Author: Omer Goldberg

Translation: TechFlow

Summary

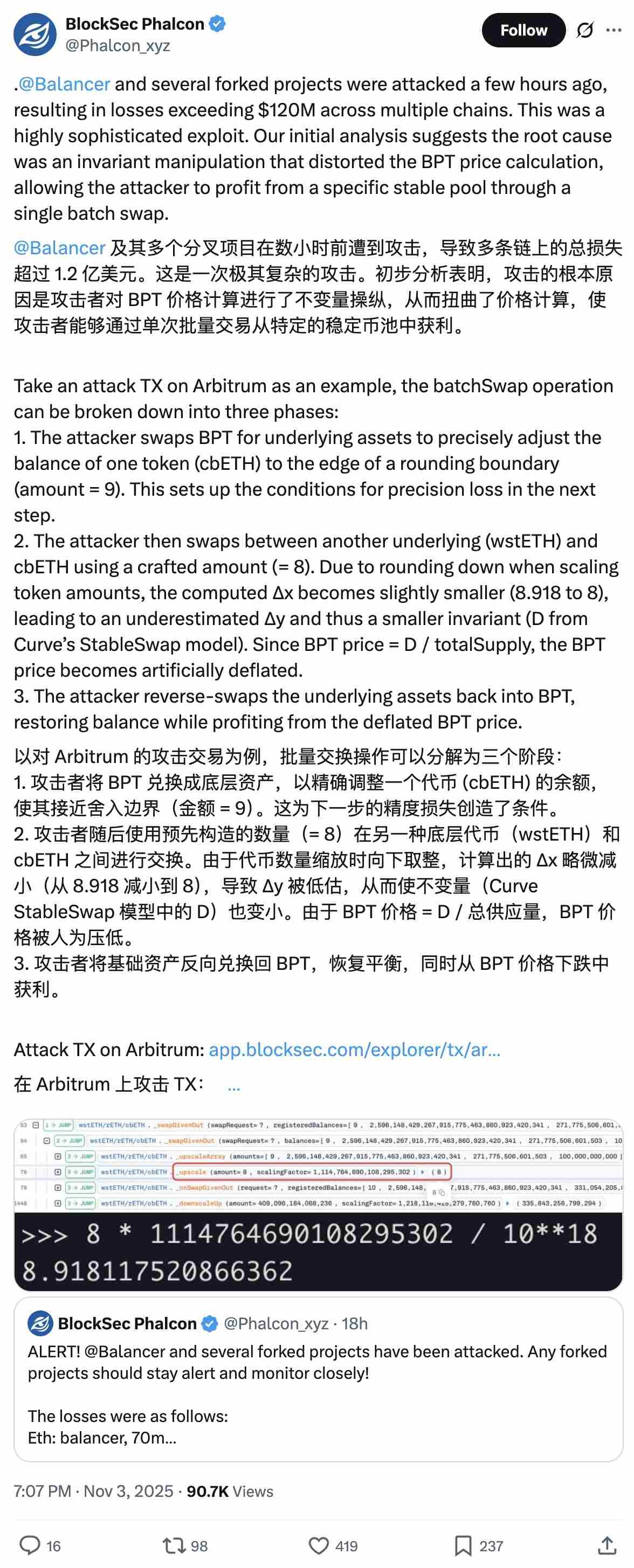

Just hours after the multi-chain platform @Balancer suffered a vulnerability attack that triggered widespread uncertainty in the DeFi sector, @berachain urgently executed a hard fork, and @SonicLabs froze the attacker's wallet.

