After a16z estimated the market potential behind the x402 protocol at $30 trillion, this protocol, once only noticed by a handful of tech pioneers, is rapidly moving into the mainstream spotlight. While many are still asking “What is x402?”, the more important question is: If this market becomes a reality, how will value be distributed? Which participants will become the ultimate winners?

This article takes a practical approach to deeply analyze the value accrual path, ecosystem structure, and challenges faced by the x402 protocol, attempting to outline a new vision for the future of the API economy and payment networks.

I. Core Positioning of x402: From API Calls to Payment Transactions

The essence of the x402 protocol is to enable every HTTP API call to carry a payment action. In other words, any interaction that occurs on the internet—a button click, a data request, a service invocation—can be transformed into a micropayment transaction.

● From a technical perspective, x402 is not a breakthrough technological innovation. It is built on existing blockchain transaction infrastructure, inheriting all the features of blockchain transactions, including gas fees and wallet verification. However, as a payment standard, the true power of x402 lies in its compatibility with the widely used HTTPS protocol, allowing it to seamlessly integrate with existing internet infrastructure and endow the entire network with native payment capabilities.

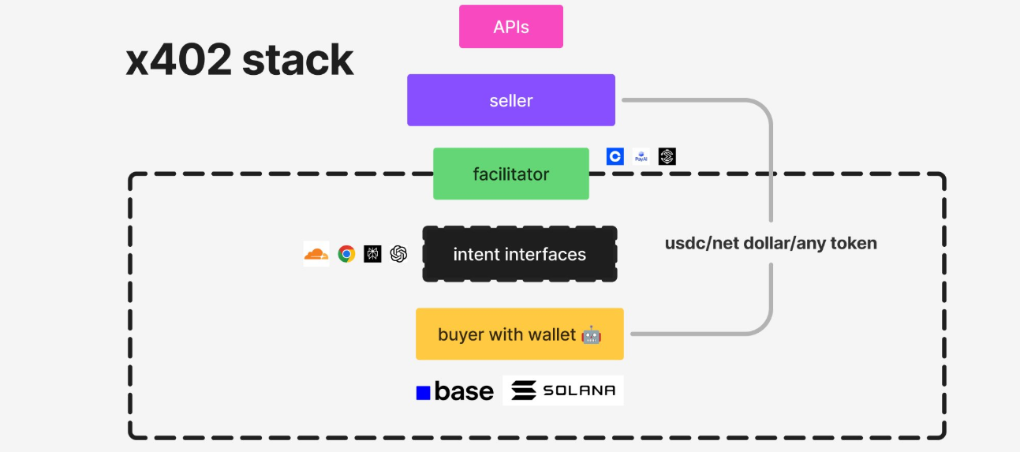

II. The Four Sides of the Ecosystem: Value Distribution and Game Dynamics

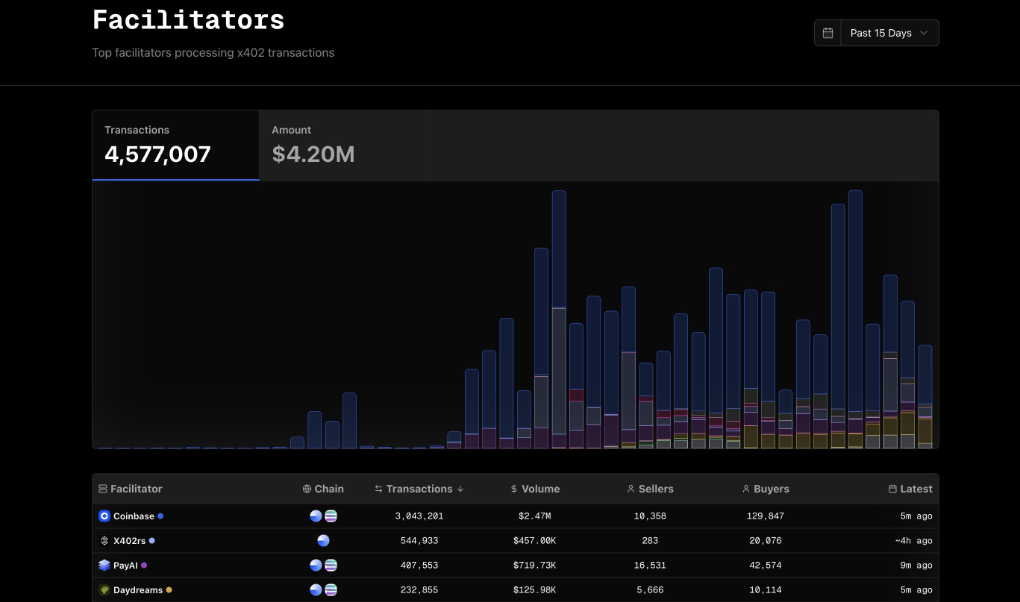

Like all payment systems, there are four key stakeholders in the x402 ecosystem: suppliers (sellers), demand side (buyers), intermediaries, and underlying chains and tokens. Each plays a unique role in this value network.

