November Crypto Crash: Experts Debate Whether to Stay Patient or Cut Losses

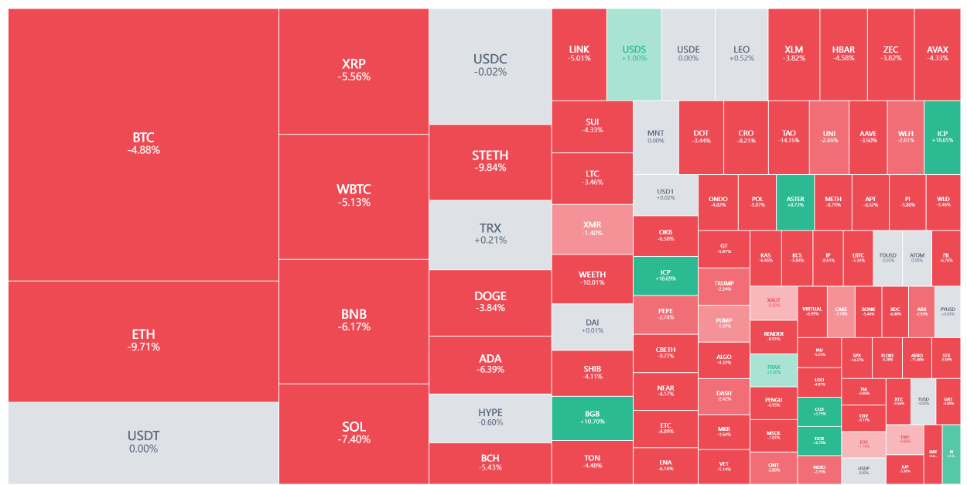

The crypto market’s $1 trillion wipeout has rattled investors, sparking debate over whether this downturn marks a new bear market or a short-term correction before recovery.

The cryptocurrency market has lost more than $1 trillion in value since October 6, effectively erasing all the gains accumulated throughout 2025.

Amid this sharp correction, investors face a pivotal decision: whether to hold their positions and wait for a potential recovery or exit the potential crypto bear market to preserve capital.

Crypto Market Wipes Out 2025 Gains

The past month has been tumultuous for the cryptocurrency market. After peaking at a record-high valuation of over $4 trillion in October, the market has continued to face mounting distress.

The downturn deepened in early November. Major assets such as Bitcoin and Ethereum tumbled to multi-month lows yesterday, reflecting the fragility of investor sentiment.

“Crypto markets have now officially erased over -$1 TRILLION of market cap since October 6th. That is, crypto adoption is still at record highs, de-regulation is in full swing, and technology is advancing rapidly. However, leverage is at unprecedented levels which is amplifying moves in the market. As a result, when uncertainty arises or technical momentum fades, downward swings are amplified,” The Kobeissi Letter posted.

