XRP News Today: "Ripple Connects Cryptocurrency and Conventional Finance Through Integrated Trading Platform"

- Ripple launches Ripple Prime, a U.S. institutional trading platform integrating Hidden Road's infrastructure with XRP/RLUSD OTC trading and cross-margin capabilities. - The platform combines custody, payments, and derivatives services, leveraging $3T+ annual transaction volume and XRP Ledger's instant settlement for institutional clients. - Ripple's 2024-2025 acquisitions (Standard Custody, Rail, GTreasury) enable diversified offerings while unlocking 1B XRP (~$2.49B) raises liquidity strategy scrutiny.

Ripple has introduced a digital asset spot prime brokerage service tailored for U.S. institutional investors, representing a major step into mainstream financial services after its $1.25 billion purchase of Hidden Road, a global multi-asset prime brokerage, according to

This launch highlights Ripple’s ongoing efforts to connect the crypto sector with traditional finance. By merging Hidden Road’s technology with Ripple’s regulatory approvals, the company now offers institutional clients a full range of services, including custody, payments, and trading, The Crypto Basic reported. Michael Higgins, International CEO of Ripple Prime, stated that this expansion equips Ripple to satisfy institutional needs for a broader array of trading solutions, CoinDesk noted. Ripple’s core assets, XRP and RLUSD, play a key role in these services, boosting liquidity and settlement speed for institutional users, CoinDesk added.

This development follows a series of strategic acquisitions. In 2024, Ripple bought Standard Custody & Trust, a U.S.-based crypto custodian, and in 2025, it acquired Rail, a stablecoin payments company, and GTreasury, a treasury management software provider, according to The Crypto Basic. These deals have enabled Ripple to handle more than $3 trillion in yearly transactions for over 300 institutions via Hidden Road, and post-trade processes are now shifting to the XRP Ledger, taking advantage of its rapid settlement capabilities to improve efficiency, The Crypto Basic reported.

As Ripple’s institutional initiatives accelerate, the XRP market remains intricate. On November 1, 2025, Ripple released 1 billion XRP (valued at around $2.49 billion) from escrow as part of its routine liquidity management, according to

Recent swings in XRP’s price have reignited discussion about how its market capitalization should be calculated. Some critics believe that escrowed tokens—totaling 35 billion XRP—should

Regulatory hurdles remain. A federal court recently supported the Federal Reserve’s decision to deny a crypto bank’s application for a master account, citing concerns about systemic risk, as reported by

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

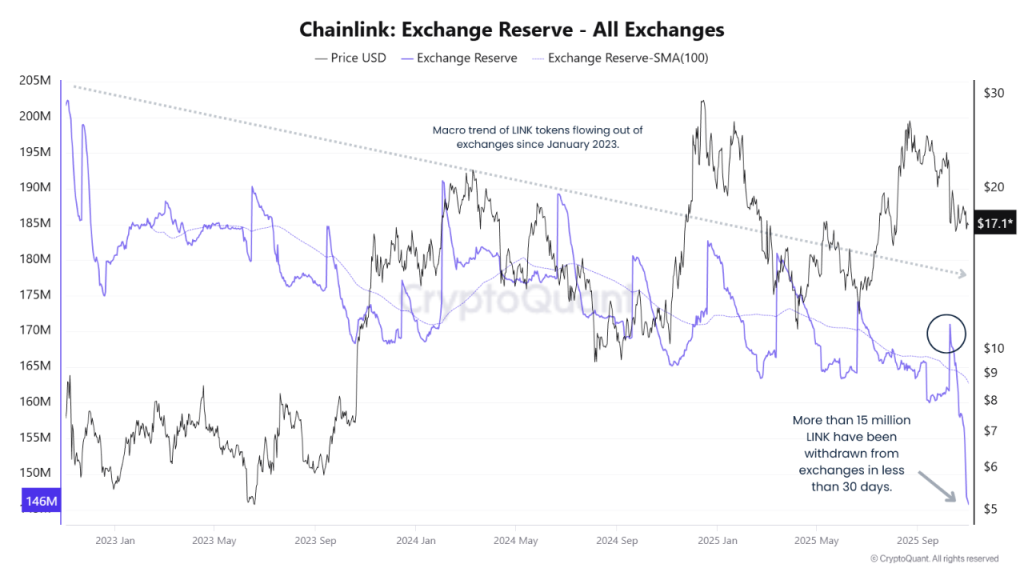

Chainlink Price Prediction 2025: Rising Institutional Adoption Eyes $100 Target

DeFi Faces Confidence Challenges: External Mismanagement Reveals Deep-Rooted Vulnerabilities

- Stream Finance halts deposits/withdrawals after $93M loss from third-party mismanagement, triggering XUSD depegging and systemic risks. - Perkins Coie investigates, highlighting DeFi governance flaws as XUSD’s 58% 24-hour drop impacts $280M in linked loans. - Industry warns of trust fragility; incident coincides with Balancer’s $116M hack, amplifying crypto sector scrutiny. - Stream’s crisis underscores risks in DeFi’s reliance on external managers amid broader economic pressures and regulatory tightenin

Solana Latest Updates: Bitcoin Falters, Solana Shows Uncertainty While MoonBull's Tokenomics Spark November Rally

- Bitcoin fell below $116,000 in late October amid cautious positioning before the Fed meeting, with on-chain metrics showing stable miner holdings. - Solana dropped 6% after Jump Crypto swapped $205M SOL for BTC, highlighting altcoin volatility despite $100B+ market cap support from ETF approvals. - MoonBull ($MOBU) surged 163% in presale with 95% APY staking, leveraging deflationary tokenomics and meme-driven adoption to outpace BNB/AVAX in 2030 ROI forecasts. - Institutional crypto infrastructure deals

Tokenized Treasuries Reach $8.7 Billion as Authorities and Competing RWA Platforms Draw Near

- Tokenized U.S. Treasuries surpassed $8.73B AUM, driven by institutional demand and yield seekers, with BlackRock and Securitize leading the market. - Regulatory scrutiny intensifies as CFTC and Hong Kong tighten oversight, while RWA rivals like tokenized gyms and education assets challenge treasury dominance. - Liquidity constraints and redemption restrictions persist, but ISO 20022 blockchain integration signals progress toward bridging TradFi and digital finance. - Market growth faces hurdles including