1. Suppliers (Sellers): Unlocking New Revenue Dimensions

Suppliers are mainly divided into two categories:

● First-party/Second-party sellers: Projects like Switchboard that directly sell their own priced data. For them, supporting x402 means opening up entirely new markets. For example, The New York Times could require web crawlers to pay for content access via the x402 protocol, creating a new revenue stream; if Airbnb integrates x402, AI agents like Perplexity AI could pay booking fees directly in USDC and automatically distribute commissions within the same transaction.

● Third-party sellers/API marketplaces: These participants aggregate multiple APIs to provide users with a unified payment gateway. Their business model is essentially arbitrage—they may access APIs for a fixed fee (e.g., $20 per month) and then charge users per call (e.g., $0.0001). In the early stages of ecosystem development, such intermediaries (like Corbits) are crucial for solving the cold start problem.

For suppliers, the immediate opportunity lies in upgrading existing APIs or websites to support x402, gaining additional revenue and traffic from network effects.

2. Demand Side (Buyers): The AI Agent-Driven Future

The demand side mainly consists of API consumers, especially the rapidly growing “AI agent” economy. Any user with a crypto wallet or an autonomous AI agent can pay API fees via x402.

However, bootstrapping the demand side is the trickiest challenge for the entire ecosystem. Currently, real demand is almost zero, and most transactions are still test cases. Two possible paths to stimulate demand are:

● Exclusive content: Sellers provide high-value data only through x402 (e.g., news sites only allow paid crawling)

● Network effects: Accumulate enough APIs supporting x402 to attract developers and agents

