Key Notes

- The workflow automates order taking, execution, settlement, and data synchronization across blockchain systems.

- The uMINT fund operates on Ethereum distributed ledger technology as part of the UBS Tokenize initiative.

- UBS manages $6.9 trillion in assets and previously tested blockchain through Singapore's Project Guardian.

UBS announced on Nov. 4 the completion of the world’s first live, in-production tokenized fund transaction. The Swiss banking giant executed an end-to-end workflow involving subscription and redemption requests for a tokenized money market fund. The transaction marks a milestone in the institutional adoption of blockchain-based financial products.

The transaction processed orders for the UBS USD Money Market Investment Fund Token, known as uMINT, which operates on the Ethereum ETH $3 568 24h volatility: 1.4% Market cap: $431.16 B Vol. 24h: $52.82 B distributed ledger, according to UBS.

DigiFT served as the on-chain fund distributor for the transaction. The workflow utilized the Chainlink Digital Transfer Agent technical standard to handle the fund operations. The company processed both subscription and redemption requests through the automated system.

Technical Framework

The Chainlink LINK $15.36 24h volatility: 0.6% Market cap: $10.71 B Vol. 24h: $1.48 B DTA standard integrates several technologies, including:

- Chainlink Runtime Environment,

- Cross-Chain Interoperability Protocol,

- Automated Compliance Engine,

- NAVLink.

These components enable Chainlink’s oracle network to automate fund lifecycle operations, including order processing, execution, settlement, and data synchronization between on-chain and off-chain systems.

The standard supports three settlement models: Offchain, Local Onchain, and Cross-chain Onchain. The Chainlink CCIP integration has been deployed across multiple blockchain applications in 2025.

Building on Previous Work

UBS developed this capability through its UBS Tokenize service, which also focuses on tokenizing bonds and structured products. The bank manages $6.9 trillion in invested assets as of the third quarter of 2025. UBS operates as the leading universal bank in Switzerland and a principal global wealth manager.

The current transaction builds on work UBS conducted with Chainlink under the Monetary Authority of Singapore’s Project Guardian initiative. Earlier in 2025, UBS tested on zkSync for its Key4 Gold service proof-of-concept.

The transaction represents UBS’s first live deployment of tokenized fund operations on a public blockchain. DigiFT processed the subscription and redemption orders using the DTA standard’s automated compliance and settlement features. The system handled order taking, execution, and final settlement without manual intervention.

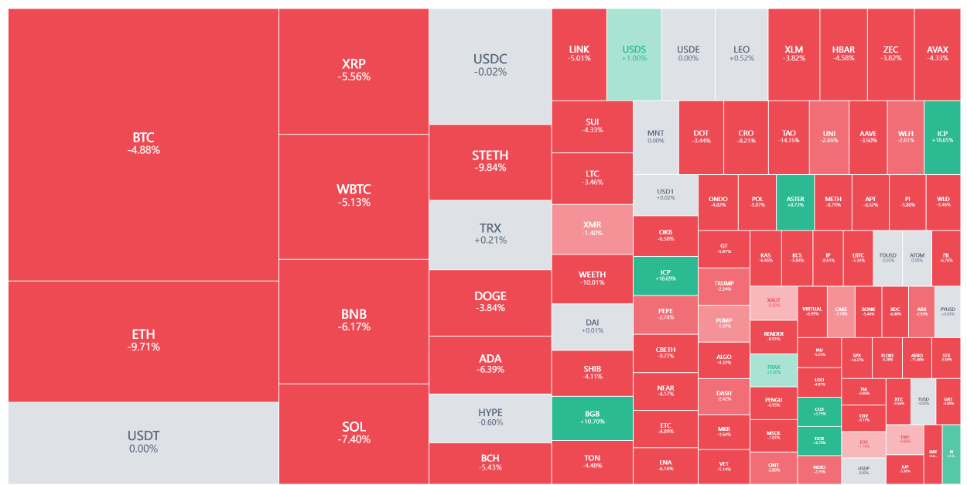

The Chainlink (LINK) price has experienced volatility in recent months despite growing institutional adoption of its infrastructure.