BNB News Today: Crypto in 2025—Will Meme Mania Prevail or Will Lasting Tokenomics Take the Lead?

- Q4 2025 crypto market highlights $BALZ (BNB-based meme coin) and MoonBull (structured presale) as top "100x" opportunities amid shifting dynamics. - $BALZ leverages Binance CEO CZ's influence and social media hype, with 40,000+ participants and 70% profitable traders ahead of October 31 presale close. - MoonBull's Mobunomics framework allocates 5% of transactions to liquidity/holders, offers 95% APY staking, and aims for decentralized governance by Stage 12. - BNB and AVAX show long-term growth potential

As we move into the fourth quarter of 2025, the cryptocurrency sector is at a crucial turning point, with both analysts and investors focusing on promising projects as market trends evolve. Among the most discussed tokens are those driven by internet memes and those with practical applications, each competing for a share of the expanding digital asset landscape. Two projects, in particular, are drawing significant interest: , a token built on BNB

The

CZ's recent reappearance on social media using his @binance account has fueled further speculation. Observers in the market suggest that $BALZ could reach a nine-figure market cap with just one tweet from CZ, reminiscent of the rapid rises seen in earlier meme token booms.

While $BALZ is propelled by community excitement, is distinguishing itself through carefully designed economic rewards. The Mobunomics model for the project dedicates 2% of every transaction to liquidity, another 2% to rewarding holders, and 1% to burning tokens, fostering a self-reinforcing ecosystem, according to a

MoonBull's roadmap spans 23 stages and features decentralized governance at Stage 12, enabling holders to vote on important project matters. Early backers from Stage 1 have already realized a 163% return, while those joining at Stage 5 could see gains as high as 9,256% if the token lists at $0.00616. Security is also a priority, with smart contracts on Ethereum and a two-year liquidity lock designed to reduce volatility.

Although new projects are making headlines, established names like and continue to play a vital role in 2025 investment strategies. BNB is expected to climb from $1,118 in 2025 to $1,427 by 2030, fueled by the growth of DeFi and the Binance Smart Chain. Likewise,

Still, some analysts believe MoonBull’s structured approach to liquidity and governance presents a strong alternative to speculative investments in established coins. "MoonBull is more than just another meme token—it's designed for lasting expansion," one analyst commented.

The current state of crypto resembles the conviction-led market of 2020-2021, with open interest in derivatives dropping to $45.1 billion from $48.7 billion and funding rates declining by 51% as excessive leverage is cleared out. This has redirected investment toward projects with tangible use cases and active communities, benefiting tokens like MoonBull and $BALZ.

Investors should thoroughly research before investing, as both projects involve significant risks. While $BALZ depends on social media buzz and CZ’s influence, MoonBull’s future relies on ongoing engagement with its staking and governance features.

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Bloodbath: BTC Price Plunges Below $100K as Whales Vanish and Traders Brace for More Selloff

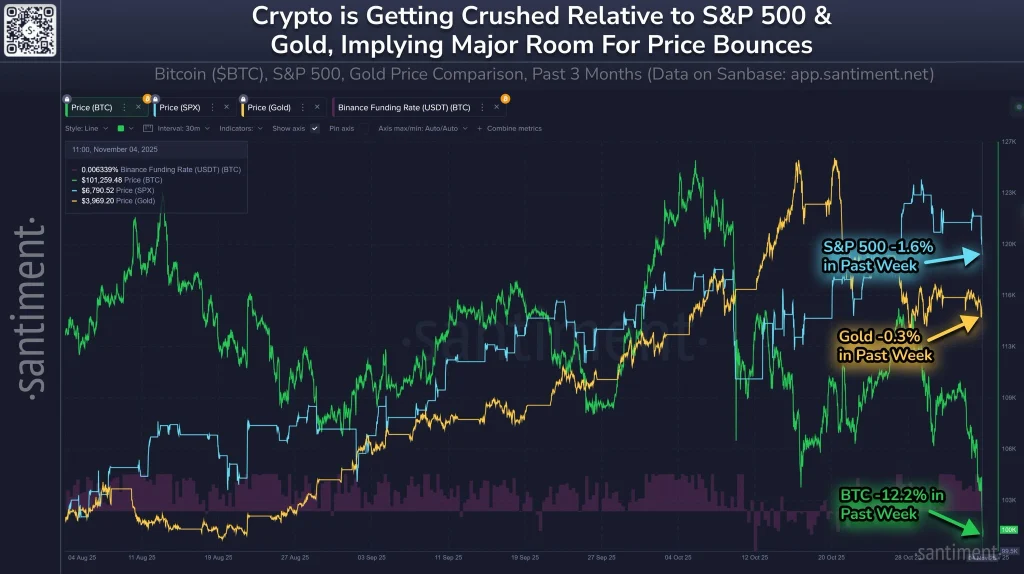

Crypto Get Crushed Relative to Gold and S&P 500, Santiment Predicts a ‘Rubber-Band’ Rebound

Ethereum News Update: Ethereum ETFs See $210M Outflows While Altcoins Gain $200M from Institutional Investors

- US Ethereum ETFs saw $210M in 5-day outflows, with BlackRock's ETHA leading $81.7M daily redemptions amid regulatory uncertainty and market shifts. - Bitcoin ETFs lost $543.59M over 3 days, while Solana's BSOL ETF attracted $197M in inflows, reflecting institutional appetite for high-performance altcoins. - Ethereum's price fell below $3,500 as ETF redemptions worsened bearish pressure, contrasting with new Solana/Hedera ETFs drawing $199M in four days. - Market analysts highlight maturing crypto dynamic