Hyperliquid Faces Its First Real Crash Test — Will the $HYPE Unlock Break the Rally?

Hyperliquid’s upcoming HYPE token unlock this November could spark short-term volatility but also reveal its long-term strength. As the leading on-chain perpetual DEX generates record revenue, investors are watching whether its fundamentals can outweigh dilution risks.

After establishing itself as a leading name in the on-chain perpetual DEX space, Hyperliquid (HYPE) is entering one of its biggest stress tests since launch.

This November, Hyperliquid will unlock a massive amount of HYPE tokens, raising a critical question: Will the release fuel liquidity and adoption or trigger a sharp price correction?

Supply–Demand Pressure and Short-Term Price Scenarios

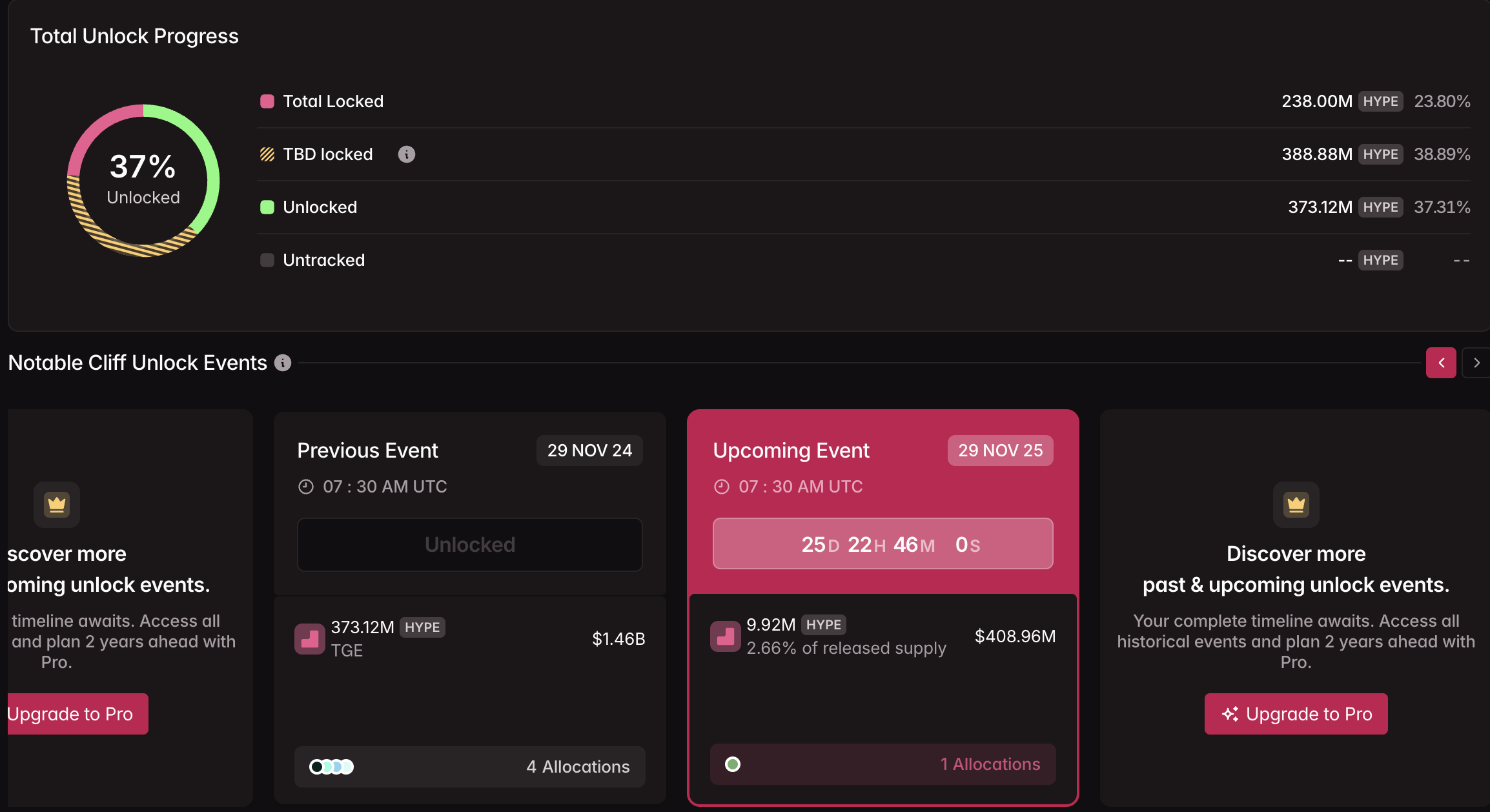

Tokenomist’s data shows that millions of Hyperliquid (HYPE) tokens will be unlocked in November, representing approximately 2.66% of the circulating supply. When a project releases many tokens at once, it inevitably faces the risks of dilution and sell pressure.