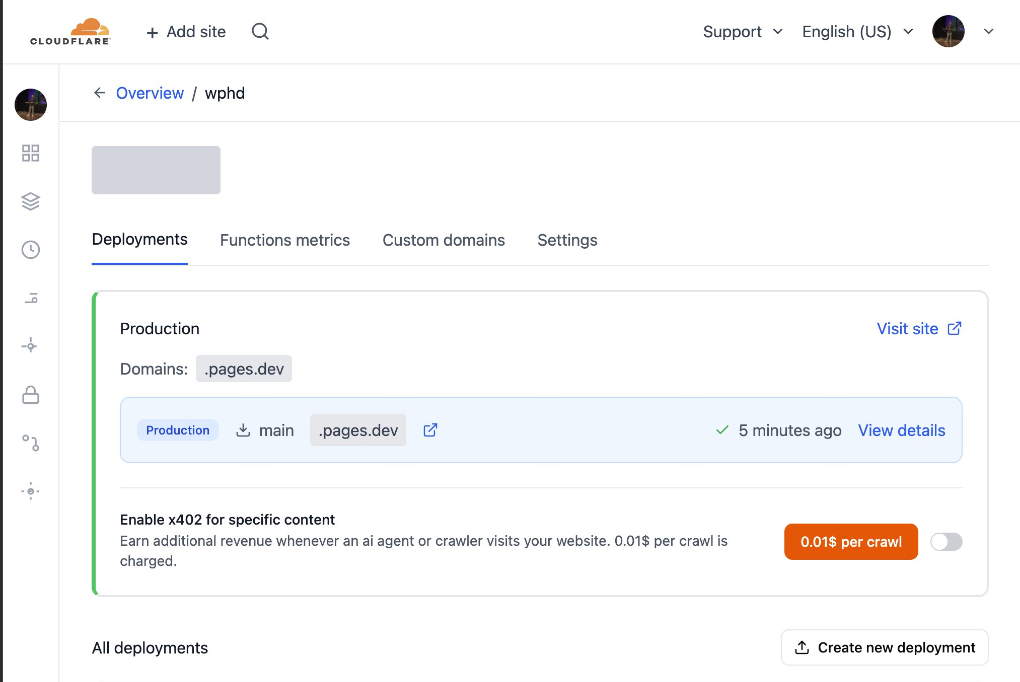

It is worth noting that Cloudflare, as a member of the x402 Foundation and the world’s largest edge network service provider, could become a key driver. Its global network nodes and core position in traffic distribution allow it to enable x402 payments for specific content with a simple “switch,” creating new revenue streams for developers.

3. Intermediaries: The Inevitable Price War

Intermediaries in the x402 ecosystem play a role similar to Visa and Mastercard, routing payments between buyers and sellers. Currently, they typically charge 0-25 basis points (most are temporarily free), but this is destined to become a fierce price war because the technical barrier to building intermediaries is extremely low.

● Unlike the deep moat of Visa/Mastercard, x402 intermediaries have almost no sustainable competitive advantage.

● The real network effects accumulate at the underlying blockchain layer, and giants like Cloudflare or Google, who control user interfaces, can easily launch their own intermediary solutions in a short time. More notably, ecosystem promoters like Coinbase may even open source and provide intermediary services for free to promote the entire ecosystem, further squeezing profit margins.

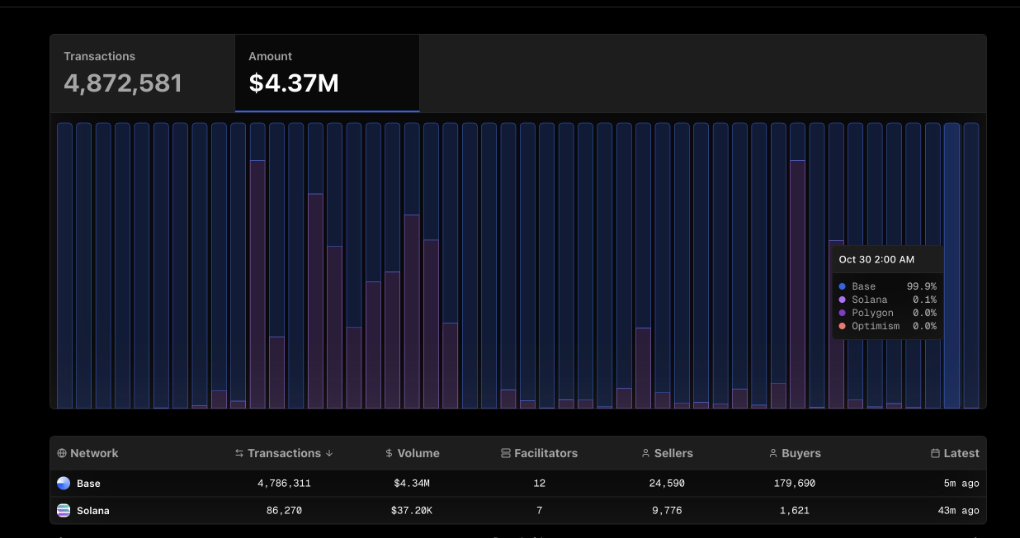

4. Public Chains and Tokens: The Ultimate Winners in Value Capture

As a key project of Coinbase, the Base chain and USDC stablecoin naturally occupy a dominant position in the x402 ecosystem. However, other public chains like Solana (which has already held x402 hackathons) are also actively deploying. All stablecoins and public chains will compete for dominance over x402, as this directly relates to the growth of on-chain TVL (Total Value Locked) and transaction volume.