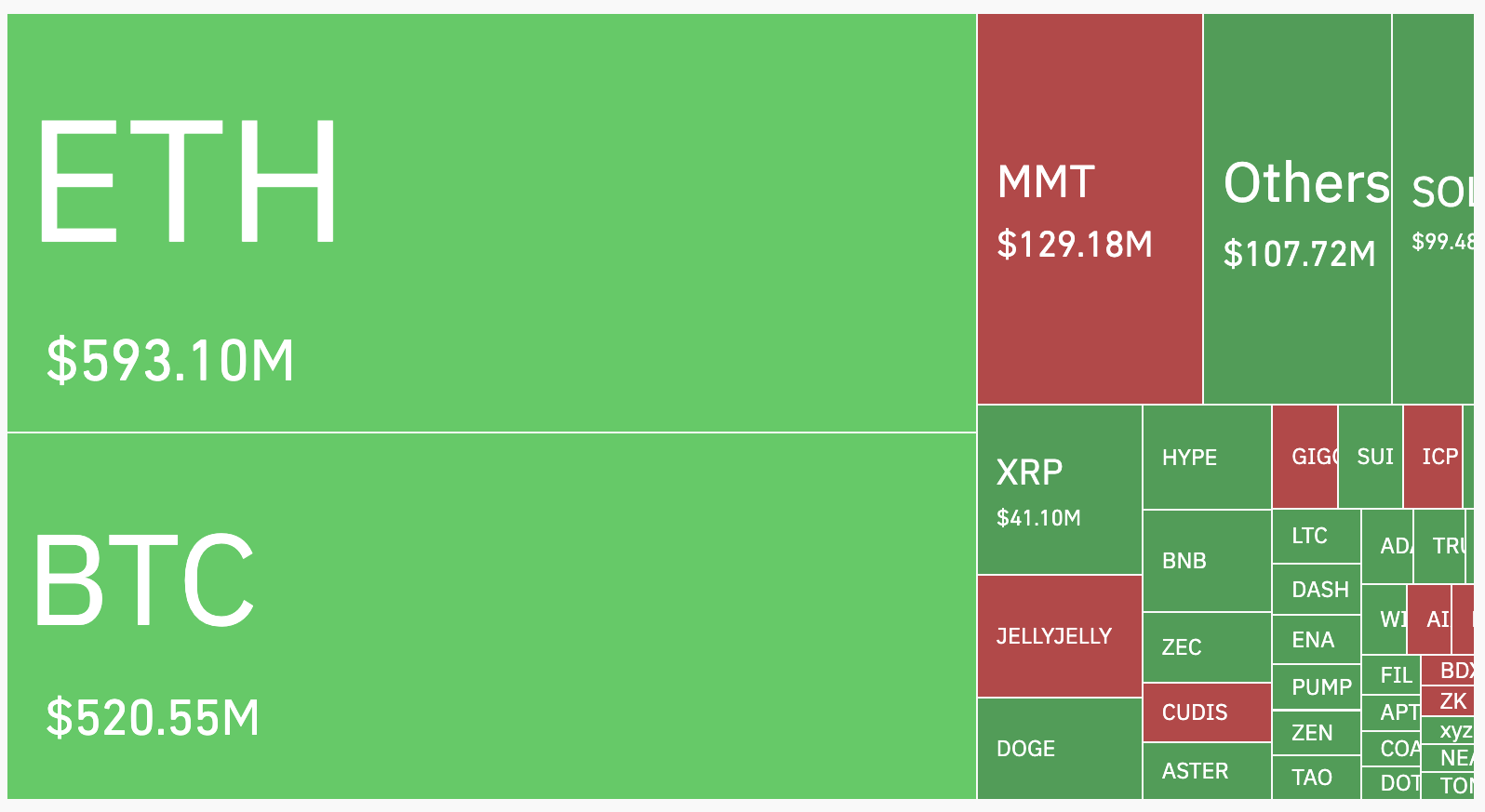

The depth of the downturn is highlighted by the most recent liquidation statistics. According to data from Coinglass, over the past 24 hours, total liquidations have reached nearly 1.8 billion, with 441,867 traders liquidated.

Crypto Liquidations Over The Past 24 Hours. Source:

Coinglass

Crypto Liquidations Over The Past 24 Hours. Source:

Coinglass

Of the total amount, roughly $1.38 billion came from long positions. The largest single liquidation occurred on Hyperliquid, where an ETH-USD position worth $26.06 million was closed.

Could November Mark the Official Start of Crypto’s Next Bear Market?

As losses deepen, experts remain divided on the next course of action. Bearish voices frame the downturn as a prelude to a broader capitulation.

Some analysts now argue that Bitcoin has officially entered a bear market. Furthermore, others assert that the bulls have, at least for now, lost the battle.

“It’s now safe to say there’s way more pain coming. I feel extremely bad for anybody holding crypto this week,” a market watcher wrote.

Economist and long-time Bitcoin critic Peter Schiff predicted that losses for Bitcoin holders and crypto investors “will be staggering.” He added that more money could be wiped out in this downturn than during the collapse of the dot-com bubble two decades ago.

“But if this signals an aversion to risk in general, look out for the even bigger AI bubble to burst,” Schiff remarked.

THE CRASH HAS BEGUN I TOLD YOU TO SELL EVERYTHING CRYPTO IS GOING TO ABSOLUTELY COLLAPSE

— stocksandrealestate (@stocksandreales) November 4, 2025

In addition, BeInCrypto recently highlighted that long-term Bitcoin holders are offloading their coins. While many believe that a new wave of traders is absorbing this supply, it still raises concerns.

Why? Because analysts warn that these newer investors may lack the experience to withstand sharp market corrections.

“For the first time ever, a majority of Bitcoin supply will be concentrated in the hands of a “new” cohort of holders, one that has never seen a 80% drawdown on Bitcoin (which the OG’s have endured at least 3 times by now) and one that likely does not have the mental fortitude or conviction to hold through such drawdown. This will imo contribute to our next bear market being the most devastating one we have ever seen in Bitcoin history,” CredibleCrypto said.

Lastly, broader market signals reinforce this pessimism. Michael Burry’s early 13F filing reveals aggressive shorts through 2027. Furthermore, the Buffett Indicator, at 233.7%, signals extreme overvaluation, likely presaging a multi-year bear market. These signs indicate that risk extends to both equity and cryptocurrency markets.

Analysts Point to 2024 Rally as a Blueprint for Crypto Market Recovery

Despite this, bullish contrarians urge restraint, viewing the dip as a fleeting shakeout. Michaël van de Poppe attributed the selloff to forced unwinding.

He asserted that these events reverse quite fast and advised against panic sales. Ran Neuner argued that only newcomers are panicking.

This is why targets are dangerous but.. it seems to me that anybody listening to Tom is long and stayed long and has become wealthy. This is in contrast to the people who call for a crash for years on end and then do a touchdown dance if it goes down for a day. Becoming wealthy…

— Eric Balchunas (@EricBalchunas) November 4, 2025

History partially supports a bullish case. Analysts emphasized that major assets experienced similar declines in 2024 before rebounding to new highs.

“In the first few days of November 2024, Bitcoin dumped from $71k to $66k, and everyone said the market was done, but then BTC pumped 60% from $66k to $108k in just 45 days. From November 4, 2024, to December 15, 2024, ETH pumped 75%, and the altcoin market cap jumped 138%, sending many alts 5x-10x in less than 2 months,” Ash Crypto pointed out.

Moreover, macroeconomic and seasonal factors also support the potential for a recovery.

“The data is positive. Fed will cut rates in December. QT ending Dec 1. QE is here (Fed buying treasury bills). Crypto market bill close to buying. US-China trade deal signed. Gold topped. US stocks hitting new highs,” Ash Crypto explained.

NOVEMBER IS USUALLY THE MOST BULLISH MONTH FOR BITCOIN…

— Crypto Rover (@cryptorover) November 4, 2025

As November 2025 progresses, the crypto market stands at a crossroads. Trillion-dollar losses and widespread liquidations have shaken investor confidence. Yet the market’s historic resilience and divided analyst opinions leave the path forward uncertain.

Whether this moment marks the beginning of a prolonged bear market or merely a short-term correction will depend on broader macroeconomic conditions, investor behavior, and market sentiment in the weeks ahead.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CZ Discusses the Memecoin Craze, Hyperliquid, and Offers Advice to Entrepreneurs

CZ's life after stepping down, reflections, and deep insights into the future of crypto.

Privacy coins surge against the trend—is this a fleeting moment or the dawn of a new era?

The whale myth has collapsed! No one can beat the market forever!

Still dare to play with DeFi? This feeling is all too familiar...