Ethereum Crash Deepens: Can the $3K Line Hold or Will It Break Next?

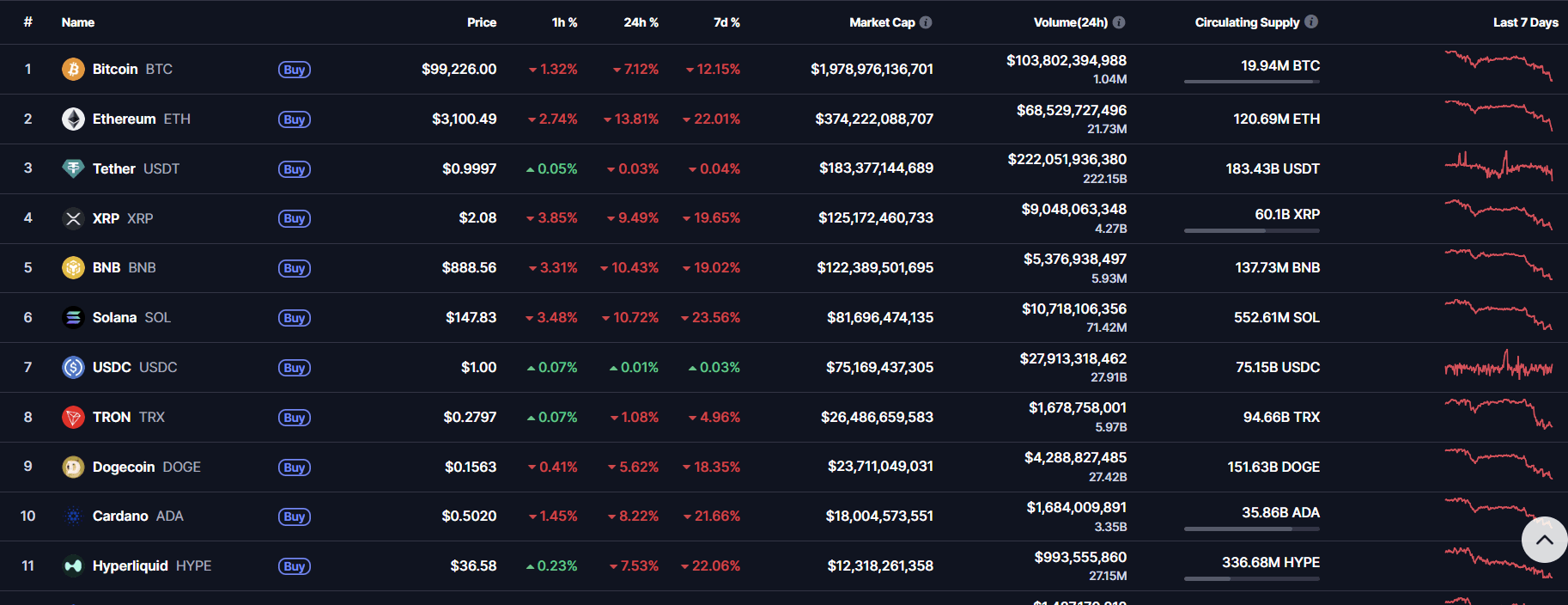

The crypto market is in freefall , and Ethereum is one of the hardest hit.

Following Bitcoin’s sharp decline under $100K, $ETH plunged over 13% in a single day, wiping out weeks of gains and reigniting fears of a deeper bear trend.

Ethereum Price Crash Toward $3,000

$Ethereum crashed from around $3,600 to nearly $3,100, breaking several key support zones. The 200-day SMA at $3,370 has been breached, confirming a bearish trend continuation.

ETH/USD 1-day chart - TradingView

RSI has dropped to 43, indicating rising selling pressure but not yet fully oversold.

MACD remains in negative territory, with widening divergence — a clear sign that momentum is still heavily bearish.

Bitcoin Crash Triggered the Avalanche

Bitcoin’s breakdown below $100K acted like a domino effect across all markets.

Ethereum, BNB, Solana, Cardano, and Dogecoin all saw steep declines as liquidations exceeded $100 billion in 24h trading volume across top exchanges.

Solana dropped 23%, Cardano lost 21%, and BNB tumbled nearly 10%.

The entire crypto market capitalization has now fallen below $3.6 trillion.

Ethereum Price Prediction: Key Levels to Watch for ETH

If Ethereum fails to hold above the $3,000 mark, the next strong supports lie at $2,730 and $2,400.

A rebound may occur if BTC finds stability near $100K, potentially sending ETH back toward $3,500.

However, sentiment remains extremely bearish — and any short-term rally could face resistance near the $3,370–$3,800 range.

Will Ethereum Price Recover?

Both $Bitcoin and $Ethereum have entered dangerous territory.

While the RSI readings suggest short-term exhaustion among sellers, macro factors — including liquidations, investor fear, and risk-off sentiment — continue to weigh on the market.

Until $BTC reclaims $106K or $ETH climbs above $3,500, the crypto correction is far from over.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Interoperability Becomes a Key Strategic Benefit as Tokenization Evolves

- Tokenization's growth depends on interoperability, enabling seamless cross-chain interactions for institutional and onchain asset scaling. - Chainlink's Runtime Environment (RTE) lets institutions tokenize real-world assets across EVM chains while maintaining compliance and data security. - Bitget integrates Morph Chain to allow direct USDT trading of Layer 2 assets, bridging CeDeFi and enhancing cross-chain liquidity for users. - These advancements highlight interoperability as a strategic advantage, en

Bitcoin News Update: U.S. Government Shutdown Wipes Out $700 Billion from Markets, Forcing Bitcoin Under $100K Amid Tightening Liquidity

- U.S. government shutdown drains $700B from markets via TGA, pushing Bitcoin below $100K amid liquidity contraction. - Corporate reports show mixed liquidity strains: 3D Systems reports $75.8M cash decline, Chord Energy spends $336M on Q3 capex. - Analysts cite "perfect storm" of macroeconomic crisis and exhausted crypto bull cycle, with 1M+ Bitcoin sold by long-term holders since June. - Markets face fragile balance: oversold conditions and seasonal Bitcoin strength contrast with political gridlock and m

U.S. and South Korea Broaden Agreement to Address China Amid Ongoing North Korean Threat

- U.S. Defense Secretary Hegseth highlights expanded military roles for troops in South Korea, including potential China-related operations, while prioritizing North Korea deterrence. - South Korea boosts defense spending by 8.2% to $46B and triples AI investment to $7B, advancing its goal to assume wartime command of joint forces by 2030. - U.S. approves South Korea's nuclear submarine project with Trump's endorsement, though fuel sourcing and construction location remain unresolved. - North Korea escalat

Can Noomez’s Clear Tokenomics Set a New Standard for the 2025 Bull Market?

- Noomez's $NNZ token emerges as a 2025 bull run contender with a 28-stage presale featuring deflationary burns and liquidity locks. - The structured model includes escalating prices (280x potential), Vault events with token burns, and 15% permanent liquidity locks. - Transparency tools like the Noom Gauge dashboard and KYC-compliant vesting aim to build trust amid meme coin volatility concerns. - Staking incentives (up to 66% APY) and a 10% referral bonus drive community participation while capping supply