Zcash (ZEC) Price Targets $594 Next Amid Pullback Risks — Will Bulls Finally Yield?

Zcash (ZEC) keeps defying market weakness, climbing nearly 180% in a month while most coins fell. Still, rising leverage, a bearish RSI divergence, and growing liquidation risks hint that bulls may soon face their first real challenge — even as whale inflows keep fueling momentum toward $594.

Zcash (ZEC) continues to outperform a weak crypto market, rising over 17% in the past 24 hours and about 178% over the past month. While most altcoins are under pressure, the ZEC price has kept climbing after confirming a flag breakout on October 24. Since then, it has hit each target one by one, recently breaking above $438. The next big target now lies at $594, with an extended projection aimed higher.

Still, after such a sharp rise, signs are building that bulls may soon face their first real test.

Derivatives Data Shows Rising Risk of Long Liquidations

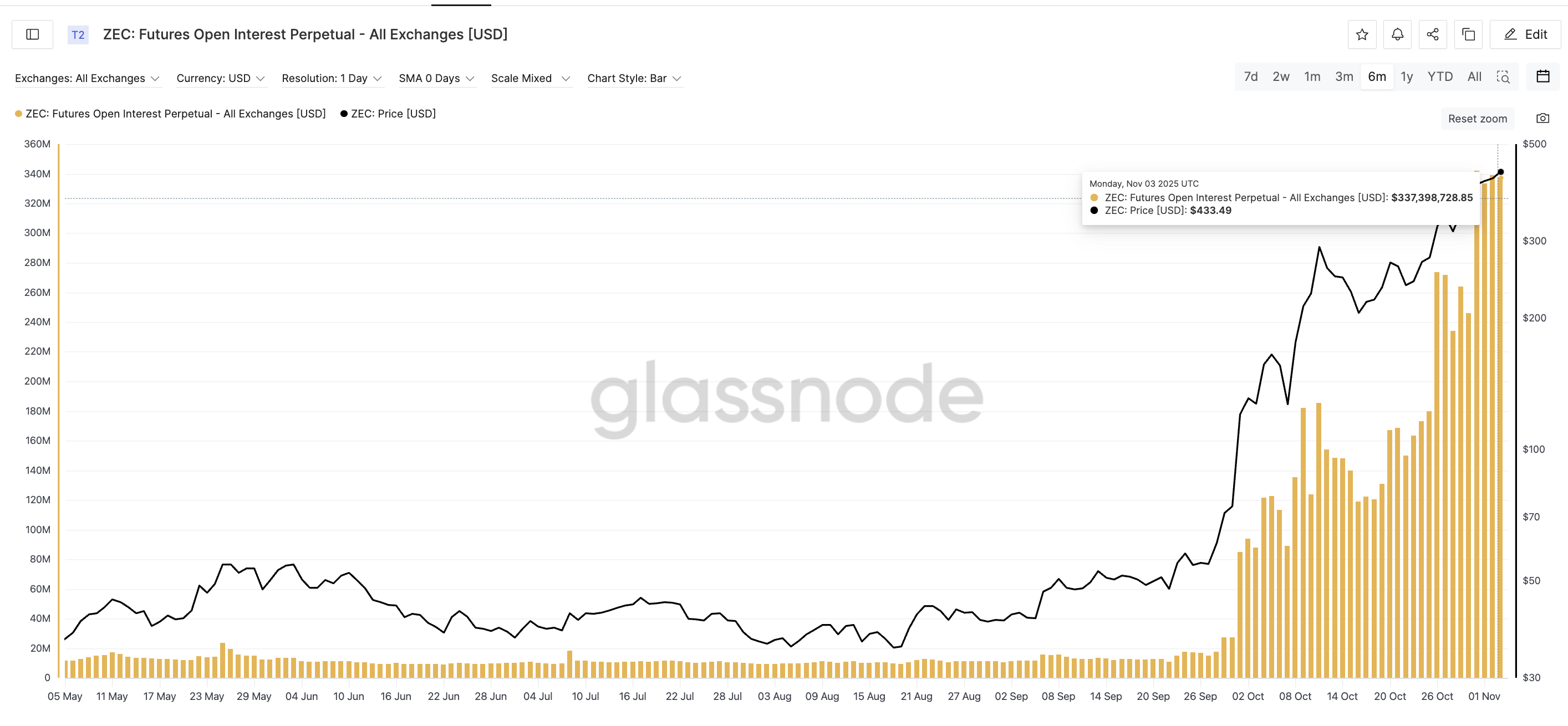

Open interest in Zcash futures — the total amount of open derivative contracts — has surged to a six-month high of $337 million, matching last October’s peak. This shows aggressive leverage building across exchanges, with traders mostly betting long.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Open Interest Builds Up:

Glassnode

Open Interest Builds Up:

Glassnode

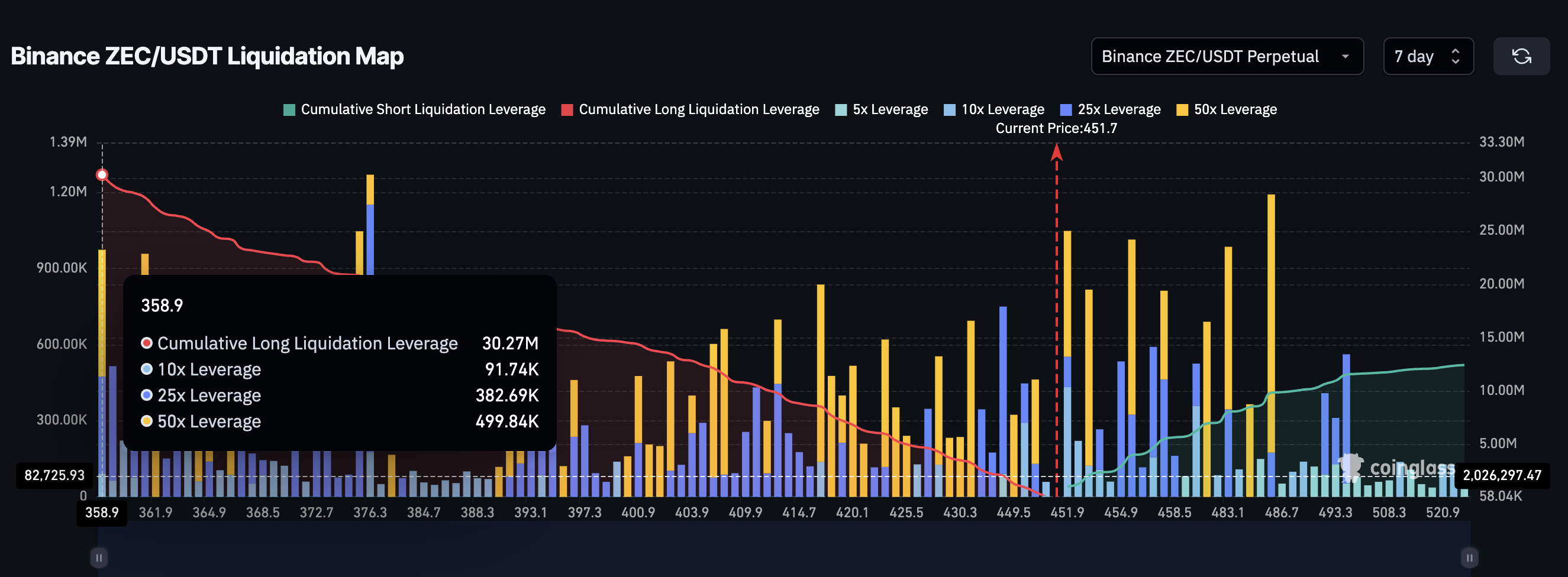

On Binance alone, long liquidations now total $30.27 million, nearly three times more than shorts at $12.43 million. That means most short positions have already been cleared out, leaving the market heavily tilted toward longs.

ZEC Liquidation Map (Binance):

Coinglass

ZEC Liquidation Map (Binance):

Coinglass

Such imbalances can make the rally fragile. Even a small drop can trigger long liquidations and cascade into a Zcash price pullback. If ZEC slips below $450, a short correction could start. A fall under $342, which aligns with a key Fibonacci level (explained later), would trigger all the long liquidations on the 7-day timeframe. That kind of long squeeze could finally hurt the ZEC price.

Bearish Divergence Warns That Bulls Could Finally Pause

Since October 11, ZEC’s price has made higher highs, but the Relative Strength Index (RSI) — which tracks momentum — has been forming lower highs. This is known as a bearish divergence, and it often signals that upward momentum is losing steam.

This divergence has persisted for a while now, even as prices have continued to climb. RSI would need to rise above 86 to cancel out this setup, but that level also marks overbought territory, where rallies often slow down as traders take profit.

Bearish Divergence Remains Active: T

TradingView

Bearish Divergence Remains Active: T

TradingView

When combined with ZEC’s overheated derivative positioning, this RSI setup suggests that the next pullback — even if brief — could finally make bulls yield, at least temporarily, before the next leg higher.