Hyperliquid token unlock in November. Source:

Tokenomist

Hyperliquid token unlock in November. Source:

Tokenomist

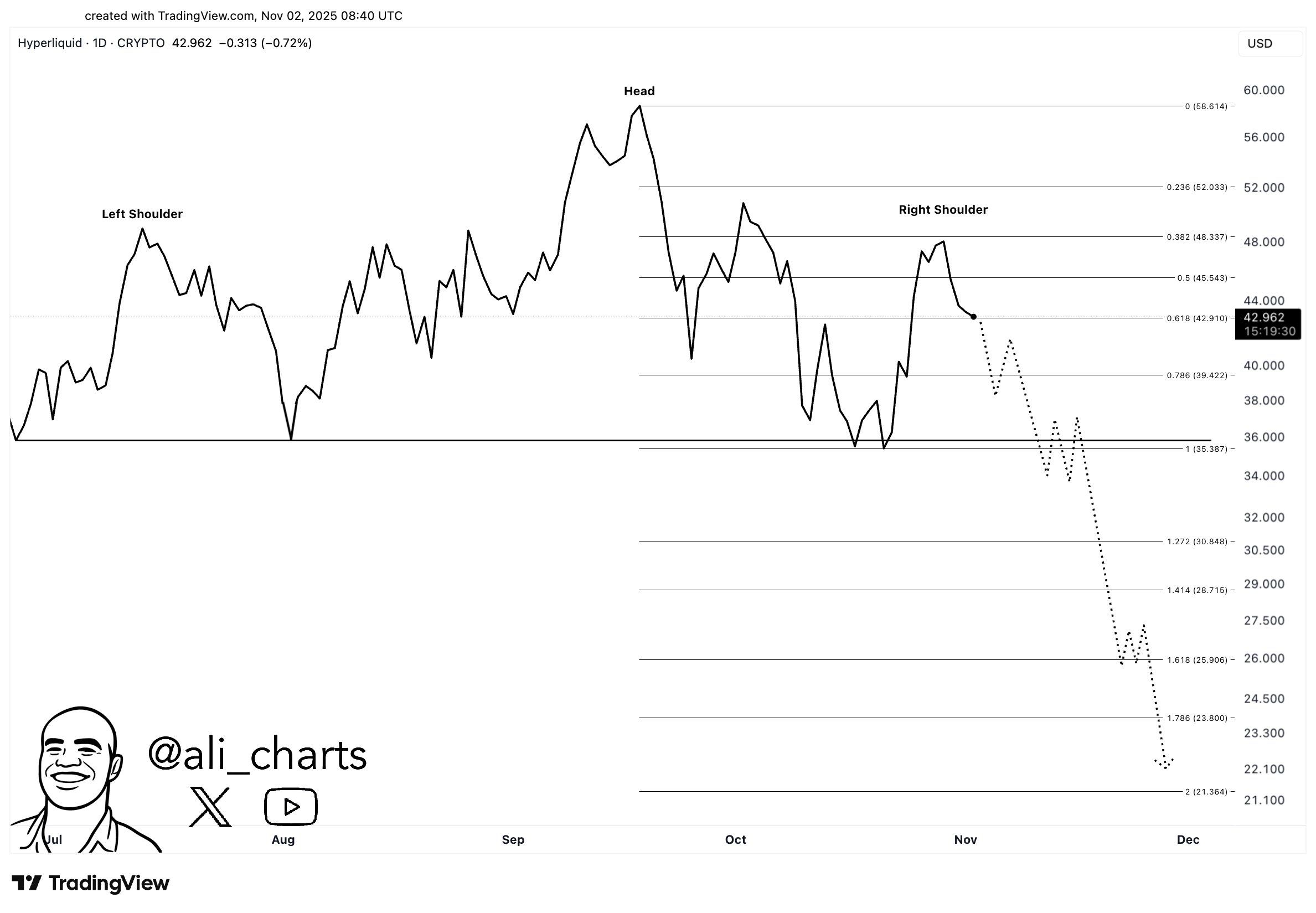

From a technical perspective, several analysts suggest that HYPE may be forming a head-and-shoulders pattern on the daily chart. This setup could project a potential decline toward $20, signaling a short-term correction phase if confirmed.

HYPE technical analysis. Source:

Ali

HYPE technical analysis. Source:

Ali

Meanwhile, another trader noted that recent price action indicates “some TWAP out, slow efficient selling,” suggesting controlled offloading by large holders. The trader added:

“Not sure what’s going on but going to just wait for more clarity.” he said.

On the other hand, some traders see opportunity in the volatility. According to Route2FI, “HYPE closing a 1-minute candle around $40 in November could turn into a temporary yield farm.”

The analyst referred to the potential opportunity to profit from short-term price fluctuations. However, this strategy is better suited for seasoned traders, as the HYPE unlock period may bring intense volatility.