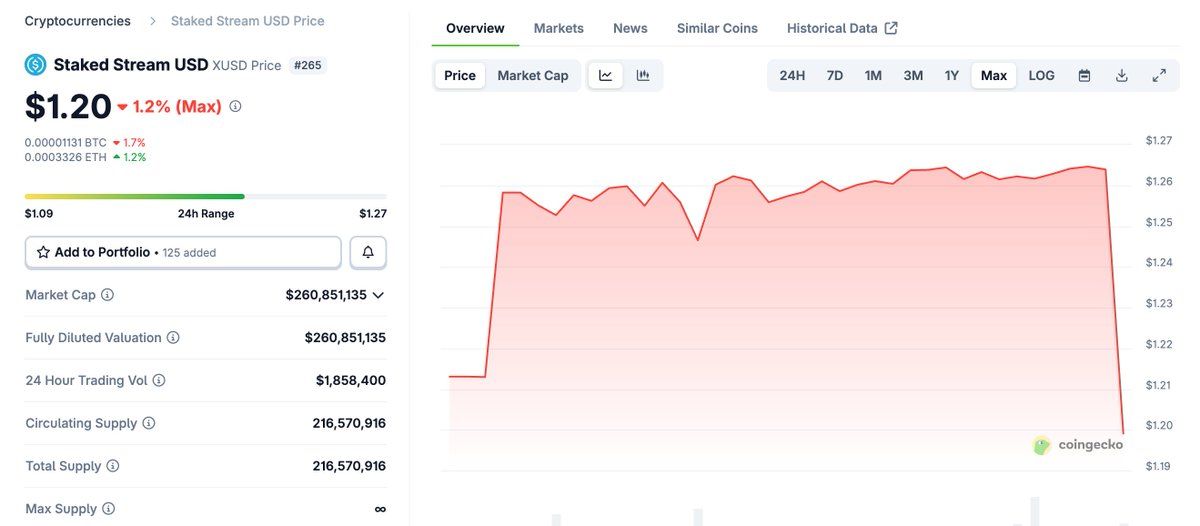

Subsequently, the price of Stream Finance's xUSD stablecoin deviated significantly from its target range, exhibiting a clear depegging phenomenon.

Long-standing Issues Resurface

Long-standing controversies surrounding leverage operations, oracle construction, and Proof of Reserve (PoR) transparency have once again become the focus of attention.

This is a typical case of a "reflexive stress event," as outlined in our article "DeFi's Black Box/Vault" last Friday.

What Happened? / Background

The Balancer v2 vulnerability broke out across multiple chains, and for a considerable period, it was unclear which pools were affected or which networks or integrated protocols were directly exposed to risk.

