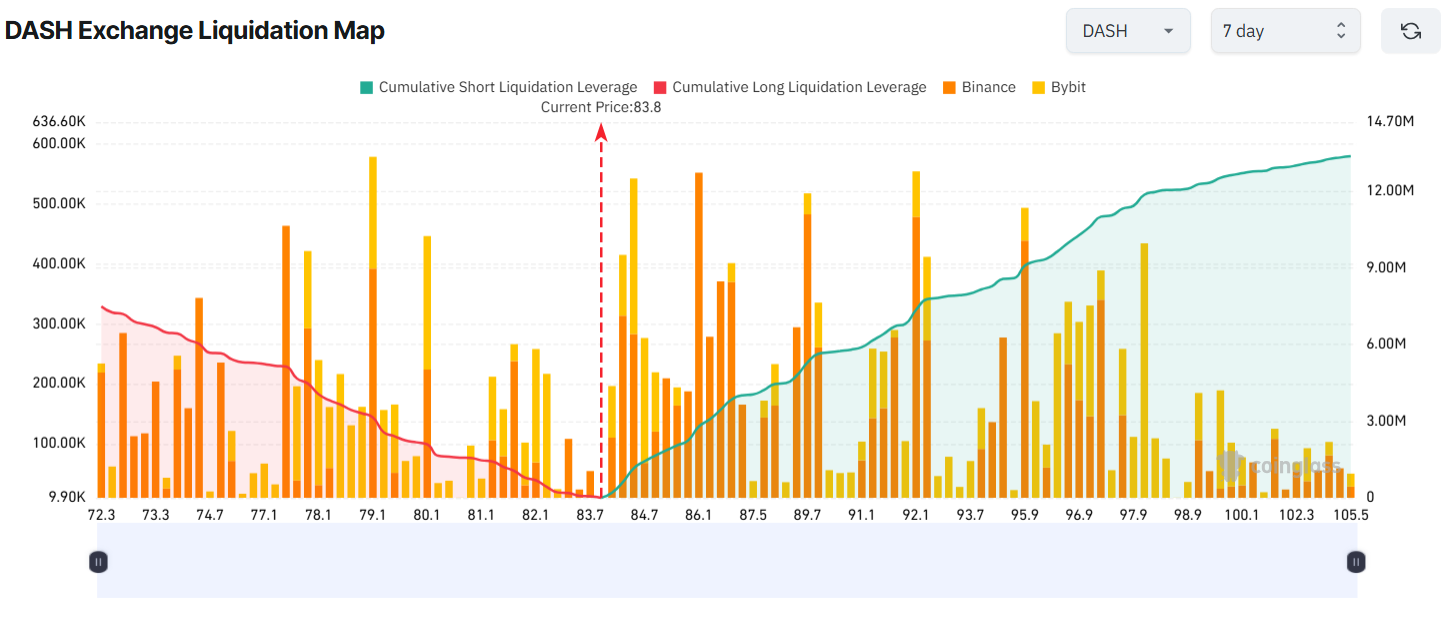

Derivative traders are leaning bearish, increasing their short exposure. If DASH climbs to $105, over $13 million in short positions could be liquidated.

DASH Exchange Liquidation Map. Source:

Coinglass.

DASH Exchange Liquidation Map. Source:

Coinglass.

On X, some analysts are even more optimistic, projecting higher targets.

“Next stop: $100–140. If privacy meta continues… don’t be surprised to see this at $250,” Tactical Investing predicted.

In a FOMO-driven rally, it’s difficult to determine when the momentum will stop. As long as community discussions remain bullish, shorting DASH may carry a substantial risk of liquidation.

The altcoins gaining community attention — such as ETH, ASTER, and DASH — reflect themes recycled from previous months, including Ethereum’s ecosystem, DEX, and privacy narratives. This pattern suggests the market is running out of new catalysts.

Therefore, even if prices recover, such rallies might lack sustainability. As volatility increases, both long and short traders may end up facing similar levels of risk and loss.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why does bitcoin only rise when the US government reopens?

Is the US government shutdown the main culprit behind the global financial market downturn?

Crypto "No Man's Land": Cycle Signals Have Emerged, But Most People Remain Unaware

If the crypto market of 2019 taught us anything, it's that boredom is often the prelude to a breakout.

Don't panic, the real main theme of the market is still liquidity.

Such pullbacks are not uncommon in a bull market; their purpose is to test your conviction.

Arthur Hayes Dissects Debt, Buybacks, and Money Printing: The Ultimate Cycle of Dollar Liquidity

If the Federal Reserve's balance sheet expands, it will be positive for US dollar liquidity, ultimately driving up the prices of bitcoin and other cryptocurrencies.