Ripple Just Sealed One of the Biggest Deals of the Year, But XRP Price Barely Moves

Ripple’s $500 million investment round led by Fortress Investment Group and Citadel Securities pushes its valuation to $40 billion — one of the largest in crypto history. The company’s acquisitions and rising RLUSD stablecoin adoption cement its institutional strategy, even as XRP’s price sees only modest gains.

The XRP price recorded a modest gain on Wednesday following reports that Ripple had secured one of the biggest deals of the year, catapulting the network to a $40 billion valuation.

This capital infusion arrives amid Ripple’s fast expansion, marked by six major acquisitions in just over two years and a strong institutional presence.

Record Valuation Fuels Ripple’s Institutional Ambitions

Ripple announced that it had secured a $500 million strategic investment led by Fortress Investment Group and Citadel Securities. This funding round highlights significant institutional confidence in the blockchain payments company.

The $500 million investment elevates Ripple to a $40 billion valuation, making it one of the most valuable private companies in crypto.

Fortress Investment Group and Citadel Securities, key TradFi leaders, co-led the round. Their involvement signals growing institutional trust in blockchain infrastructure.

This deal is among the largest single funding events in the crypto industry and mirrors the broader consolidation and maturation of the sector.

As noted in Ripple’s official announcement, the company processed a total of $95 billion in payment volume through its Ripple Payments network.

It has completed 25% in share repurchases and holds 75 regulatory licenses globally. These achievements highlight the scale and regulatory compliance that institutions seek.

Swell 2025: We have closed a $500 million strategic investment at a $40 billion valuation, led by Fortress Investment Group and Citadel Securities: → $95B+ in total Ripple Payments payment volume→ $1B+ $RLUSD stablecoin market cap→ 6 strategic…

— Ripple (@Ripple) November 5, 2025

The timing of this investment follows a more favorable regulatory environment in the US. Industry reports show crypto mergers and acquisitions reached over $10 billion in Q3 2025 alone, a 100% rise from the previous quarter.

This trend enables established players like Ripple to accelerate their initiatives, free from many legal uncertainties they previously faced.

Ripple’s acquisition strategy has transformed its business. The company deployed roughly $4 billion across six deals in two years, acquiring firms such as Rail, GTreasury, and most notably, Hidden Road.

Each deal has expanded Ripple’s reach into key areas, such as treasury management and prime brokerage services.

Expansion Through Strategic Acquisitions

Ripple’s $1.25 billion acquisition of Hidden Road ranks among the largest digital asset deals. Hidden Road, which clears over $3 trillion annually and serves more than 300 institutional clients, was rebranded as Ripple Prime.

The acquisition made Ripple the first crypto company to own and operate a global, multi-asset prime broker. Ripple now offers clearing, financing, and brokerage services across foreign exchange, digital assets, derivatives, swaps, and fixed income.

Ripple Prime has since tripled in size, according to company disclosures. The platform now enables institutional clients to trade large volumes over-the-counter (OTC). Alongside Ripple Prime, the company recently acquired Palisade, a digital asset custody platform.

Furthermore, Ripple’s acquisitions of GTreasury for $1 billion and Rail for $200 million expanded its reach. Together, these acquisitions strengthen Ripple’s ecosystem for institutional clients, covering custody, settlement, treasury, and prime brokerage needs.

