From Zero to the Top: How to Bounce Back from the Crypto Bottom?

The real damage caused by a portfolio crash is not just financial loss, but also the destruction of confidence.

The real harm caused by a portfolio crash is not just the financial loss, but the destruction of confidence.

Written by: Alexander Choi

Translated by: AididiaoJP, Foresight News

Just in the past week, your assets may have shrunk by 80% or even more from their historical peak.

You start to repeatedly reflect:

- What could I have done differently?

- How could I have managed risk better?

- Should I have been clearer about the nature of cryptocurrency as a high-risk asset?

- The time spent staying up late watching the market could have been spent with family and friends or learning new skills.

My darkest moment happened in the summer of 2024, when the market crashed due to post-war panic.

Before that, I had experienced nearly half a year of break-even or even loss. I spent 18 hours a day trading while also juggling my studies.

In May 2024, my life took a turn. With my last $500, I made $104,000 in two weeks. Unfortunately, the good times didn’t last. In the following month, my assets plummeted, leaving only $18,000.

That was the darkest period of my life. I left the crypto world, started drinking every few days, and spent nights binge-watching Game of Thrones and playing League of Legends.

Now my situation is much better. Although this market correction is even more severe, those who have been through it know: the real harm of a portfolio crash is not just the financial loss, but the destruction of trading confidence.

You can’t help but doubt:

- “Was my previous success just luck?”

- “Is it all just luck?”

The scariest part is falling into a vicious cycle of self-doubt, always wanting to make it back with the next trade.

What should you do?

First, understand this: all top traders have experienced their assets being cut in half multiple times.

Their strength lies in knowing how to bounce back from the lows. Be sure to remember this:

“If you’ve done it before, you can do it again.”

Every day when you wake up, use this phrase to motivate yourself.

Some people say, “Forget the historical high, that’s not the real you.” I completely disagree.

Being able to set a historical high proves you truly have the ability. These abilities don’t just disappear. The problem may be that you overlooked certain factors or impulsively broke trading discipline.

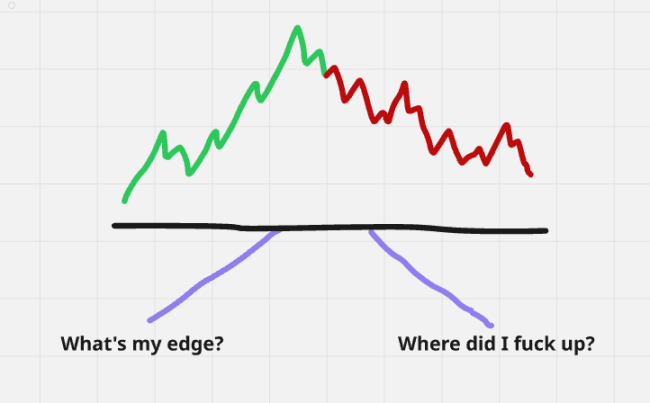

I suggest reviewing from two dimensions:

- What are my strengths? (How did I achieve the historical high?)

- Where did I go wrong?

Write down your thoughts on these two aspects seriously. The questions are simple, but the answers are not.

Take myself as an example:

- The leap from $500 to $104,000 was due to accurately capturing new tokens on-chain. I’m good at spotting market trends, evaluating new sectors, conducting in-depth research, and trading beta coins. At that time, the on-chain market was booming, perfectly matching my abilities.

- But my mistake was: when the market cooled and trading volume shrank, I still used aggressive strategies. After consecutive losses, I tried to increase my position to recover, which only made things worse.

It’s important to establish the right mindset: trading is a systematic project, profits and losses do not exist in isolation.

The only way to rebuild confidence is to rediscover yourself as a trader.

I suggest starting a trading journal:

- Record every trade

- Write down your market thoughts daily

The format doesn’t matter (document/note/paper), the key is to record it yourself.

Keep asking yourself:

- What is the narrative logic of this coin?

- Why buy at this price point?

- Why hold for this long?

- Why sell at this price point?

- Where did I go wrong?

This not only helps constrain mistakes but also strengthens your advantages. Black and white on paper lets you see clearly: which habits created your highlight moments.

Why do you trade?

At this moment of restarting, ask yourself before every trade: Why am I making this trade?

During those sleepless nights after my assets dropped 80%, I kept thinking: Is my life just about staying up late playing games, drinking aimlessly, with nothing to show except my game ranking?

It wasn’t until I figured out my “why” that I regained the motivation to keep trading:

Why do I crave success so much?

To make my parents, who gave everything for me, proud, instead of having a son who only knows games and chasing girls.

Why do I crave success so much?

To repay all the friends and family who have helped me.

Why do I crave success so much?

So I don’t have to study hard for years only to end up as a wage slave.

Now, with every trade, I carry these “whys.” If your drive is just cold numbers, you won’t make it through the dark times.

Now imagine: if you suddenly died.

Leaving this world without warning. What would be your last thought?

- Is it that you didn’t make your parents proud?

- Is it that you didn’t take good care of your family?

- Or is it regret that you didn’t truly experience life?

You definitely won’t think of a number in your account. That is your “why,” that is the meaning of your life.

Besides risk management, this is the most crucial question:

“Will this trade bring me closer to my life goals?”

Having a clear goal allows you to maintain discipline and motivation during market downturns.

Believe in yourself

If you’re still young, time is your greatest asset. Apply this long-term thinking to your trading:

Think this cycle is over?

No problem. Hone your skills in the bear market. When everyone else gives up, accumulate strength for the next cycle.

I understand how tough this road is. I know how it feels when the whole world seems against you and no one around you understands your struggle.

But as long as you learn from every failure and maintain discipline when others give up, you will eventually get through it.

Remember: you may have lost gold coins, but your experience points will always remain.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Federal Reserve keeps cutting interest rates, so why does the crypto market continue to decline?

The Federal Reserve's ongoing interest rate cuts continue to inject liquidity into the market, which should, in theory, boost the prices of risk assets. However, why does the crypto market continue to decline? In particular, why did BTC experience a significant breakdown yesterday? This article will explore the underlying reasons and present key observation indicators.

10x Research Warns Of Bearish Setup For Ethereum