Capital Panic in an Information Vacuum

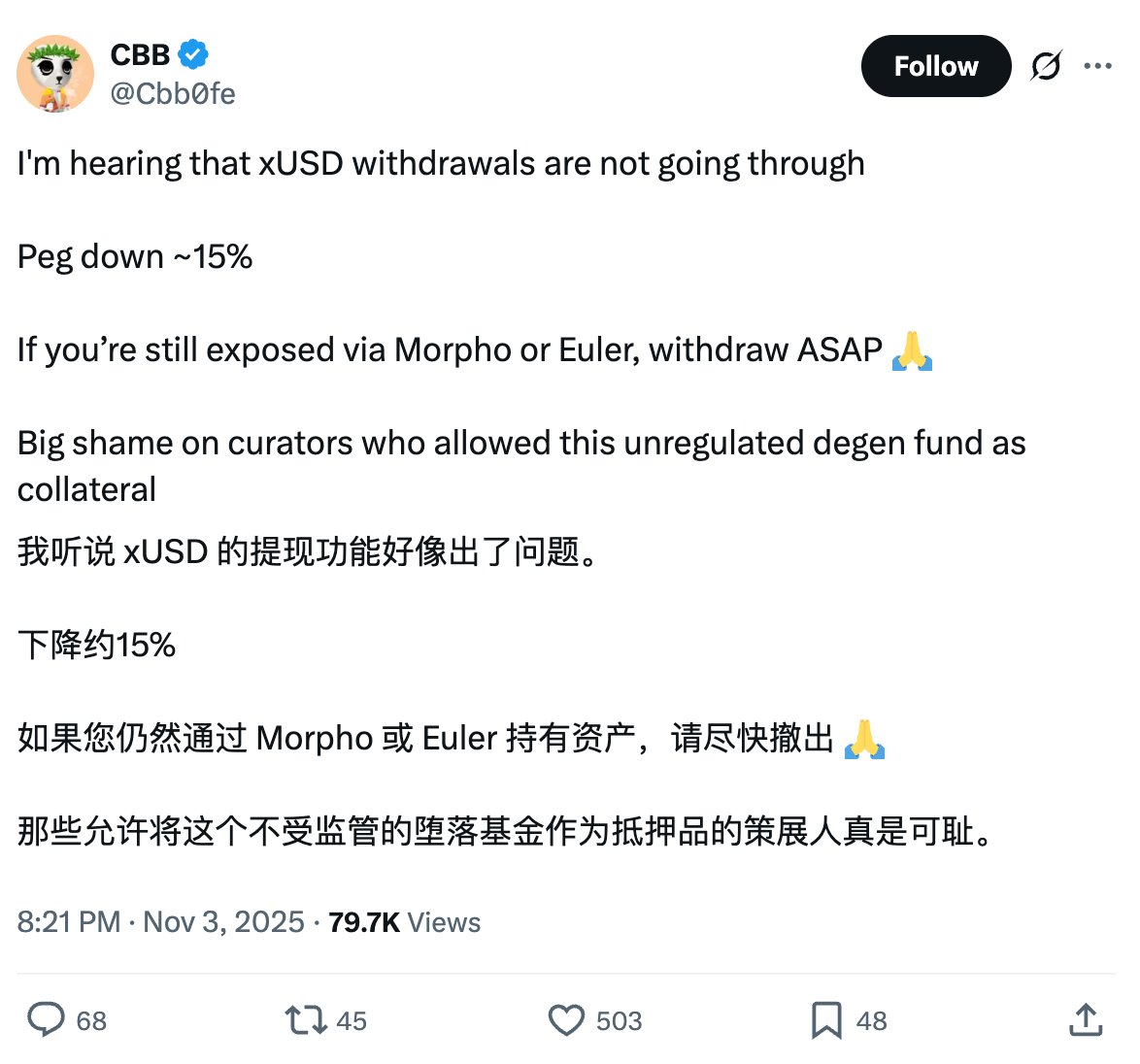

In the absence of information, capital reacts as always: depositors rush to withdraw liquidity from anywhere they believe may be directly or indirectly affected, including Stream Finance.

Controversy Over Lack of Transparency

Currently, Stream Finance does not maintain a comprehensive transparency dashboard or Proof of Reserve; however, it does provide a link to a Debank Bundle to display its on-chain positions.

However, after the vulnerability broke out, these simple disclosures failed to clearly address risk exposure: the price of xUSD (Stream's yield-bearing dollar product) fell from its target price of $1.26 to $1.15, and has now rebounded to $1.20, while users report that withdrawals have been suspended.

Risks and Controversies of Stream Finance

Stream is an on-chain capital allocation platform that uses user funds to run high-yield, high-risk investment strategies.

Its portfolio construction employs significant leverage, making the system more resilient under stress. However, the protocol has recently become the focus of public attention due to controversies over its recursive loop/minting mechanism.

Although the current situation does not directly indicate a liquidity crisis, it does reveal the market's high sensitivity. When negative news emerges and confidence is questioned, the shift from "probably fine" to "redeem immediately" is often very rapid.

xUSD is used as collateral and is distributed across Curated Markets on multiple chains, including Euler, Morpho, and Silo, covering ecosystems such as Plasma, Arbitrum, and Plume.

