BasePerp To Enable Creation of Perpetual Futures Markets on Base

November 3, 2025 – Singapore, Singapore

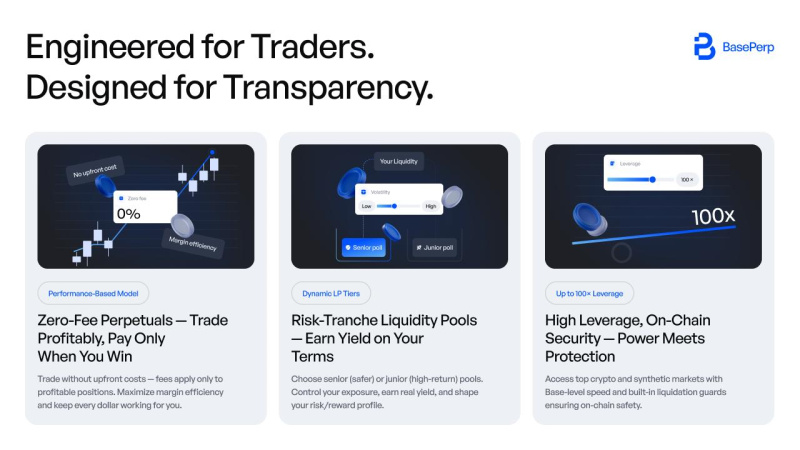

BasePerp has announced the launch of the first native perpetual DEX (decentralized exchange) built on the Base blockchain.

The platform is designed to deliver high-performance derivatives trading within one of the fastest-growing ecosystems in 2025, combining scalability, security and deep liquidity to support both retail and institutional participants.

Perpetual DEXs have become the main narrative in 2025, driving substantial liquidity growth and increased institutional participation across major blockchain networks.

New-generation perpetual trading platforms illustrate how the derivatives market can enhance ecosystem adoption and TVL (total value locked) through greater speed, liquidity depth and diverse trading options.

The perpetual futures market now represents a dominant liquidity driver in the crypto sector, attracting institutional capital, market makers and high-frequency traders.

Strong perpetual markets enhance a blockchain’s financial relevance, often surpassing spot trading and yield-farming activity in both scale and engagement.

Perpetual DEXs he new frontier of DeFi power

The perpetual futures market now represents a dominant liquidity driver in crypto.

Platforms across the sector have proved that perpetual derivatives can outpace spot market growth, bringing attention from institutional capital, market makers and high-frequency traders.

The success of perpetual DEXs causes the growth of deep liquidity pools and new high-volume DeFi ecosystems.

The explosive growth of next-gen perp DEXs proves that institutional capital and funds participate in high-performance trading infrastructures.

Derivatives traders and LP users influence TVL growth and the development of DeFi systems.

Strong perpetual markets make a chain financially relevant, outperforming spot trading and yield-farming activity.

BasePerp he first perpetual DEX launching on Base blockchain

Base has become one of the fastest-growing ecosystems by this year, overtaking Optimism in TVL, and continues to show strong user and developer interest.

Recent network inflation spikes and massive user migration can boost the chain’s rapidly increasing usage.

BasePerp , with its release, can become a cornerstone of perpetual trading for Base investors and traders. It can boost TVL to $100 billion and 25 million users, according to analyst data.

Reports indicate over 25,000 developers are building on Base, and BasePerp can become a driver that will enter the entire Base ecosystem, encouraging DeFi protocols and accumulating migration from networks where perpetual trading is already saturated.

Perpetual DEXs already dominate volume metrics, and BasePerp has strong upside potential. It can leverage the Base infrastructure and offer fresh liquidity options, scaling derivative capital inflow.

About

Based on Base’s scalability and security, BasePerp is positioned to become the first native perpetual DEX on Base, offering high-performance trading.

Attracting the interest of retailers and institutional investors, it has the potential to become a fundamental component of the Base ecosystem, boosting the DeFi market and liquidity.

Website

Contact

Mark , BasePerp

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Partisan Stalemate Intensifies: 20% Likelihood of Resolving 35-Day Government Closure

- U.S. government shutdown enters 35th day with 20% chance of ending Nov 4–7 due to partisan funding disputes over healthcare subsidies. - Congressional gridlock disrupts $7B in economic output, delays critical data, and leaves 65,500 firms at risk of $12B payment losses. - Global media like Radio Free Asia faces funding cuts while Fed struggles to assess inflation amid shutdown-related data gaps. - Prediction markets show 33% odds for Nov 8–11 resolution as political analysts warn of growing recession ris

Ethereum News Update: Crypto Whales Employ Flash Loans to Manage Market Fluctuations and Prevent Liquidation

- Ethereum-based whale avoided liquidation by selling 465.4 WBTC/2,686 ETH ($56.52M) to repay flash loans amid Nov 5 market crash. - ETH dropped below $3,400 for first time since June 2024, triggering $1.1B+ in liquidations as 303,000 traders exited leveraged positions. - Similar strategy seen earlier when nemorino.eth sold 8,000 ETH via flash loan to secure $7.58M profit during downturn. - Analysts highlight systemic risks in leveraged trading, noting disciplined deleveraging via flash loans is critical d

Bitcoin slips below $100K as analysts say BTC is set to drop lower: Here’s why

Bitcoin Updates: Crypto Shifts Toward Privacy—Zcash Gains Momentum While Bitcoin Welcomes Institutional Investors

- Zcash's 700% price surge to $388 highlights growing demand for privacy-focused crypto, surpassing Monero with a $6.2B market cap. - Technological upgrades like Zashi wallet's cross-chain swaps and Hyperliquid's $115M ZEC contracts boost Zcash's usability and liquidity. - Analysts like Will Owens frame Zcash as Bitcoin's "spiritual successor," emphasizing cypherpunk principles against institutionalized Bitcoin adoption. - Regulatory risks (EU's 2027 privacy coin ban) and skepticism about rally sustainabil