Balancer audits under scrutiny after $100M+ exploit

Many cryptocurrency traders are seeking answers after a successful exploit at the decentralized exchange and automated market maker Balancer resulted in more than $100 million in digital assets being stolen.

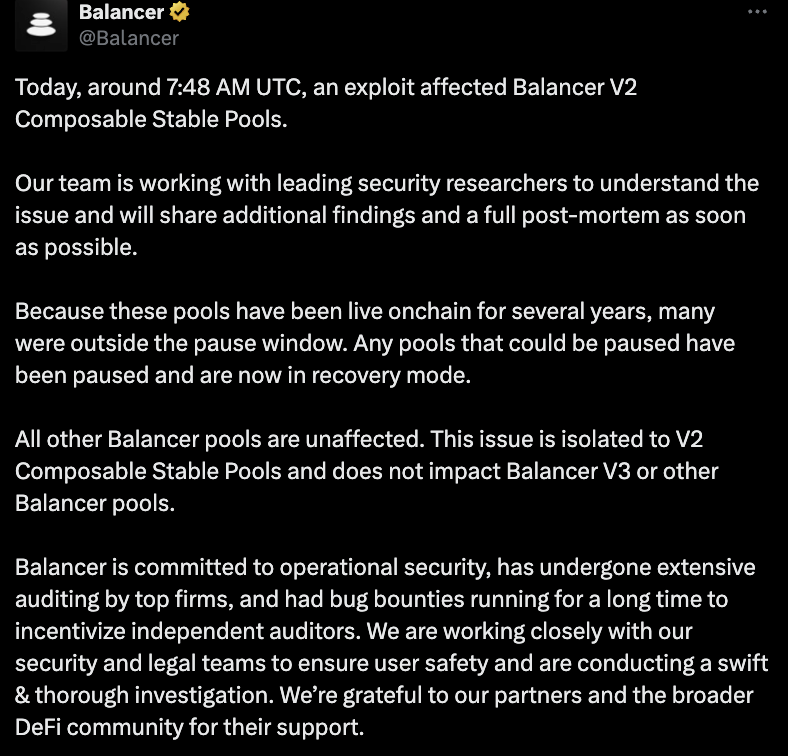

In a Monday X post updating users on the exploit, Balancer said the incident was “isolated to V2 Composable Stable Pools and does not impact Balancer V3 or other Balancer pools.”

The platform added that it had “undergone extensive auditing by top firms, and had bug bounties running for a long time to incentivize independent auditors,” calling into question how the exploit was accomplished.

“Balancer went through 10+ audits,” said Suhail Kakar, a developer relations lead at the TAC blockchain on X. “The vault was audited [three] separate times by different firms still got hacked for $110M. This space needs to accept that ‘audited by X’ means almost nothing. Code is hard, DeFi is harder.”

According to a list of Balancer V2 audits available on GitHub, four different security companies — OpenZeppelin, Trail of Bits, Certora, and ABDK — conducted 11 audits of the platform’s smart contracts, with the most recent on its stable pool by Trail of Bits in September 2022.

Cointelegraph reached out to OpenZeppelin for comment, but had not received a response at the time of publication. A Trail of Bits spokesperson declined to comment on the exploit “until the root cause is identified and all Balancer forks are safe.”

Related: ‘Attack on Bitcoin’ — Bitcoiners slam ‘legal threats’ in soft fork proposal

The exploit, reported early on Monday, resulted in more than $116 million worth of staked Ether (ETH) — including StakeWise Staked ETH (OSETH), Wrapped Ether (WETH) and Lido wstETH (wSTETH) — being moved to a newly created wallet. A Nansen research analyst told Cointelegraph that the Balancer incident could have stemmed from smart contract issues that had a “faulty access check allowing the attacker to send a command to withdraw funds.”

Project offers a 20% white hat bounty for returning funds

In a blockchain transaction note addressing the attackers on Monday, Balancer’s team offered a white hat bounty of up to 20% of the stolen funds if the full amount was returned within 48 hours of the notice.

“[I]f you choose not to cooperate, we have engaged independent blockchain forensics specialists and are actively cooperating with multiple law-enforcement agencies and regulatory partners,” said Balancer.

At the time of publication, the project had not announced any additional updates on the bounty or details of the exploit.