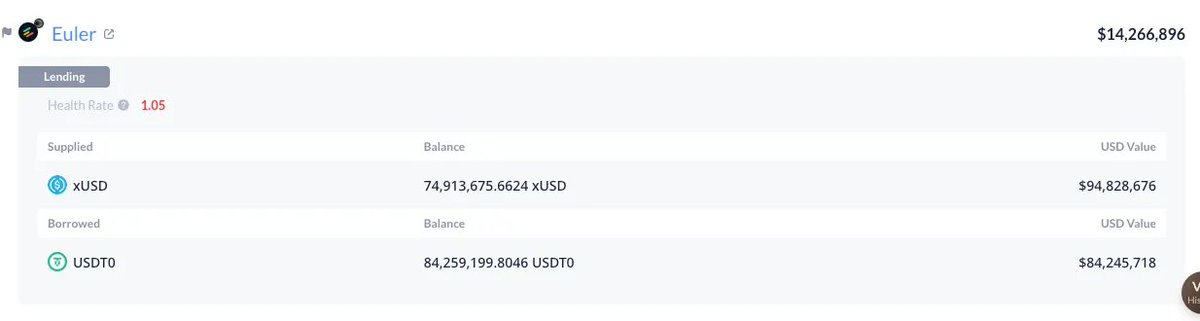

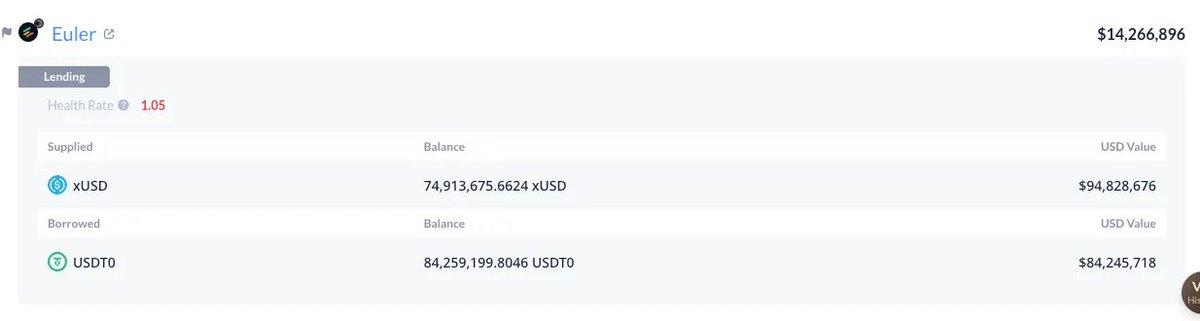

The protocol itself has significant risk exposure in these markets, with the largest being $84 million USDT borrowed on Plasma using xUSD as collateral.

Collateral Mechanism and Risk Buffer

When the market price of xUSD falls below its book value, the related positions are not immediately liquidated. This is because many markets do not peg the value of collateral to the spot AMM (Automated Market Maker) price, but instead rely on hardcoded or "base value" oracles, which track reported asset backing rather than the current secondary market price.

During calm periods, this design can mitigate tail risk liquidations caused by short-term volatility, especially in stable products. This is also one reason why DeFi protocols performed better than centralized platforms during the liquidation wave on October 10.

However, this design can also quickly turn price discovery into trust discovery: choosing a base (or hardcoded) oracle requires thorough due diligence, including the authenticity, stability, and risk characteristics of the asset backing.

In short, this mechanism is only applicable if there is comprehensive Proof of Reserve and redemption can be completed within a reasonable time. Otherwise, the risk is that lenders or depositors may ultimately bear the consequences of bad debt.

Stress Test on Arbitrum

Taking Arbitrum as an example, the current market price of the MEV Capital Curated xUSD Morpho Market has fallen below the LLTV (Lowest Loan-to-Value). If xUSD's peg cannot be restored, and with utilization reaching 100% and lending rates soaring to 88%, the market could deteriorate further.

We are not opposed to base oracles; on the contrary, they play a decisive role in preventing unfair liquidations caused by short-term volatility. Similarly, we are not against tokenized or even centralized yield-bearing assets. But we advocate that when deploying money markets around these assets, basic transparency must be achieved, and modern, systematic, and professional risk management must be adopted.

Curated Markets can be engines for responsible growth, but they cannot become a race to sacrifice safety and rationality in pursuit of high yields.

If what is being built is a "domino-like" complex structure, then when the first gust of wind blows, its collapse should not come as a surprise. As the industry becomes more professional and some yield products become more structured (but perhaps more obscure to end users), risk stakeholders must raise their standards.

Although we hope that the issues faced by affected users can ultimately be properly resolved, this incident should serve as a wake-up call for the entire industry.