Key Notes

- The board approved a flexible buyback program allowing share purchases through 2027 to boost earnings per share and shareholder value.

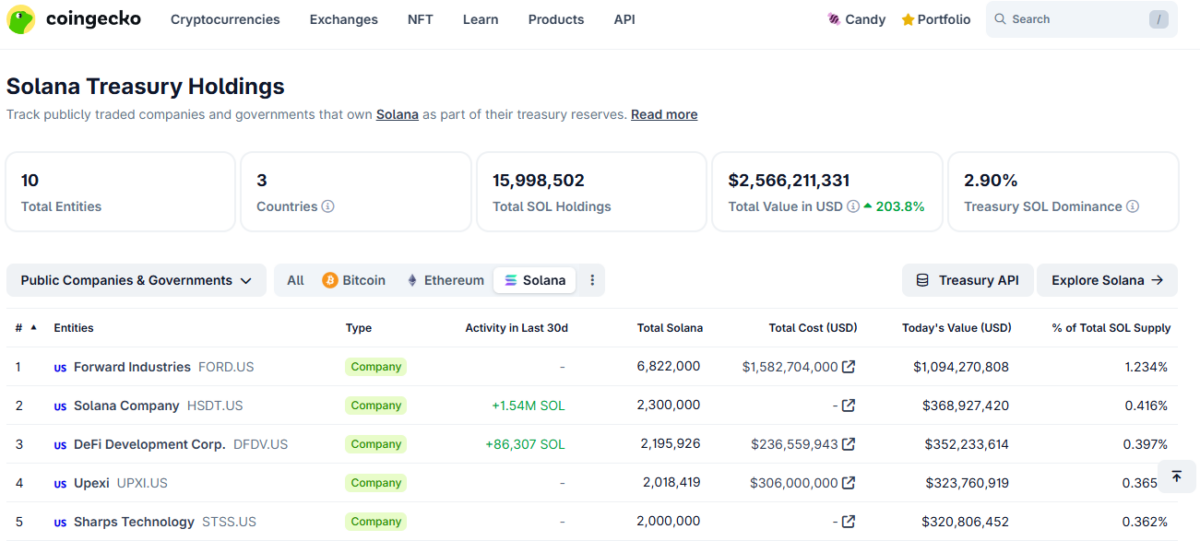

- Forward holds over 6.8 million SOL tokens worth $1.5 billion, generating approximately 7% annual staking yield for shareholders.

- The stock plummeted 30% following the announcement as investors reacted to potential dilution from recent private placements and financing activities.

Forward Industries has initiated a $1 billion share repurchase program effective through September 2027. This decision aligns with its expanded strategic commitment to Solana SOL $155.5 24h volatility: 8.3% Market cap: $86.38 B Vol. 24h: $9.15 B , as it now holds the network’s most extensive SOL treasury.

The announcement came alongside a notable drop in the company’s share price, signaling immediate investor reaction as the stock fell approximately 30% on heavy trading volumes today.

What does the buyback mean for investors?

The board authorized the stock repurchase program on November 3. Under this plan, Forward Industries can repurchase its own shares through various mechanisms, including open-market purchases and block trades.

This program supports shareholder value by reducing the number of outstanding shares, potentially increasing earnings per share. The authorization period stretches through September 2027 and is intended to give management flexibility to engage based on prevailing market and treasury conditions, according to its press release .

Breaking news from our team

The Forward Industries Board authorized, on November 3, 2025, a share repurchase program permitting Forward Industries to repurchase up to $1 billion of its common stock.

Get the full press release below pic.twitter.com/rqsDDRGp54

— Forward Industries $FORD (@FWDind) November 4, 2025

The company keeps the largest Solana treasury

Forward Industries pivoted to a Solana-focused treasury model in September 2025, deploying over $1.5 billion to acquire more than 6.8 million SOL tokens, now the most significant such holding globally.

As of mid-October, these holdings were generating a staking yield of around 7%, directly providing yield revenue to the company and, indirectly, to shareholders. The board’s shift toward on-chain asset management, supported by partnerships with major entities such as Galaxy Digital and Multicoin Capital , places Forward Industries at the forefront of crypto-native treasury strategies among public companies.

Top 5 Solana treasuries as of November 04 | Source: Coingecko

Investors are not happy with the buyback

Forward Industries’ stock saw heightened volatility following the news. After a multi-month rally fueled by its Solana-driven strategy, the stock plunged by around 30% in a single session, as investors reacted to the resale prospectus supplement and to possible dilution from recent private placements.

Nonetheless, the buyback announcement signals management’s efforts to support market value amid short-term price pressure, according to the company.

next