Magazine: Solana vs Ethereum ETFs, Facebook’s influence on Bitwise: Hunter Horsley

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

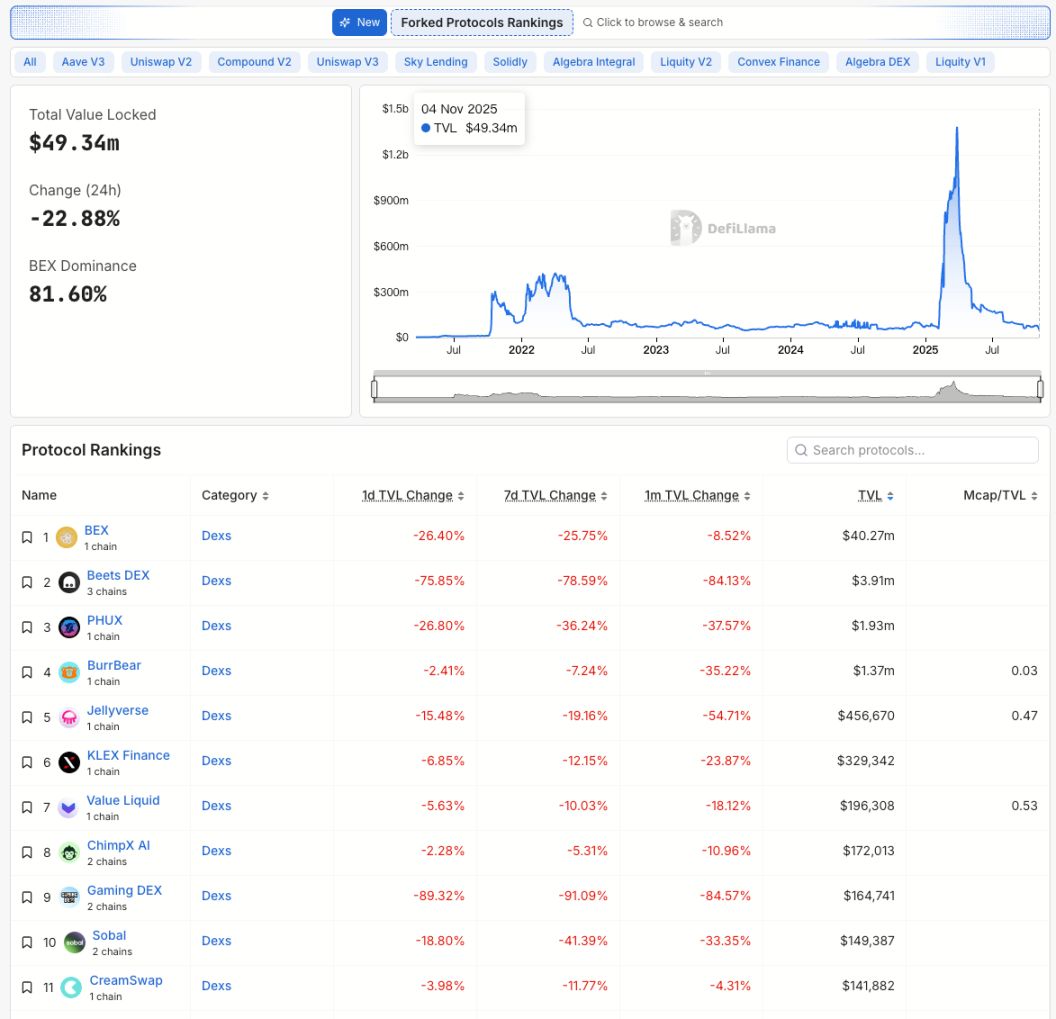

From Balancer to Berachain: When Chains Hit the Pause Button

A single vulnerability exposes the conflict between DeFi security and decentralization.

Discover How Hong Kong Advances Digital Trade with Tokenized Currency

In Brief Hong Kong’s tokenized currency advances digital trade, transforming global payment systems. Winters views projects as crucial for digital international trade transitions. SFC-approved initiatives improve efficiency, positioning Hong Kong as Asia’s crypto hub.

Unlock Potential Profit with Strategic Moves for ZK Coin

In Brief ZK Coin saw a significant rise on November 1, gaining attention from Vitalik Buterin. Its price recently spiked to $0.075 but has now settled at $0.057. Alex Gluchowski proposes strategies to expand ZK Coin's utility and benefit the ecosystem.

Nasdaq Reprimands TON Strategy Over Toncoin Deal Rule Breach