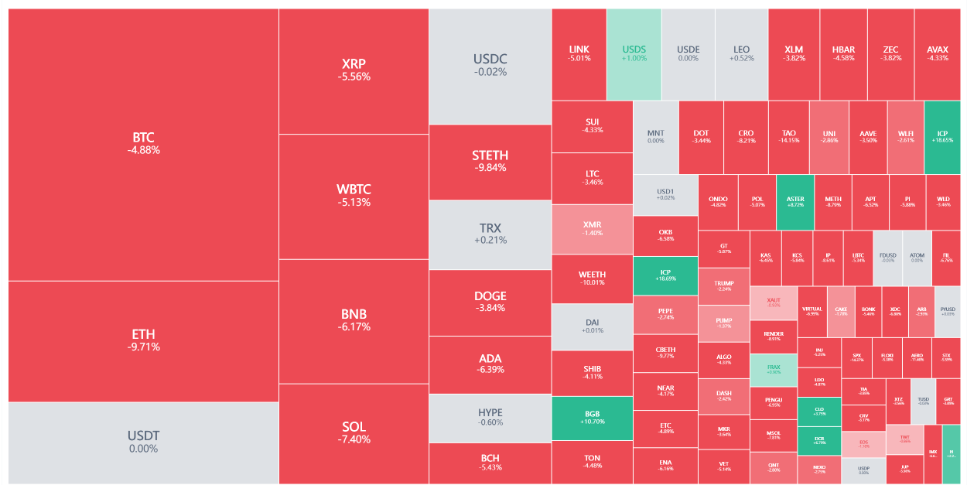

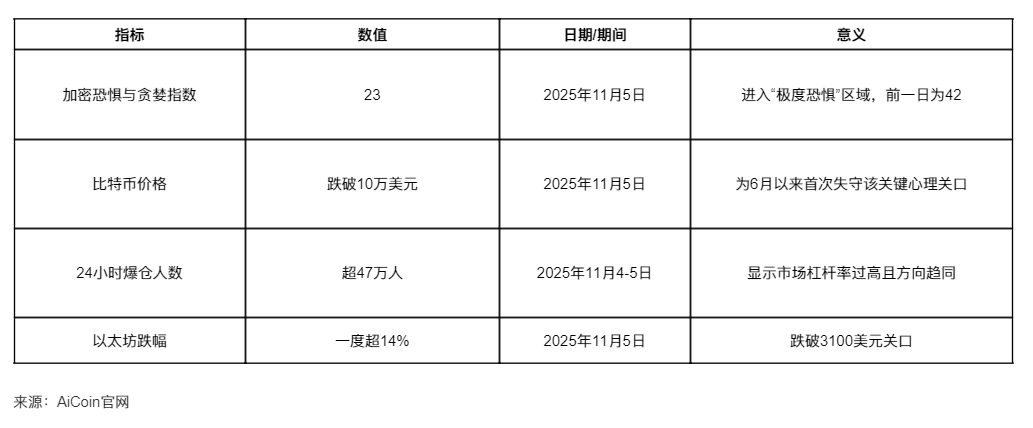

The Crypto Fear & Greed Index has plummeted to 23, entering the "Extreme Fear" zone. In a market where over 470,000 people have been liquidated, the seeds of a historic rebound are being sown. Over the past 24 hours, the cryptocurrency market has experienced a "bloodbath." Bitcoin's price fell below the $100,000 mark for the first time since June, and Ethereum dropped below $3,100, at one point plunging more than 14%.

According to AiCoin data, in the past 24 hours, the cryptocurrency market saw over 470,000 people liquidated, with total liquidation amounts reaching $2.025 billion. This brutal scene is reminiscent of the historic liquidation event on October 11, when over $19 billion in crypto assets were liquidated across major global exchanges.

I. Extreme Market Fear: Liquidity Drought Triggers Broad Selloff

The cryptocurrency market is undergoing a severe liquidity crisis, with multiple key indicators flashing red.