● From a value capture perspective, public chains, tokens, and wallets are likely to become the biggest winners in the x402 ecosystem.

● It is no coincidence that Coinbase and its CEO Brian Armstrong are vigorously promoting x402—the company controls the complete tech stack: intermediary (CDP), public chain (Base), stablecoin (USDC), and wallet (Base app and Coinbase embedded wallet). This end-to-end control allows it to provide complete solutions to enterprise clients (such as Cloudflare, Vercel) while keeping the core protocol open source.

III. Challenges and Bottlenecks: Technical Limitations and Competitive Landscape

1. Technical Reality: Wallets and Gas Fees Have Not Disappeared

A common misconception is that x402 allows payments without a wallet. In reality, x402 is not magic—it still requires wallets and blockchain transactions (including gas fees), but these complexities are abstracted away or batch-processed off-chain via API credits.

2. Economic Feasibility: The Real Dilemma of Micropayments

On public chains like Solana or Base, large-scale micropayments are currently not economical. Due to the existence of base fees plus priority fees, any payment below $0.1 may not be cost-effective, as payment transactions must compete for block space with speculative trades (such as Memecoin swaps). Solutions like Tempo, which design dedicated channels for payment transactions, may better meet practical needs.

It is foreseeable that as x402 becomes more popular, sidechains, appchains, or rollup solutions dedicated to handling x402 payments will emerge.

3. Competition from Giants: The Shadow of Stripe

The most direct competition x402 faces comes from Stripe. This payment giant has already launched its own Agent Commerce Protocol (ACP), processing payments over the existing card network via shared payment tokens. When the largest consumer AI application, ChatGPT, announced business functionality through Stripe, it clearly signaled that traditional payment giants will not sit idly by as the market is encroached upon.

IV. Future Outlook: Beyond Fixed Pricing, Toward Resource Markets

Currently, x402 mainly handles fixed pricing scenarios (such as “$0.001 per API call”), but this falls far short of realizing the true potential of blockchain: creating markets for everything.

The unique value of x402 may lie in enabling “resource markets.” These resources could be:

● Data or computation results (such as price information, news content)

● Computing power or inference capability

● Complex workflows (such as custom product manufacturing)

● Priority services (such as time slot or bandwidth reservation)

Imagine a future where you tell an AI agent, “Customize a chair for me for $500 according to these specifications.” The agent autonomously coordinates multiple resources—procures wood, hires carpenters, arranges delivery—all fully automated, completely solving the resource coordination problem.

Thanks to the development of large language models and AI agents, for the first time we have machines capable of reasoning and negotiating across the entire supply chain. This will drive hyper-financialization, with market dynamics forming and every resource and action priced in real time, while AI agents trade and pay seamlessly in the background.

Although x402 itself does not support dynamic pricing, blockchains like Solana can support permissionless market creation mechanisms. Imagine every Airbnb host having a dynamic pricing market, where room rates are no longer set by the host but are entirely determined by market demand—this is the future x402 could lead us toward.

V. Sober Perspective: Short-term Hype vs. Long-term Value

Despite the broad prospects, it is necessary to view the current stage of x402 development with sobriety. The protocol is undoubtedly overhyped, and if you are considering investing in x402-related tokens, 99% are likely to be worthless.

● However, in the long run, there is reason to remain extremely optimistic: x402 is expected to become the foundational technology for the agent-based internet and deeply integrated into the crypto network structure. It is reminiscent of previous Solana Blinks (which allowed every click to become a Solana transaction request), but this time, it is being fully promoted by a giant like Coinbase. If successful, x402 will forever change the way payments work on the internet.