Upexi's SOL holdings have increased to over 2.1 million, with an unrealized profit of approximately $15 million.

According to ChainCatcher, Nasdaq-listed Solana treasury management company Upexi (ticker: UPXI) disclosed that as of today, its SOL holdings have increased by 4.4% compared to September 10, reaching 2,106,989 SOL, with an additional approximately 88,750 SOL acquired. Based on the end-of-month price of $188.56, the total value of its holdings is about $397 million, achieving an unrealized gain of approximately $72 million compared to the purchase cost of $325 million. However, due to the broad decline in the crypto market this Monday, the price of SOL dropped by about 15% to $160.94, corresponding to a holding value of about $340 million, with the book profit shrinking to around $15 million.

Upexi CEO Allan Marshall stated that despite the bearish market sentiment, the company remains committed to creating long-term value for shareholders. Nearly all of Upexi's SOL is staked, with an annualized yield of about 7%–8%, generating approximately $75,000 in daily income. About 42% of the holdings are locked SOL purchased at a double-digit discount to the spot price, providing "endogenous returns" for shareholders.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

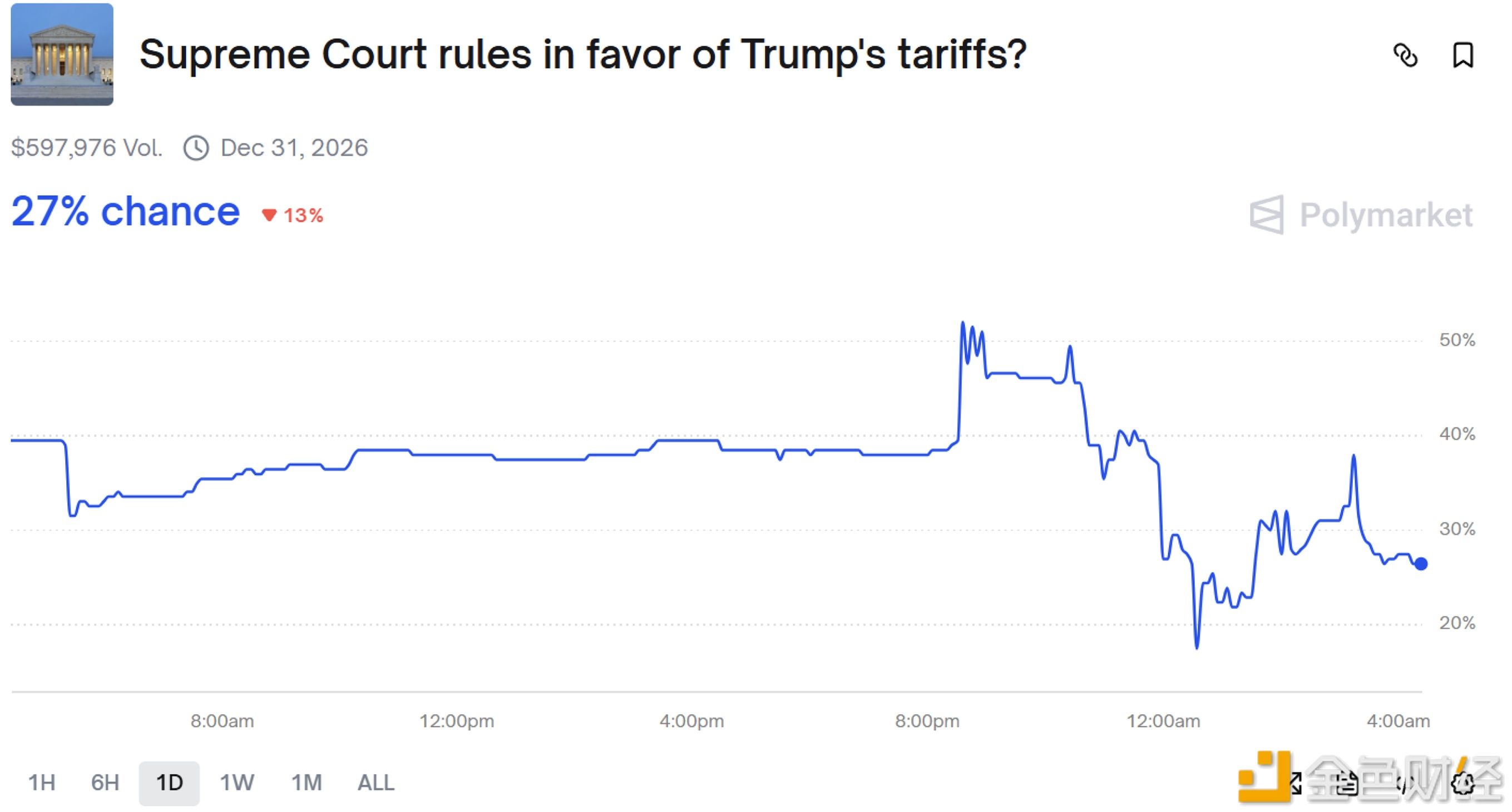

US Treasury Secretary Optimistic About Supreme Court Tariff Case

The US Dollar Index edged down to 100.204, with significant fluctuations in major currency exchange rates.