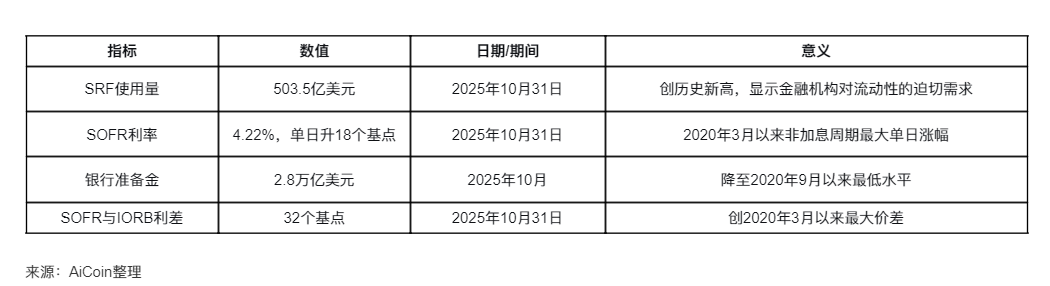

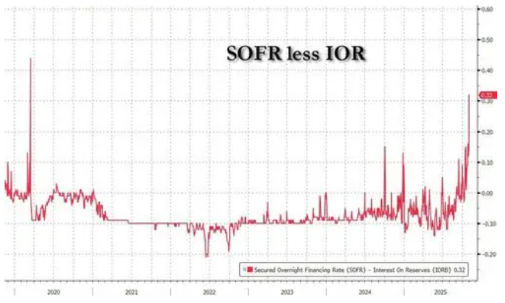

● Extreme tension in the financing market, liquidity on the verge of drying up. Last Friday, the US Secured Overnight Financing Rate (SOFR) surged 18 basis points to 4.22%, marking the largest increase in a year. This jump is the biggest single-day fluctuation since March 2020, excluding rate hike cycles. SOFR has remained above the Federal Reserve's key policy rate, indicating that financing market stress has spilled over into the entire short-term rates market.

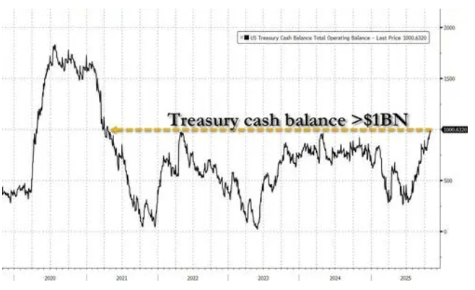

The core reason for the liquidity crunch lies in the government shutdown, which forced the Treasury to increase its cash balance from $300 billion to $1 trillion over the past three months, draining market liquidity. The Federal Reserve's reserves have dropped to $2.85 trillion, the lowest since early 2021, while foreign commercial banks' cash assets have plunged by over $300 billion in just four months.

The entire cryptocurrency market plummeted. In the early hours of November 5, Bitcoin's price fell below the $100,000 mark for the first time since June. Ethereum dropped below $3,100, at one point falling more than 14%. In addition, BNB, SOL, and others all fell by more than 5%, leaving the entire market in disarray.

● Panic selling intensifies, surge in liquidations. AiCoin data shows that in the past 24 hours, the cryptocurrency market saw over 470,000 people liquidated, with total liquidation amounts reaching $2.025 billion. Of this, long positions accounted for $1.63 billion, while short positions accounted for $400 million. The largest single liquidation occurred on HTX-BTC, highlighting the sharp rise in market leverage.

II. Root Causes of the Crisis: Monetary Liquidity Tightening and Structural Industry Issues

The core reasons for the current cryptocurrency crisis stem from both a tightening macro monetary environment and internal structural flaws within the industry.

● Persistent liquidity drought in the money market. Wall Street analysts point out that the tight liquidity situation in the US money market may persist through November. As financing costs remain high, the Federal Reserve may have to increase liquidity injections even before officially ending quantitative tightening next month. Although SOFR eased somewhat on Monday as month-end pressures subsided, it still remains above the Fed's key policy rate.

● Fed's slow policy shift exacerbates market pressure. Mark Cabana, head of US rates strategy at Bank of America, noted: "The Fed is already too late to respond, and they seem a bit flustered. December 1 is the only compromise they can reach. I suspect the market will soon force them to react." Dallas Fed President Logan has stated that if repo rates remain elevated, the Fed will need to start asset purchases.

