DeFi's Security Challenges Confront Hong Kong's Efforts to Regulate for International Liquidity

- DeFi protocol Balancer lost $128.6M via a V2 pool exploit, triggering pool pauses and a 4% BAL token drop. - Hong Kong's SFC now allows licensed crypto exchanges to access global liquidity pools, easing ringfenced rules to boost market competitiveness. - Ethereum stablecoins hit $2.82T in October volume, with USDC and USDT dominating as traders seek yields amid market volatility. - Hong Kong's reforms align crypto rules with traditional finance, exempting licensed tokens from trading history requirements

DeFi protocol

At the same time, Hong Kong’s Securities and Futures Commission (SFC) revealed a significant policy update, now permitting locally licensed crypto exchanges to connect with global liquidity pools, as reported by

The new rules, outlined in a regulatory notice, bring crypto trading regulations closer to those for traditional financial assets and provide exemptions for SFC-approved tokens and stablecoins from the usual 12-month trading history rule, according to a

Ethereum’s stablecoin sector reached unprecedented activity in October, with monthly transaction volumes soaring to $2.82 trillion—a 45% jump from September,

These events underscore the contrasting paths within the crypto sector: while DeFi platforms contend with security threats, regulators in Hong Kong and elsewhere are actively developing policies to attract both institutional and retail investors. As the industry faces hacks, regulatory developments, and new applications, liquidity and innovation continue to drive its expansion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Bloodbath: BTC Price Plunges Below $100K as Whales Vanish and Traders Brace for More Selloff

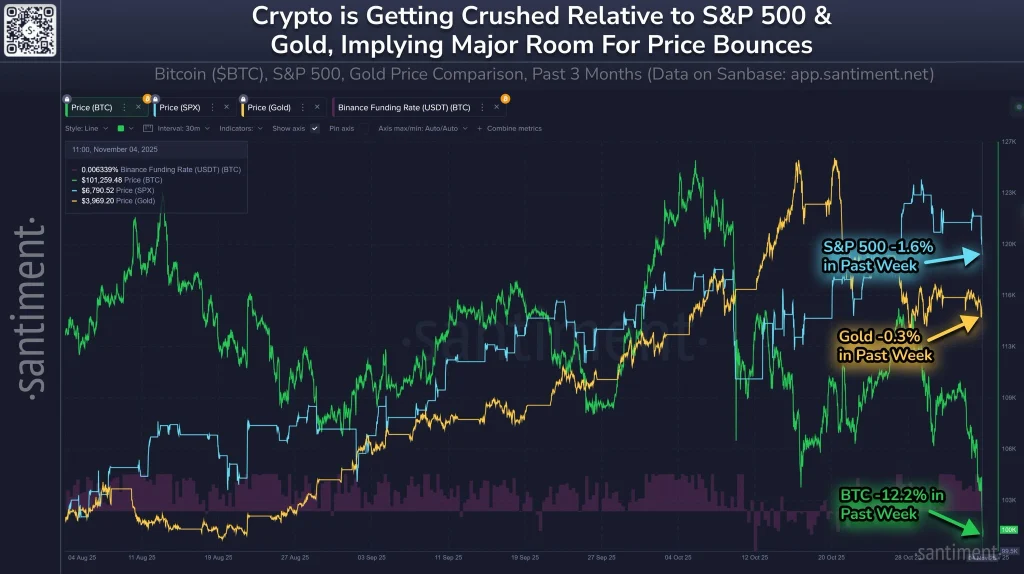

Crypto Get Crushed Relative to Gold and S&P 500, Santiment Predicts a ‘Rubber-Band’ Rebound

Ethereum News Update: Ethereum ETFs See $210M Outflows While Altcoins Gain $200M from Institutional Investors

- US Ethereum ETFs saw $210M in 5-day outflows, with BlackRock's ETHA leading $81.7M daily redemptions amid regulatory uncertainty and market shifts. - Bitcoin ETFs lost $543.59M over 3 days, while Solana's BSOL ETF attracted $197M in inflows, reflecting institutional appetite for high-performance altcoins. - Ethereum's price fell below $3,500 as ETF redemptions worsened bearish pressure, contrasting with new Solana/Hedera ETFs drawing $199M in four days. - Market analysts highlight maturing crypto dynamic