Solana News Today: The Rise of Solana ETFs and On-Chain Growth Reflects Bitcoin’s Initial Adoption Surge

- Solana's SOL token near $186 shows bullish momentum, with 24.5M tokens accumulated at $189 support, signaling potential for $200+ gains. - Institutional adoption accelerates as Solana ETFs attract $155M in 3 days, outpacing Ethereum in stablecoin growth with $152M 24-hour inflows. - Technical analysis highlights $200 as key resistance; sustained break could trigger $210–$220 rally, while 50-day SMA remains dynamic barrier. - Bitwise's Hougan compares Solana's growth to Bitcoin's early phase, projecting 5

Solana's native asset,

Recent blockchain data shows that approximately 24.5 million SOL tokens have been gathered around the $189 support region, establishing a strong foundation that could support further price increases. This accumulation, as highlighted in a

Interest from institutional players has also grown, with

Technical analysis presents a cautiously positive outlook. Although the Relative Strength Index (RSI) indicates some bearish pressure in shorter periods, buyers are defending key resistance zones. Maintaining a close above $200 could spark a rally toward $210–$220, according to

This momentum has caught the eye of industry executives. Bitwise's Chief Investment Officer Matt Hougan recently likened Solana's growth to Bitcoin's early days, stressing its capacity to absorb 5% of the total token supply within one or two years. At present valuations, this would mean ETF holdings could exceed $5 billion—a 3,000% jump from current levels, as

Meanwhile, Solana's ecosystem is expanding faster than many rivals. Its recent collaboration with Western Union to launch a U.S. dollar stablecoin, planned for 2026, highlights its increasing relevance for real-world payments. This comes after institutional recognition from Grayscale, whose research team pointed to Solana's potential to replicate the regulated market achievements of

Still, the journey to $200 faces some obstacles. Lower trading volumes and mixed technical signals suggest caution, and some experts warn that short-term profit-taking could postpone a breakout. Nevertheless, with ETF inflows, stablecoin expansion, and on-chain accumulation aligning, the outlook for Solana's continued rise remains strong.

As the market anticipates a clear move above $200, the wider crypto sector provides additional context. While projects such as

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

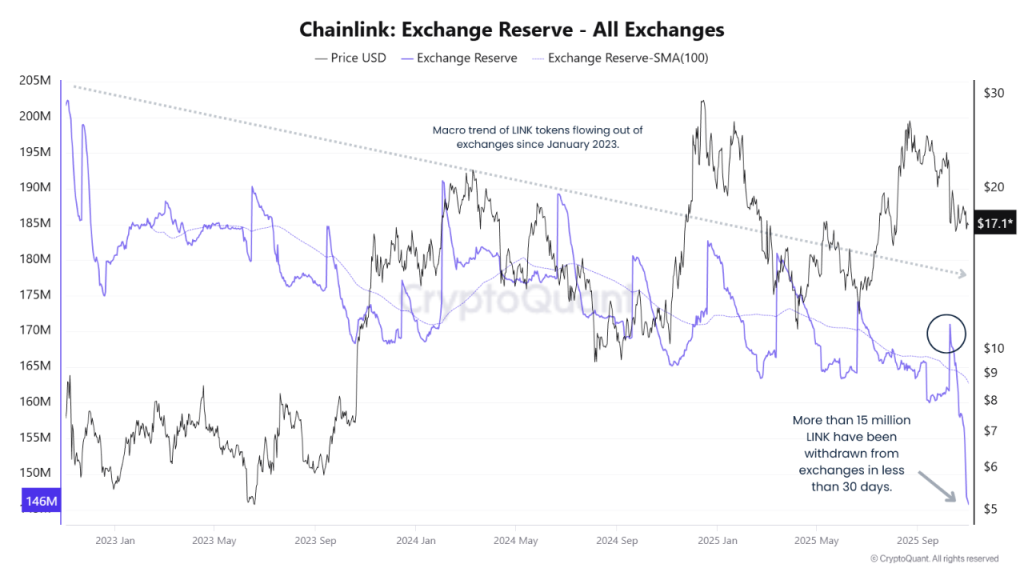

Chainlink Price Prediction 2025: Rising Institutional Adoption Eyes $100 Target

DeFi Faces Confidence Challenges: External Mismanagement Reveals Deep-Rooted Vulnerabilities

- Stream Finance halts deposits/withdrawals after $93M loss from third-party mismanagement, triggering XUSD depegging and systemic risks. - Perkins Coie investigates, highlighting DeFi governance flaws as XUSD’s 58% 24-hour drop impacts $280M in linked loans. - Industry warns of trust fragility; incident coincides with Balancer’s $116M hack, amplifying crypto sector scrutiny. - Stream’s crisis underscores risks in DeFi’s reliance on external managers amid broader economic pressures and regulatory tightenin

Solana Latest Updates: Bitcoin Falters, Solana Shows Uncertainty While MoonBull's Tokenomics Spark November Rally

- Bitcoin fell below $116,000 in late October amid cautious positioning before the Fed meeting, with on-chain metrics showing stable miner holdings. - Solana dropped 6% after Jump Crypto swapped $205M SOL for BTC, highlighting altcoin volatility despite $100B+ market cap support from ETF approvals. - MoonBull ($MOBU) surged 163% in presale with 95% APY staking, leveraging deflationary tokenomics and meme-driven adoption to outpace BNB/AVAX in 2030 ROI forecasts. - Institutional crypto infrastructure deals

Tokenized Treasuries Reach $8.7 Billion as Authorities and Competing RWA Platforms Draw Near

- Tokenized U.S. Treasuries surpassed $8.73B AUM, driven by institutional demand and yield seekers, with BlackRock and Securitize leading the market. - Regulatory scrutiny intensifies as CFTC and Hong Kong tighten oversight, while RWA rivals like tokenized gyms and education assets challenge treasury dominance. - Liquidity constraints and redemption restrictions persist, but ISO 20022 blockchain integration signals progress toward bridging TradFi and digital finance. - Market growth faces hurdles including