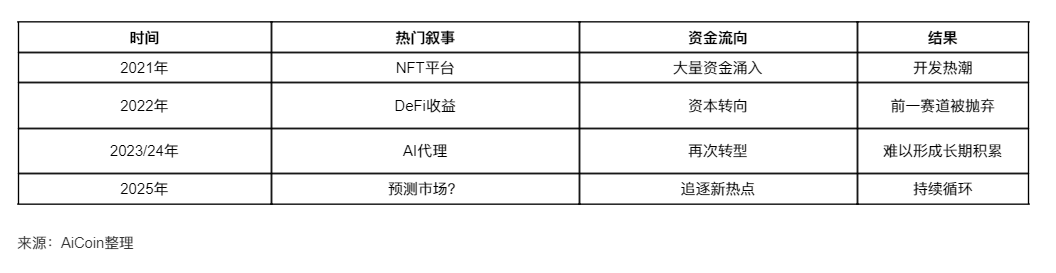

● The crypto industry's own problem of "narrative maximization". According to Rosie Sargsian, Head of Growth at Ten Protocol, most crypto projects struggle to build for the long term because they are forced to constantly chase new narratives to attract investors.

● The crypto industry has an 18-month product cycle: a new narrative emerges, funds and capital flow in, and during the hype everyone pivots. This process typically lasts 6 to 9 months, and once the hype fades, founders seek new directions.

● Capital chases attention, not completion. In crypto, if you have a new narrative, you can raise $50 million even without a product; if the narrative is established and the product is available, you might struggle to raise even $5 million; if it's an old narrative with a product and real users, you may not be able to raise any funds at all. VCs don't invest in products, they invest in attention. Attention flows to new narratives, not to completed old ones.

III. The Fuse for a Historic Surge: Stealth QE and the Return of Liquidity

Paradoxically, the current extreme tightening is breeding future extreme easing, and the key to this transition lies in the US government reopening and the release of fiscal funds.

● Government reopening will trigger a flood of funds. Once the government shutdown ends, the Treasury will begin large-scale spending, and the over $1 trillion in cash hoarded in its TGA account will be rapidly released back into the market. BitMEX co-founder Arthur Hayes claims that the US Treasury and the Fed are conducting "stealth quantitative easing" (stealth QE), which could trigger a crypto bull market.

● Massive liquidity will chase risk assets. Hayes believes these SRF operations are equivalent to "de facto QE," with funds created through lending ultimately supporting the Treasury market. As SRF usage increases, global dollar liquidity expands and risk appetite returns. Historically, every time the Fed's balance sheet expands, Bitcoin rises. Once stealth QE begins, a strong crypto market rebound will follow.

● The crypto market will be the main beneficiary of liquidity release. The core logic of Bitcoin has always been: the more 'liquidity' in the system, the more 'Bitcoin price action' there is. When the Fed prints money and injects liquidity (QE), Bitcoin rises; when the Fed shrinks its balance sheet and withdraws liquidity (QT), Bitcoin falls. The Fed's announcement to stop QT this time means liquidity will be released: dollar liquidity will return, and bank reserves will increase.

● Short-term pain and long-term opportunity. Hayes previously predicted a $100,000 price drop before the rebound, insisting these are only temporary corrections. He advises investors to prepare for a "volatile market" before the government shutdown ends and to wait for the best buying opportunity in crypto.

IV. Industry Paradox: Maximizing Sunk Costs and the Dilemma of Long-Term Development

The cryptocurrency industry faces a deep structural paradox: a fundamental contradiction between short-term narrative chasing and the need for long-term development.

● The 18-month product cycle restricts long-term building. New concept emerges → funds pour in → everyone pivots → continues for 6-9 months → new concept fades → pivot again.

A crypto cycle once lasted 3-4 years (the ICO era), then shortened to 2 years. Now, if you're lucky, a crypto cycle lasts at most 18 months. It's nearly impossible to build anything meaningful in 18 months; real infrastructure takes at least 3-5 years, and true product-market fit requires years, not just a few quarters of iteration.

● The sunk cost fallacy as a survival mechanism. Traditional business advice is to avoid the sunk cost fallacy. If a project doesn't work, pivot immediately.

But in crypto, the industry is completely caught in it, using the sunk cost fallacy as a survival mechanism. Now, no one persists long enough to validate if what they're doing works; instead, they pivot at the first sign of resistance, slow user growth, or fundraising difficulties.

● Challenges of team retention and sustained user attention. If you're a crypto founder, after a new narrative emerges, your best developers may be poached with double salaries to join hot new projects, and your marketing director may be lured away by a company that just raised $100 million.

● The infrastructure paradox. In crypto, the things that last are mostly those built before cryptocurrencies drew attention. Bitcoin was born when no one cared—no VCs, no ICO. Ethereum was created before the ICO boom, before people foresaw the future of smart contracts. Most things born in hype cycles disappear when the cycle ends.