Strong On-chain Revenue and Long-term Balance Sheet Factors

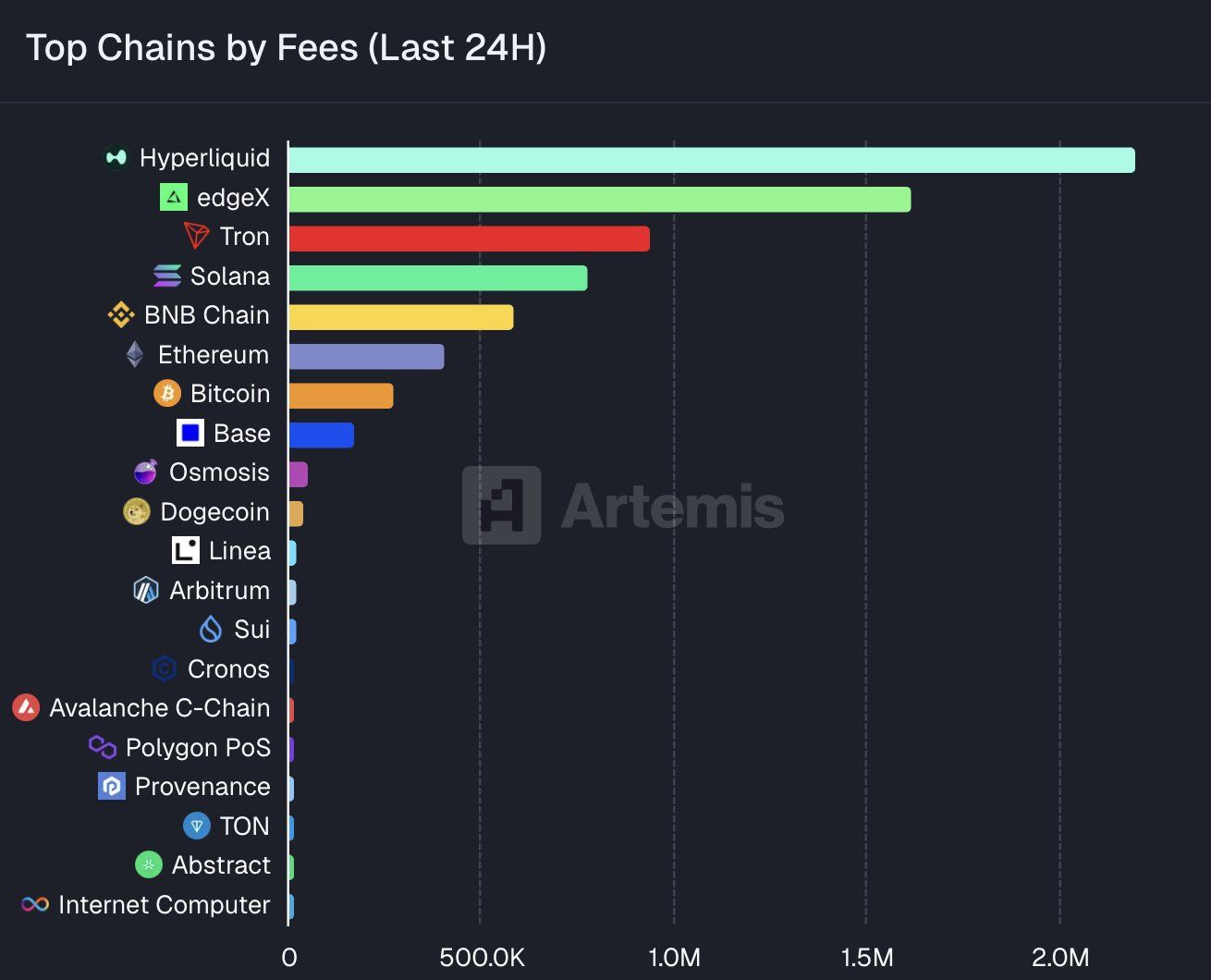

While short-term supply pressure seems unavoidable, Hyperliquid’s core strength lies in its on-chain revenue generation. Data from Artemis shared on X shows that in the past 24 hours, Hyperliquid has generated over $2.2 million in trading fees, surpassing all other blockchains.

Hyperliquid leads in on-chain fee revenue (24h). Source:

X

Hyperliquid leads in on-chain fee revenue (24h). Source:

X

Earlier this month, reports showed that Hyperliquid captured up to 33% of blockchain revenue. This made it the top fee earner in the crypto economy, effectively a “transaction fee goldmine” within DeFi. If the project uses some of these fees for token buybacks or burn mechanisms, it can partially absorb the selling pressure from the HYPE unlock and help stabilize the market.

In summary, the upcoming HYPE unlock this November will be a major test for the project and its investors. In the short term, dilution risks and market caution may weigh on price action. However, Hyperliquid’s substantial on-chain revenue could help offset the upcoming supply shock. This would depend on how effectively the revenue is used through buybacks, staking, or liquidity programs.

In the long run, HYPE’s value will depend on how well the team converts real revenue into tangible returns for holders, rather than relying on short-term hype surrounding the unlock. The November unlock won’t signal the end if Hyperliquid proves its model is sustainably profitable on-chain perpetual DEX. Instead, it could become a revaluation milestone for one of DeFi 2025’s most promising projects.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto: Balancer victim of a massive hack despite 11 security audits

Standard Chartered Chief Calls Cash Obsolete At Hong Kong Fintech Week

Changpeng Zhao’s $2M Aster Investment Boosts DeFi Market Confidence

Bitcoin ETFs Undergo $946 Million in Withdrawals