Key Notes

- Market volatility intensified as Bitcoin whale investors continued large-scale sell-offs, contributing to the sharp price decline.

- Supreme Court case on Trump's tariff powers triggered risk-off sentiment, spooking both equity and digital asset investors.

- US spot Bitcoin ETFs recorded fourth consecutive day of outflows with $187 million withdrawn, signaling profit-taking activity.

Bitcoin BTC $101 033 24h volatility: 5.6% Market cap: $2.01 T Vol. 24h: $96.26 B price tumbled below the $100,000 mark for the first time in three months, sliding more than 6% on Nov. 4, 2025. The decline extended Bitcoin’s losses to 20% from its October record highs near $124,500.

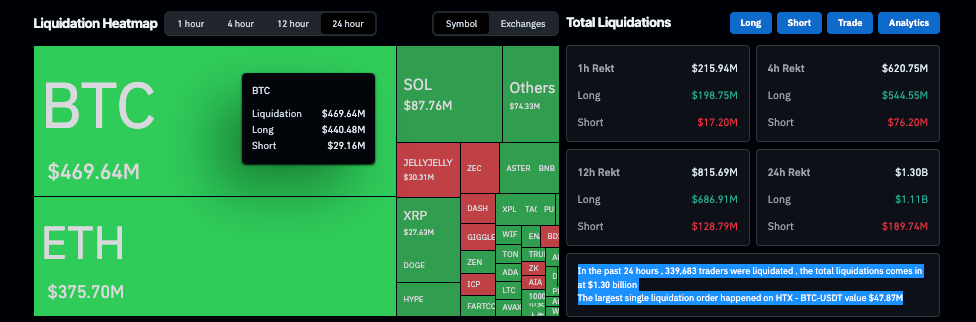

Crypto market liquidations crossed $1.3 billion on Nov. 4, 2025. | Source: Coinglass

Data from Coinglass revealed that over 339,448 traders were liquidated in the past 24 hours, totaling $1.3 billion across the crypto market. Bitcoin accounted for $445 million of those losses, signaling the steepest bull wipeout since August.

Large sell-offs from Bitcoin whale investors also continued on Nov. 4, 2025, further exacerbating the BTC price decline below $100,000.

Sequans Redeems 50% of Convertible Debt Through Strategic Asset Reallocation.

This move opportunistically leverages Bitcoin holdings to enhance financial flexibility, reduce Debt-to-NAV ratio, and boost buyback capacity while preserving long-term treasury optionality. $SQNS

Learn… pic.twitter.com/bTbVMQGC2T— Sequans (@Sequans) November 4, 2025

Sequans Communications, a publicly listed semiconductor company, announced that it had redeemed 50% of its convertible debt using Bitcoin holdings. The firm sold 970 BTC, worth roughly $94.5 million, to bring its debt-to-NAV ratio down from 55% to 39%.

Why Is Bitcoin Price Falling Today?

The broader risk-off tone in global markets intensified on Nov. 4, 2025, following reports that the US Supreme Court would hear a case concerning Trump’s executive powers on tariff enforcement . The move reignited trade war fears, spooking both equity and digital asset investors.

According to Reuters , top Wall Street executives are warning investors to brace for an imminent 10% correction in equity markets within the next 12 to 24 months, citing overvalued prices.

Adding to the pressure, US spot Bitcoin ETFs recorded their fourth consecutive day of outflows, with $187 million withdrawn on Nov. 3 , 2025. The sustained withdrawals suggest institutional investors are taking profits and reallocating capital to short-term bonds amid global uncertainty.

Bitcoin Price Forecast: Technical Breakdown Points to $98K Support Zone

On the 12-hour BTC/USDT chart, Bitcoin trades near $101,290, down 3.15%, as selling pressure intensifies across major exchanges. The Keltner Channel (KC) bands have widened, signaling heightened volatility. The upper band sits near $114,517, while the lower band provides interim support at $103,321, with BTC price currently testing below it.

Bitcoin (BTC) Technical Price Analysis | BTCUSDT

The MACD indicator underscores ongoing bearish momentum. Both the MACD line (-896.20) and signal line (-798.14) remain deep in negative territory, confirming that bears maintain control. The widening histogram highlights increasing downside momentum, suggesting further declines before stabilization.

Meanwhile, the Volume Delta (-2.02K) reflects a dominant sell imbalance, confirming that sell orders continue to outweigh buying interest. The breakout probability of 58.24% on the downside reinforces this bearish narrative.

If Bitcoin fails to hold above $100,000, it risks extending losses toward the $98,000, $96,500 range, key demand zones that previously acted as accumulation areas in September. A sustained close below $96,000 could validate a deeper correction toward $92,000.

However, if BTC rebounds above the mid-Keltner resistance at $108,919, the next upside target lies around $114,500, aligning with the upper channel boundary and prior consolidation zone.

For now, with a 60.67% trading profitability rate, Bitcoin remains technically oversold but vulnerable to macro-driven volatility. Short-term traders should monitor liquidation clusters near $98K, which could potentially trigger a relief rally if market sentiment stabilizes.

next