Money Flow and ZEC Price Action Still Back the Bulls

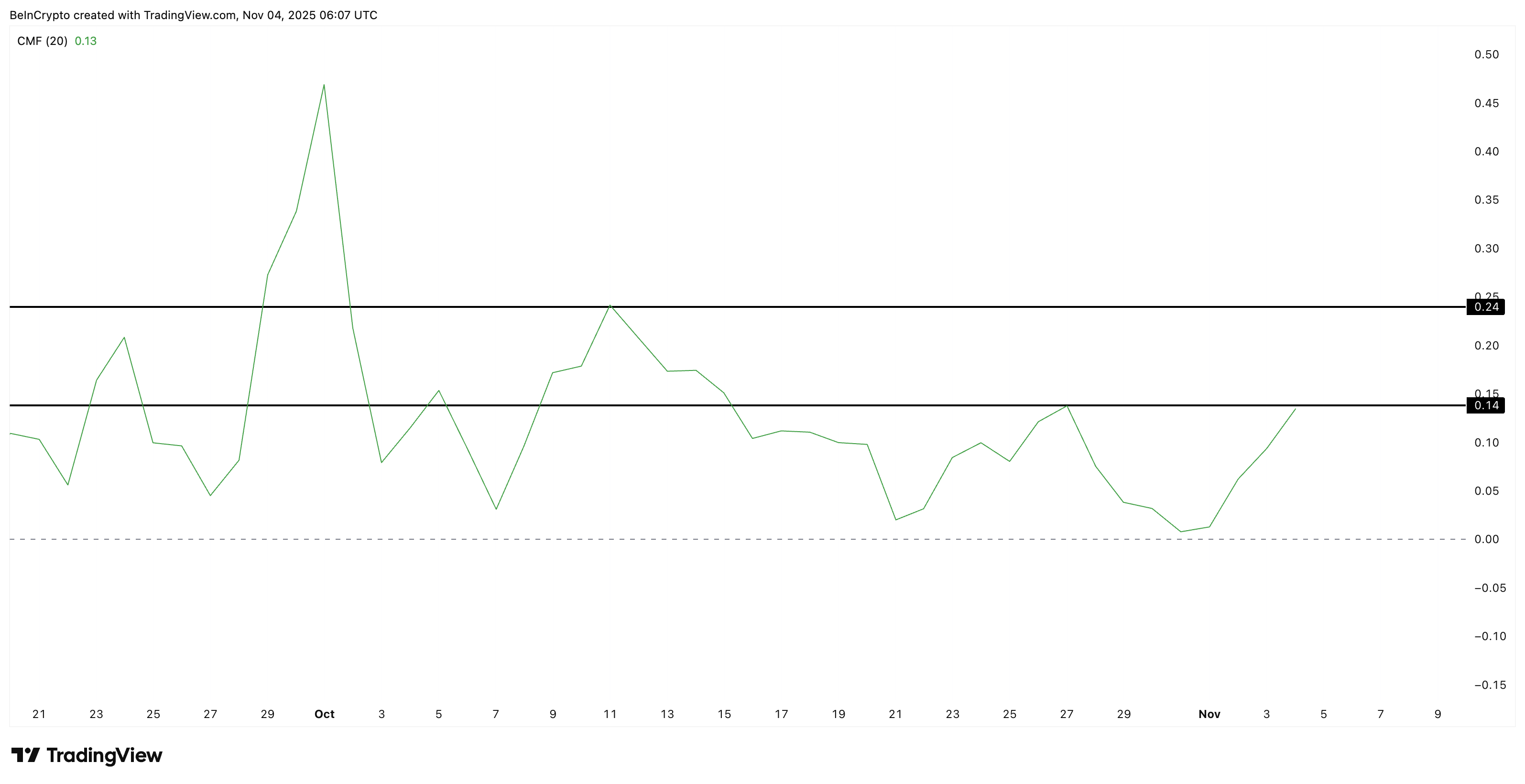

Despite these risks, large spot wallet inflows remain strong. Chaikin Money Flow (CMF) — which measures how much money is entering or leaving the token — stands at 0.13, confirming positive inflows. A move above 0.14 would show growing buyer dominance, and a break over 0.24 would likely mark aggressive whale accumulation.

Big Money Continues To Flow Into Zcash:

TradingView

Big Money Continues To Flow Into Zcash:

TradingView

That strong money flow continues to support Zcash’s bullish structure. The flag breakout from October 24 remains active, with momentum pointing toward $594 as the next major resistance. If buyers defend above $438, the ZEC price could test the $847 extension.

ZEC Price Analysis:

TradingView

ZEC Price Analysis:

TradingView

However, a close below $342 would break the bullish pattern and confirm that the long-anticipated pullback has begun. Until then, bulls remain firmly in control — but the pressure to hold those gains is now higher than ever.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Secret Script of the Crypto Market: How Whales Manipulate 90% of Traders, and How You Can Stop Being "Liquidity"

Polymarket, Kalshi Hit Record Volumes as Sports Betting Dominates Prediction Markets

One of Tesla's top ten shareholders challenges Musk's trillion-dollar compensation plan

Ahead of Tesla's annual shareholders meeting, Norway's sovereign wealth fund, with assets totaling 1.9 trillion, has publicly opposed Elon Musk's 100 million compensation package. Musk previously threatened to resign if the proposal was not approved.

Bitcoin falls to its lowest point since June, with the "after-effects" of October's flash crash still lingering!

Multiple negative factors are weighing on the market! Trading sentiment in the cryptocurrency market remains sluggish, and experts had previously warned of a potential 10%-15% correction risk.