Bayes Market undergoes a comprehensive upgrade

Integration of points section, order book architecture, and brand new UI, with a full commitment to building the next-generation professional prediction market.

In 2025, decentralized prediction markets are entering a new stage.

Bayes Market announced today that it is about to complete a comprehensive platform upgrade and will relaunch soon. This revamp is not only a technical iteration but also a systematic reshaping of its future strategic direction, aiming to provide users with a more professional prediction trading environment and more valuable market data.

Points System Removal: Value Returns to Real Assets

As a key measure in this upgrade, Bayes Market will officially take down the Points section and convert all existing points into USDC trading rewards for users at a ratio of 100:1.

This move signifies a comprehensive simplification and realignment of the platform's value system. Users no longer need to switch between multiple asset zones and can participate directly in trading within a unified USDC market, where all profits and risks return to measurable real assets.

Strategic Focus: Probability Pricing of Industry Marginal Effects

Unlike traditional prediction markets that focus on single hot events, the new version of Bayes Market will concentrate on the marginal effects of individual events on key industry turning points.

This strategic transformation means the platform is not only a trading venue for event probabilities but also a systematic risk pricing platform:

- By breaking down key variables such as macro policies, on-chain protocol developments, and capital flows,

- transforming “information advantage” into quantifiable probability data,

- providing real-time industry foresight signals for professional traders, research institutions, and institutional investors.

This positioning makes Bayes Market not just a trading platform, but also the pricing infrastructure for industry cognition.

Order Book Matching Mechanism: A Technical Choice for Professional Liquidity

The upgraded Bayes Market will adopt an order book matching mechanism to replace the traditional AMM pool model.

Compared to automated market makers (AMM), the order book offers:

- More accurate price discovery: Market prices directly reflect the real bids and asks of buyers and sellers,

- Lower spreads and more flexible strategy space: Providing strategic arbitrage opportunities for market makers and high-frequency traders,

- Higher capital utilization: Improving capital efficiency while ensuring depth.

The introduction of this architecture marks Bayes Market's official move towards becoming a professional trading platform on the technical level.

Looking Ahead

The core mission of Bayes Market is to make “price = probability” the universal language of the market.

From the removal of points and asset unification, to a brand new UI experience, and the introduction of the order book matching mechanism, Bayes is building a more authentic, efficient, and scalable prediction market infrastructure.

The new Bayes Market is not only a place for users to trade future probabilities, but also an important tool for researching industry trends and capturing market turning points.

The brand new version will be launched soon,

Bayes Market sincerely invites users worldwide to participate and witness how probability becomes an asset and how the future is priced.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

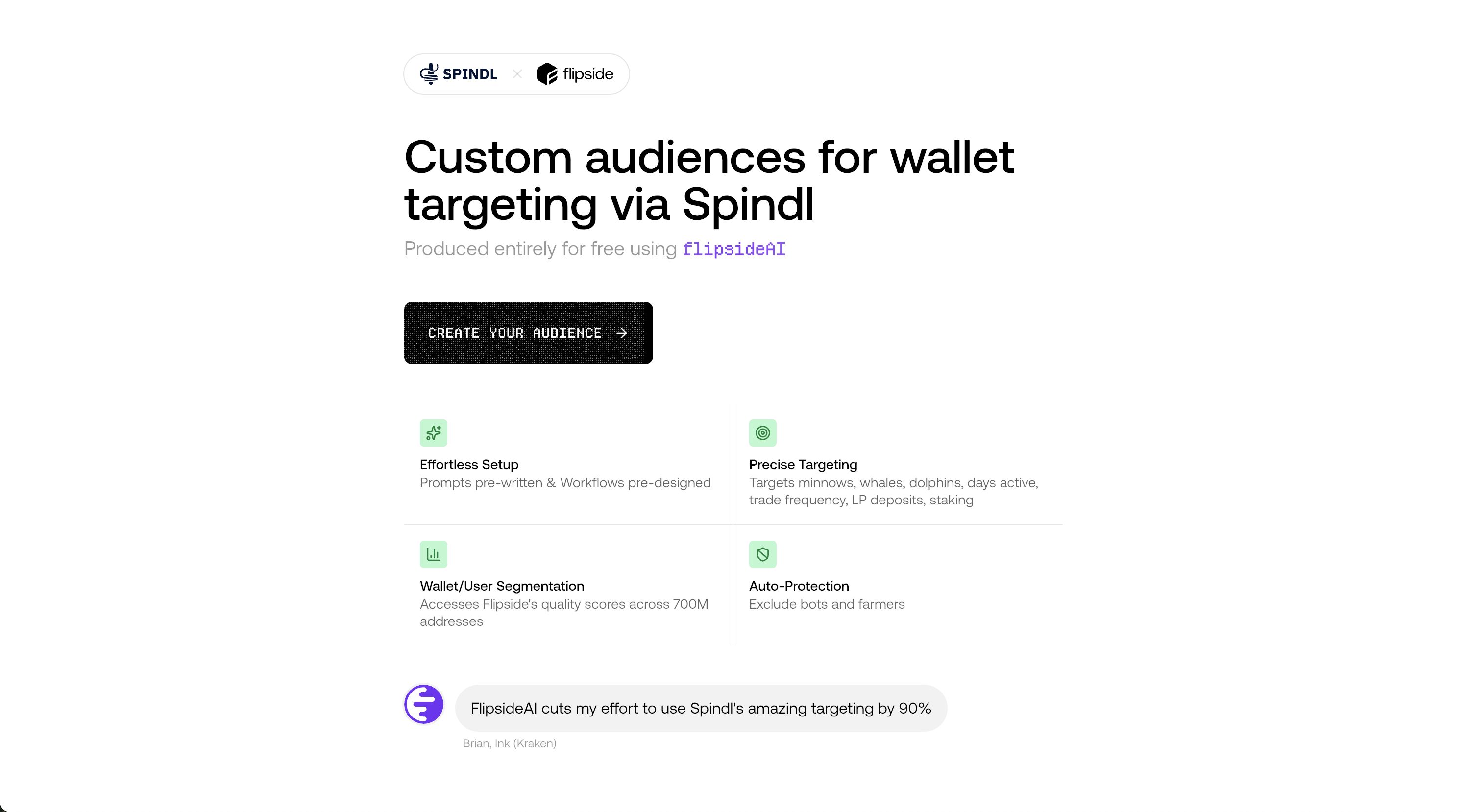

Wallet Targeting Agent for Spindl: Activate High-Value Users With Ease

The market faces a significant correction— is this the midpoint or the end of the cycle?

There are differing interpretations regarding the reasons for this pullback, but it is certain that the market is currently in a crucial waiting period, including the reopening of the U.S. government and a potential policy shift by the Federal Reserve. It is also undeniable that bitcoin’s fundamentals are stronger than ever before.

Giants step back, ETF cools down: What is the real reason behind bitcoin's recent decline?

With structural support weakening, market volatility is expected to increase.

Is the fact that Strategy is no longer "aggressively buying" the reason for bitcoin's recent decline?

Spot Bitcoin ETFs, which have long been regarded as "automatic absorbers of new supply," are also showing similar signs of weakness.