RLUSD Stablecoin Surges Past $1 Billion

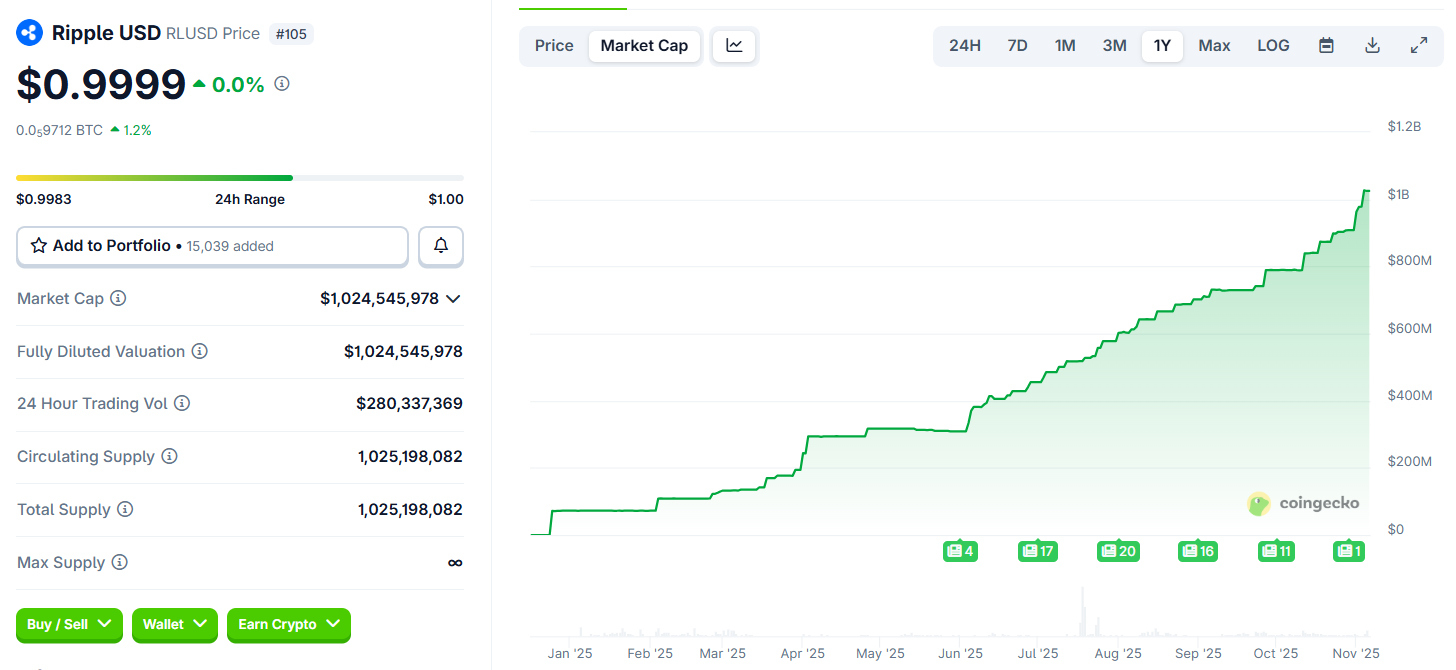

Ripple’s RLUSD stablecoin recently crossed the $1 billion mark in market capitalization. CoinGecko data lists RLUSD as the 105th cryptocurrency, with approximately 1.02 billion tokens in circulation.

RLUSD Price Performance. Source:

CoinGecko

RLUSD Price Performance. Source:

CoinGecko

Anchored to the US dollar, RLUSD has gained traction among institutions seeking strong settlement tools for payments and DeFi applications.

Integrating RLUSD into Ripple Prime expands its uses, including collateralized lending, cross-border settlements, and institutional DeFi.

As more institutions adopt stablecoins for their treasuries and payments, RLUSD’s growth demonstrates demand for compliant, scalable digital dollar alternatives.

Ripple (XRP) Price Performance. Source:

BeInCrypto

Ripple (XRP) Price Performance. Source:

BeInCrypto

Despite these achievements, Ripple’s success has prompted questions about XRP, its native token. While the company grows, XRP’s price is down by 15% over the past week to $2.27. As of this writing, it was up only by a modest 0.57% despite this news.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Behind Polymarket’s $2 billion splurge: The New York Stock Exchange’s self-rescue campaign

The New York Stock Exchange's self-rescue movement essentially redefines the business model of traditional exchanges. With the IPO market shrinking, trading volumes declining, and data services experiencing sluggish growth, traditional exchanges can no longer rely solely on their conventional profit models to maintain competitiveness.

As treasury companies start selling coins, has the DAT boom reached a turning point?

From getting rich by holding coins to selling coins to repair watches, the capital market is no longer unconditionally rewarding the narrative of simply holding tokens.

Bitcoin Falls Below the 100,000 Mark: Turning Point Between Bull and Bear Markets?

Liquidity is the key factor influencing the current performance of the crypto market.

The "mini nonfarm payrolls" rebound beyond expectations, is the US job market recovering?

US ADP employment in October saw the largest increase since July, with previous figures also revised upward. However, experts caution that the absence of nonfarm payroll data means this figure should be interpreted cautiously.