Why is the current crypto market operating at a hell-level difficulty?

More than 90% of crypto assets are essentially driven by speculation. However, pure speculation is not a perpetual motion machine; when market participants lose interest or are unable to continue profiting, speculative demand will diminish.

More than 90% of crypto assets are essentially driven by speculation, but pure speculation is not a perpetual motion machine. When market participants lose interest or can no longer make continuous profits, speculative demand will fade.

Written by: @0xkyle

Translated by: AididiaoJP, Foresight News

As a trader, the core goal is always to look for high-conviction investment opportunities with asymmetric return potential. I am passionate about discovering such high risk-reward trades, such as Solana at $20, Node Monkes at 0.1 BTC (which later rose to 0.9 BTC), Zerebro with a market cap of $20 million, and so on.

However, such asymmetric opportunities are becoming increasingly rare. There are many reasons for this, which together form a huge and thorny problem.

Take this chart as an example. It shows Zerebro, which soared from a $20 million market cap to a peak of $700 million, delivering a 30x return; but it also fell 99% from its high, almost returning to its original starting point.

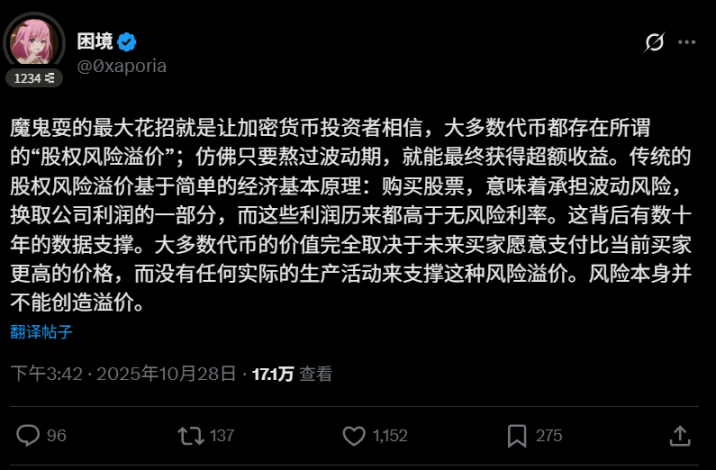

This leads to the first problem: it is well known that most tokens in this industry "eventually need to be sold." This creates a vicious cycle that hinders the creation of long-term appreciating assets. More than 90% of crypto assets are essentially driven by speculation, but pure speculation is not a perpetual motion machine. When market participants lose interest or can no longer make continuous profits, speculative demand will fade. User @0xaporia's tweet hits the nail on the head:

The second problem is the structural flaws of the crypto market. The "wick" event on October 10 fully exposed this: major exchanges caused massive losses for users, with over $40 billion in open interest wiped out in an instant, teaching all participants a fundamental financial lesson: if something can go wrong, it will. This kind of risk keeps institutions and large funds away—if there is a risk of going to zero, why take the risk?

The third and fourth problems have existed for a long time: first, the daily flood of newly issued tokens; second, the excessively high initial valuations of these tokens. Every new project dilutes the overall market liquidity, and high-valuation launches squeeze the profit space for public market investors. Of course, you can choose to short, but if the entire industry relies on shorting to make profits, it is definitely not a good thing in the long run.

There are other issues not mentioned here, but the above are the most noteworthy. Returning to the theme of this article: why is it so hard to find asymmetric opportunities in the current crypto market?

- High-quality projects are launched at excessive valuations, with prices fully or even overly reflecting expectations

- The flood of token issuances dilutes value; today a perfect L1 appears, tomorrow there’s another, making people doubt if any are truly as advertised

- The industry iterates too quickly, making it hard to build long-term investment conviction; leading projects may lose their edge within a year

- Market structure issues hinder capital inflow; investors demand higher returns to compensate for the risk of going to zero, and if actual returns fall short, the investment logic collapses

The most fatal issue is that most tokens are essentially just fundraising tools, with tokens sold to raise funds for operations, while the real value is concentrated in the equity. These tokens, lacking value accrual and company rights, are essentially just speculative musical chairs, not real investments.

None of these are new points. Why am I repeating them? Because although everyone knows, no one changes their investment approach. People still chase new narratives and new hot spots, repeating ineffective strategies. This is the definition of insanity: doing the same thing over and over and expecting different results.

I am always searching for the next asymmetric opportunity. If you play by the rules, you can only get mediocre returns. I believe the next asymmetric opportunity in crypto lies in:

- Mining yields

- Equity investment in blockchain companies

- Exchange platform tokens

- Finding severely undervalued assets—these do exist, but are extremely rare

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Staking Weekly Report November 4, 2025

1️⃣ Ebunker ETH staking yield: 3.32% 2️⃣ stETH (Lido) 7-day average annualized yield...

XRP price flashes classic ‘hidden bullish divergence.’ Is $5 still in play?

Bitcoin falls under $101K: Analysts say BTC is ‘underpriced’ based on fundamentals

The Secret Script of the Crypto Market: How Whales Manipulate 90% of Traders, and How You Can Stop Being "Liquidity"